For many, credit cards are the easiest way to fall into the debt trap. In reality, however, it always depends on how you use them. If you make one consumer spending after another without an overview and don’t pay off the accumulated outstanding balance at the end of the month, you have to pay expensive interest. With credit cards, this is often well over 17% p.a., which is very noticeable even with the smallest amounts. But if you use credit cards correctly, you can benefit from them. We show you a few possibilities.

The first and most obvious option is to use and build up a credit line. Mastercard or Visa credit cards can now be used almost anywhere – whether in a hotel, at the petrol pump, in a restaurant or at the supermarket checkout. If you pay all your monthly expenses by credit card and only at the end of the billing period, you can keep the majority of your income on the high side and earn valuable interest for this period.

You get virtually free money, which you always pay back on time and without additional costs, and let your own money work for you. With 1,000 euros and a good call money account with 3% interest, for example, this can be as much as 2.50 euros per month.

Building up and utilizing a credit line

You also build up your credit line by regularly using your credit card limit. Credit card providers in particular are not stingy with limits. You can often get more than three times your salary. If you continuously build up your credit line and even have several cards in use, you remain flexible in all circumstances in life. If you want to buy a new used car, for example, you can pay for it immediately from your credit line, giving you an advantage over potential competitors who may first have to sort out the financing. Once the car has been purchased, you can still apply for a cheaper consumer loan and then simply switch it over.

The leverage can be scaled up with additional tricks. For example, some banks and fintechs allow you to pay money into your account by credit card and then send the money by direct debit or a traditional SEPA transfer. In this way, you can even pay your rent and ancillary costs for electricity, insurance, telecommunications and broadcasting fees from the credit line, while your own money works for you in higher amounts.

Once you have built up a decent credit line, you can even use the above trick to pay it out in full to your account and earn interest on your call money. You use money that doesn’t belong to you to generate investment income. With a credit card limit of 6,000 euros, that’s 15 euros a month at 3% annual interest. If payment of the outstanding bill is due, the money is simply withdrawn from the daily allowance. However, this requires discipline and an overview, as a mistake can quickly result in expensive penalty interest!

Depositing to your own account by credit card

Providers that allow you to deposit money into your current account using a credit line include Western Union with the WU+ account (referral code: GeEspyTwXMPFWsq), Revolut* or bunq*. Deposits are generally free of charge, although you must observe the corresponding limits. With bunq, only 500 euros per month can be deposited free of charge via the paid premium subscription; a fee of 2.5 % is charged for amounts above this, which makes the structure almost unprofitable or not worth the effort.

With the Visa card from Barclays*, it’s even easier: you can have the money sent directly to your main account by bank transfer. Up to a sum of 499.99 euros and with payment over three months, this is even completely free of charge. Theoretically, up to ten such transfers are possible. Particularly practical: the interest-free installment payment allows you to keep your money for longer and let it work for you.

However, the Barclays card* is only free of charge if you repay the outstanding amounts in full by bank transfer, otherwise new customers will be charged a card usage fee of 2 euros per month.

Additional packages and customer loyalty programs

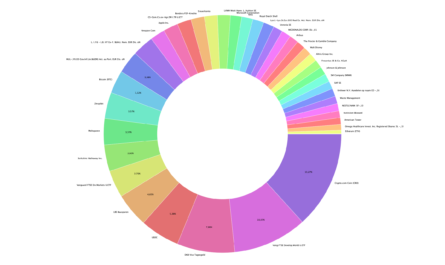

Many credit card providers put together interesting packages that include an insurance package or lounge access at the airport. Some even offer a worthwhile bonus program in the form of points, miles or cashback, which, depending on the provider and card, is even available for the above-mentioned deposits. We have already presented a few of these cards in detail in the past.

There is currently also a Mastercard cashback promotion that allows you to save at least 10% per purchase – only until the end of June! You can find the right credit card using our credit card calculator. You can then collect and merge your own collection very easily via Curve.

- KOMPAKTES UND LEICHTES DESIGN: Mit einer Größe von nur 9,8x7,3x2,4 cm und einem Gewicht von 110 g passt das Travison Smart Wallet mühelos in jede Tasche, ohne Ausbeulungen zu verursachen.

- MAXIMALE KAPAZITÄT: Die Geldbörse für Herren kann bis zu 10 Karten sicher aufbewahren. Es bietet sechs Plätze im robusten Aluminiumgehäuse und vier weitere in den Innenfächern.

- SCHNELLER KARTENZUGRIFF: Durch den innovativen Kartenschieber erscheinen Ihre Karten übersichtlich gestapelt, sodass Sie nie wieder Ihre Bank- oder Kreditkarte suchen müssen.

- ELEGANT UND FUNKTIONAL: Dieses stilvolle und praktische Portmonnee kombiniert hohe Funktionalität mit einem schlanken Design und eignet sich perfekt als Geschenk in der hochwertigen Geschenkebox.

- ULTIMATIVER KARTEN- UND DATENSCHUTZ: Ausgestattet mit einem RFID-Schutz-mantel verhindert das Wallet unbemerkten Datenklau, während das Aluminiumgehäuse Ihre Karten vor Beschädigungen schützt.

Letzte Aktualisierung am 2024-07-26 at 08:08 / Affiliate Links / Bilder von der Amazon Product Advertising API