Over the course of an investor’s career, it is almost certain that not only will numerous individual positions accumulate or even the odd custody account creep in, but also more and more providers. Due to the constantly changing market environment, you will always try out new brokers and custodian banks, either because they entice you with lower fees, offer various analysis functions to try out, or because they offer dividends other than the usual amount of money in the form of pyjamas, chocolate or free trips as well as additional discounts because they simply enter the purchases and sales in the respective shareholder register.

When I started to get more involved with the stock market, I opened a securities account with ING, and later with comdirect, because they offered a wider range of ETF and share savings plans and also offered more favorable conditions. With the advent of neobrokers and thus commission-free share trading, I finally opened a custody account with Scalable Capital and gradually moved my savings plans there.

Although I use several tools for my overview, additional performance figures and for tracking my monthly cash flow and everyday expenses, I wanted to have all my share and ETF positions available in one place again. When Scalable Capital advertised a bonus payment for a custody account transfer in November, I decided to take this step and at the same time write a report about it for this blog.

Unfortunately, it was not quite as positive as I had originally hoped.

Many different parties involved

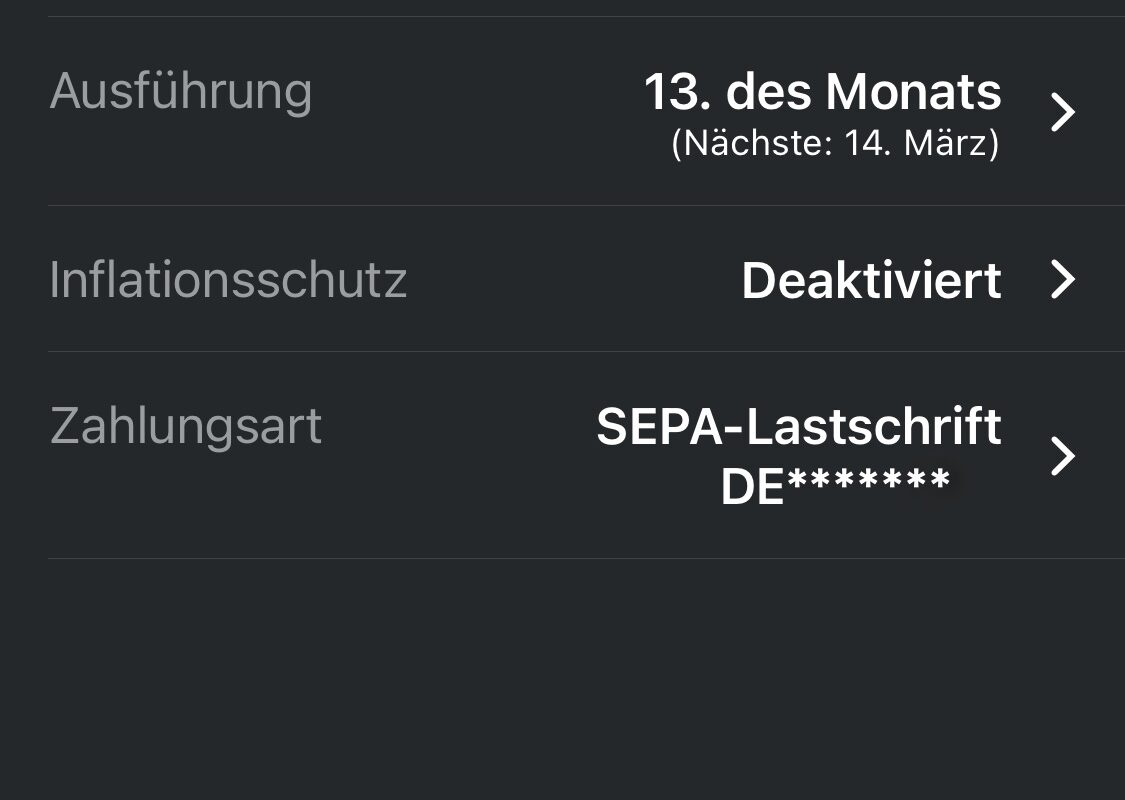

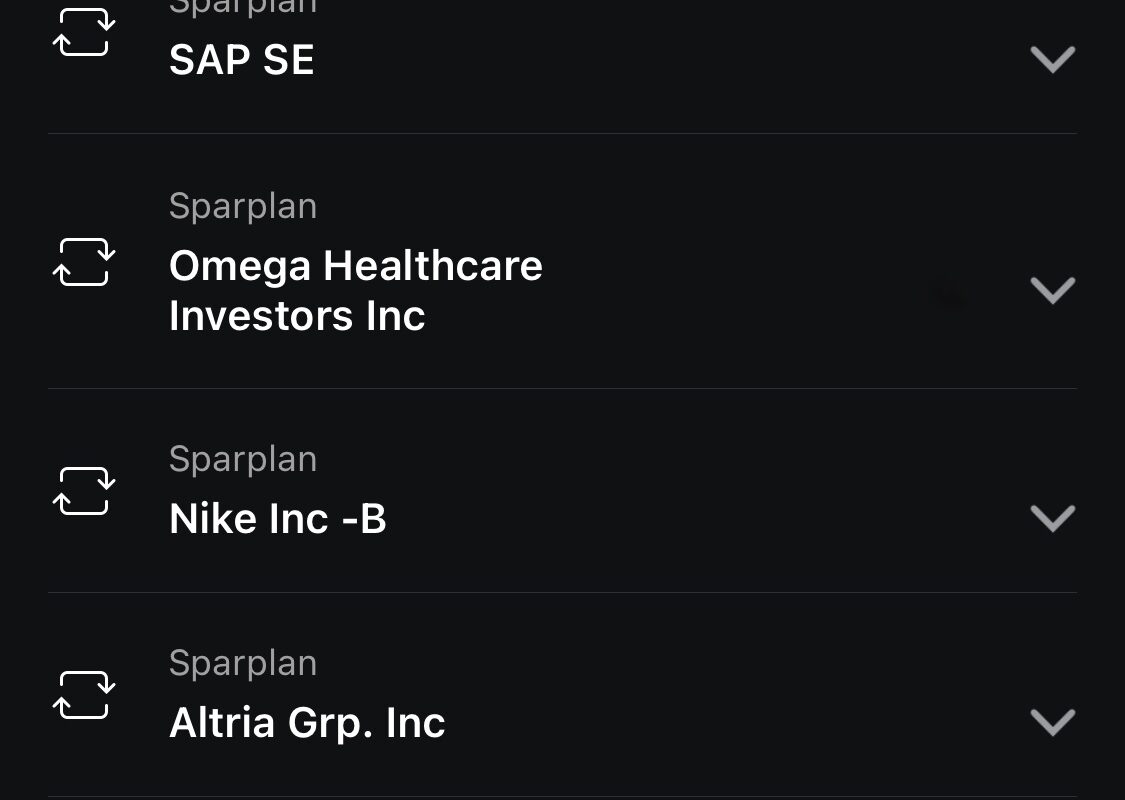

As there are numerous parties involved in a securities account transfer, from banks and stock exchanges to custodians, I wanted to minimize the potential points of error right from the start and sold all my positions that were not tradable with the new broker myself. Of course, all current savings plans were deactivated. I swapped my Nestlé position for Koninklijke Ahold Delhaize and got rid of my remaining Wirecard holdings, which were supposed to remain in the portfolio as a reminder to take advantage of the tax-free amount that could arise from selling the fragments. The move was not simply haphazard, but of a strategic nature.

On November 14, the actual application was finally submitted to Scalable Capital. The process was fully digital. All 26 positions had to be neatly listed by name along with the portfolio sizes, a few tax details had to be entered and a digital signature had to be provided. Although the entire process was quite an effort, Scalable Capital made it very pleasant. In the background, the application was then sent by post to comdirect as the outgoing custodian bank.

An allegedly different signature

On November 20, about a week later, a letter from comdirect suddenly landed in my digital mailbox rejecting the securities account transfer due to a “deviating signature”. I was told to either submit a new application or send in a specimen signature with a copy of my ID. I had held the custody account for more than eight years up to this point, but my signature had never changed during this time. In fact, I still have the same childish signature as when I was first allowed to sign my own contracts.

A quick search made it clear that I was not alone with this problem. I found several forum posts and blog articles about it. comdirect seems to make it difficult for its departing customers to switch to the competition under the pretext of a false signature.

There probably wouldn’t have been any damage if someone had actually tried to steal my share positions. The new securities account is managed under the same name, and the potential attacker would have had to know all my positions, including all holdings. But you have to give comdirect credit for the fact that the signature was made either with the mouse, the touchpad or on the smartphone, which means that it is quite likely to look different than if it had been handwritten on a piece of paper.

I initiated the custody account order via comdirect, which incidentally required no further signature, and at the same time informed Scalable Capital of the custody account transfer. The second application was finally submitted on November 23, almost ten days later than I had first initiated it.

Second attempt and partial transfer

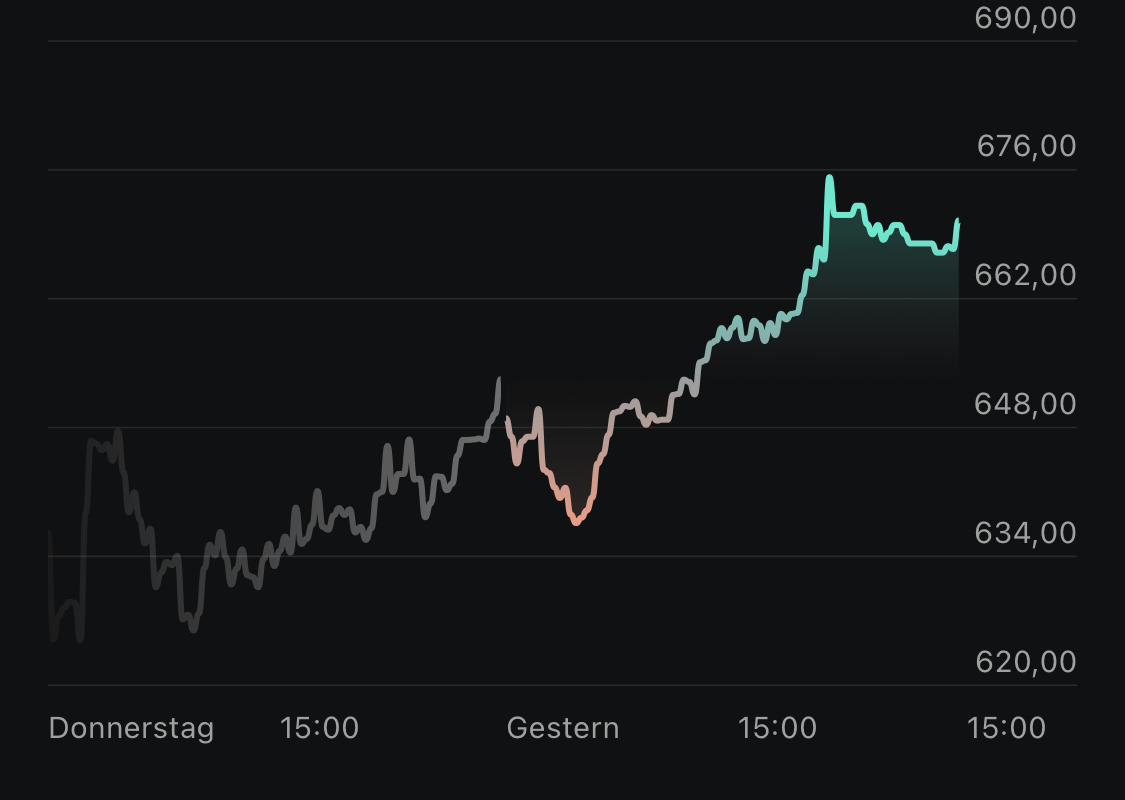

As early as December 1, comdirect automated the sale of all fractions and booked out all positions on December 8 – shortly before a weekend – which I was informed of in writing on December 11. Just one day later, three of the 26 individual positions appeared in the new Scalable custody account. But nothing happened for a long time after that. It was clear to me that many stations were involved and that not much would happen over the Christmas and New Year holidays anyway. Nevertheless, the three weeks set by BaFin for the acceptable duration of a securities account transfer had been exhausted, even after deducting all national holiday.

I decided to contact Scalable Capital by phone on January 4. In a conversation lasting over nine minutes, the employee assured me that they would consult with Baader Bank and then proactively inform me of the status. However, eight more days passed without a single response. On Friday, January 12, I called Baader Bank and described the situation in a conversation that again lasted almost ten minutes. The employee promised me that the process would be completed the following Tuesday. Unfortunately, I was disappointed again and picked up the phone for the third time on Wednesday, January 17.

The call had to be postponed due to technical problems. However, as promised, the employee called back a little later to tell me that all my missing items would be booked the next day and that the colleague from the responsible department would get straight to work on the bookings. That’s exactly what happened, as the missing items gradually appeared in my online banking at 10:46 a.m. on the same day.

It took almost exactly 5,508,780 seconds, or in other words 2 months, 2 days, 18 hours and minutes, from the first request to the actual transfer.

Mistakes happen, but you have to inform people about them

I am not angry that there were problems due to the complexity of the process, for which a solution could certainly always have been found. But I am disappointed that Scalable Capital and Baader Bank left me alone as a customer by not adhering to agreements and that I as a customer had to constantly take the initiative. Good support and assistance are different.

It remains to be seen whether this is the end of the matter; after all, it has to be checked whether dividends have been paid in full for the period in which a large part of the assets were in digital nirvana. As a customer, I have to check everything again very carefully if I don’t want to miss out on payments I am entitled to.

The events in the time steel:

- November 14, 2023: Initial application for securities account transfer

- November 20, 2023: Rejection due to “deviating signature”

- November 23, 2023: Second application for transfer of custody account

- December 01, 2023: Sale of all fragments from the old custody account

- December 08, 2023: Derecognition of all positions in the old custody account

- December 11, 2023: Submission of all derecognition documents

- December 12, 2023: Entry of the first three positions in the new custody account

- January 04, 2024: Call to Scalable Capital

- January 12, 2024: Call to Baader Bank

- January 17, 2024: Another call to Baader Bank

- January 17, 2024: Subsequent booking of all missing positions