Over the past few weeks, we have published a number of extensive articles, some of which not only involved a lot of heart and soul, but also a great deal of research. While the focus at the beginning was mainly on the German pension system and limited to simple savings tricks, the topic has recently become a lot more colorful. In the meantime, we even deal with the investment of cryptocurrencies as a sensible addition to regular stocks and ETFs, give tips for exciting projects and apps, and let it get political here and there. Of course, we also took a look at our portfolios and investments.

A few of the latest highlights we want to point out separately in this blog post.

The German pension system

At the start of this blog, we published an extensive article section on the German pension system. We not only explained how it works and addressed various issues such as demographic change or the fact that women in particular could slip into old-age poverty later on. We also made constructive suggestions for improvement, calculated that a pension of 2,000 euros in old age is probably out of reach for most people and showed the necessary savings amounts for the pension of one’s dreams later on.

- How the German pension system works

- What the pension gap means

- Demographic change puts pensions at risk

- Pensions: How the state and the system work against you

- Women in particular are threatened by old-age poverty

- How we could make the pension better

- Pension levels: Germany way down

- Pension gap: This is how much money you should have saved

- 2,000 euros pension: Unattainable for many

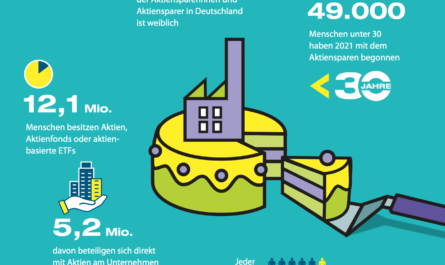

Shares and ETFs

In the area of traditional investments, we mainly dealt with stocks and ETFs and found out that savings plans are the best instrument for most private investors, but that they also have some disadvantages, especially compared to one-time investments. We dealt with past return statistics, gave an outlook on the future and always advised a broad diversification in order to be able to smooth the average returns especially in the long term. Of course, key figures and numerous aids in the search for the right stocks and ETFs were not missing. Our broker recommendation – Scalable Capital – was also frequently mentioned.

- Great things can come from a savings plan

- Why ETF and stock savings plans are so ingenious

- Advantages and disadvantages: One-time purchase vs. savings plan

- Average returns only smooth out fluctuations

- Fractions in the savings plan also have disadvantages

- Fundamental analysis: important stock ratios

- The magic triangle of investing

- Finding the right ETF easier

- Three simple investment strategies for everyone

- Past and future: Good times for stocks

- Diversification minimizes risk enormously

Cryptocurrencies

If you’re looking for an extra yield booster and aren’t afraid of risk, there’s no getting around cryptocurrencies – certainly not Bitcoin as a reserve currency. Here, we showed that high power consumption is essential for the network and made clear why Bitcoin could solve many problems of our current monetary system, but also of our society. Of course, we dealt with the offers of various exchanges and introduced one or the other crypto payment card with partly attractive bonus and cashback programs. The guiding principle “Not your Keys, not your Coins” was of course also not to be missed, especially in view of the turbulent times.

- Bitcoin as a problem solver: The advantages outweigh the disadvantages

- How a stablecoin made the crypto markets shake

- Two crypto payment cards with lots of cashback

- Crypto.com: great playground for cryptocurrencies

- Brave Browser: Earn cryptocurrency while browsing

A bit of politics

While tax changes are part of every financial blog, especially at the beginning of the year, we got quite political in parts. Among other things, we criticized the planned generation capital as a replacement for the share pension and showed why the electricity and gas price brakes of the traffic light government are anything but a good idea with regard to climate protection and economic aspects. Of course, in this section we dealt with the high tax burden in Germany or a possible wealth tax.

- Generational capital: A stock pension that is not one

- Price brakes are harmful and promote the overexploitation of the planet

- A wealth tax is extremely harmful

- Germany needs a Norwegian sovereign wealth fund

- Demonetization turns the whole world into a casino

- This changes financially for investors in 2023

- The coalition agreement for us investors

- Two insane taxations for investors

- Everyone pays more taxes to the state than they think they do

Goals and motivation

Long-term wealth accumulation requires staying power and thus regular new motivational impulses. Here, we took a detailed look at the concept of financial freedom, showed how a certain amount of capital can make everyday life more carefree, and told you about our freedom calendar.

- The steps to financial freedom

- 100,000 euros at 30 years: A magical goal

- Financial freedom: The 4% withdrawal rule

- Money is printed freedom

- 10 pieces of advice for difficult times on the stock market

- Motivational candy: The freedom calendar

- Everyday shares: Like left pocket, right pocket

- My last salary adjustment is worth over 275,000 euros

- Dividends are the best salary increases

- How the snowball eventually starts rolling

- Yesterday was the best day to start!

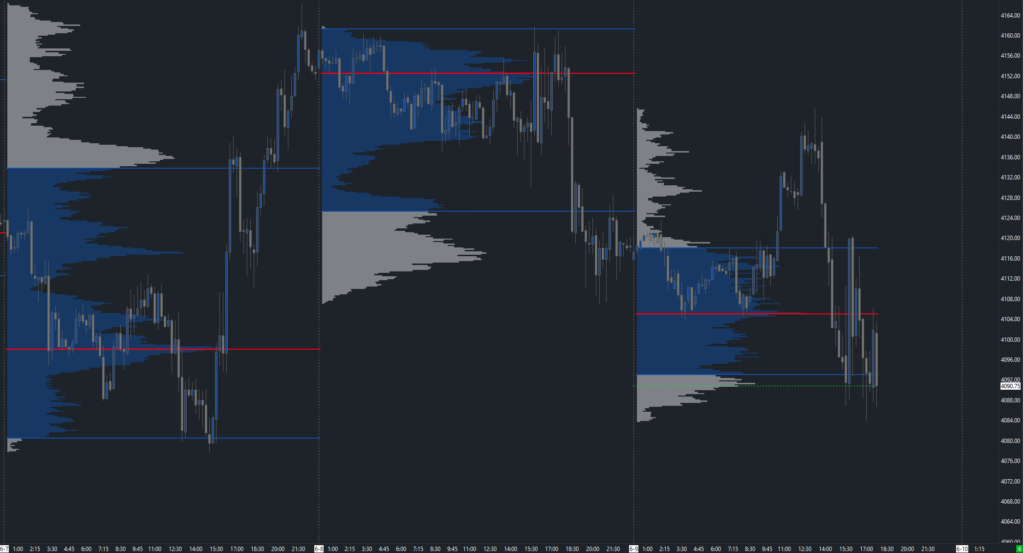

Daytrading

Even if the name of this blog puts the topic “Trading” in the foreground, the contents are still to be counted on one hand. The reason is simple: The topic is too extensive and needs to be structured in a meaningful way. The entire topic is not an easy one and is (rightly) disreputable in many places. Only recently we published an article on why the trading business is not easy, but recently we also revealed the basics of the candlestick chart and dealt in detail with the psychological factors.

- The trading business is not easy

- Day trading: All paths can lead to success

- Trading without equity is possible

- What you need for futures trading

- The candlestick chart introduced

- The head is the biggest obstacle in trading

- What is a future? The basic idea of the derivative

- The attraction of short-term trading

- Ullstein Taschenbuchvlg.

- Factfulness: Wie wir lernen, die Welt so zu sehen, wie sie wirklich ist Der Bestseller zum Erreichen einer offenen Geisteshaltung für Ansichten und Urteile, die nur auf soliden Fakten basieren

- ABIS-BUCH

- Weiss

- Rosling, Hans (Author)

Letzte Aktualisierung am 2024-07-26 at 02:39 / Affiliate Links / Bilder von der Amazon Product Advertising API