The pressure on global stock markets has increased significantly again in recent months. First, the Corona pandemic shook up the global economy, then Russia caused much suffering in Europe with its war of aggression on Ukraine. Global supply chains have become more difficult, and in some cases there is even a threat of food shortages and energy crises. Prices in all areas seem to be heading in only one direction: upward, and inflation continues to escalate.

In addition, German politics and society do not want to make it easy for companies. Excess profit taxes are being discussed, the wealthy and rich are to be asked to pay through redistribution intentions. In times like these, you think twice about whether you want to build up assets at all or whether it would not be better to liquidate your existing portfolio.

Our tip is quite clear: Just keep going and never let yourself be influenced by others! Ten pieces of advice to motivate you to stick to your goals in everyday life.

Do not look into the depot every day!

If you check the prices of your securities account every day or even several times a day in bad times, you can quickly drive yourself crazy. We simply recommend to check the development in the depot as seldom as possible and to let the regular savings installments be executed automatically. We invest for the long term, we don’t care about short-term price fluctuations!

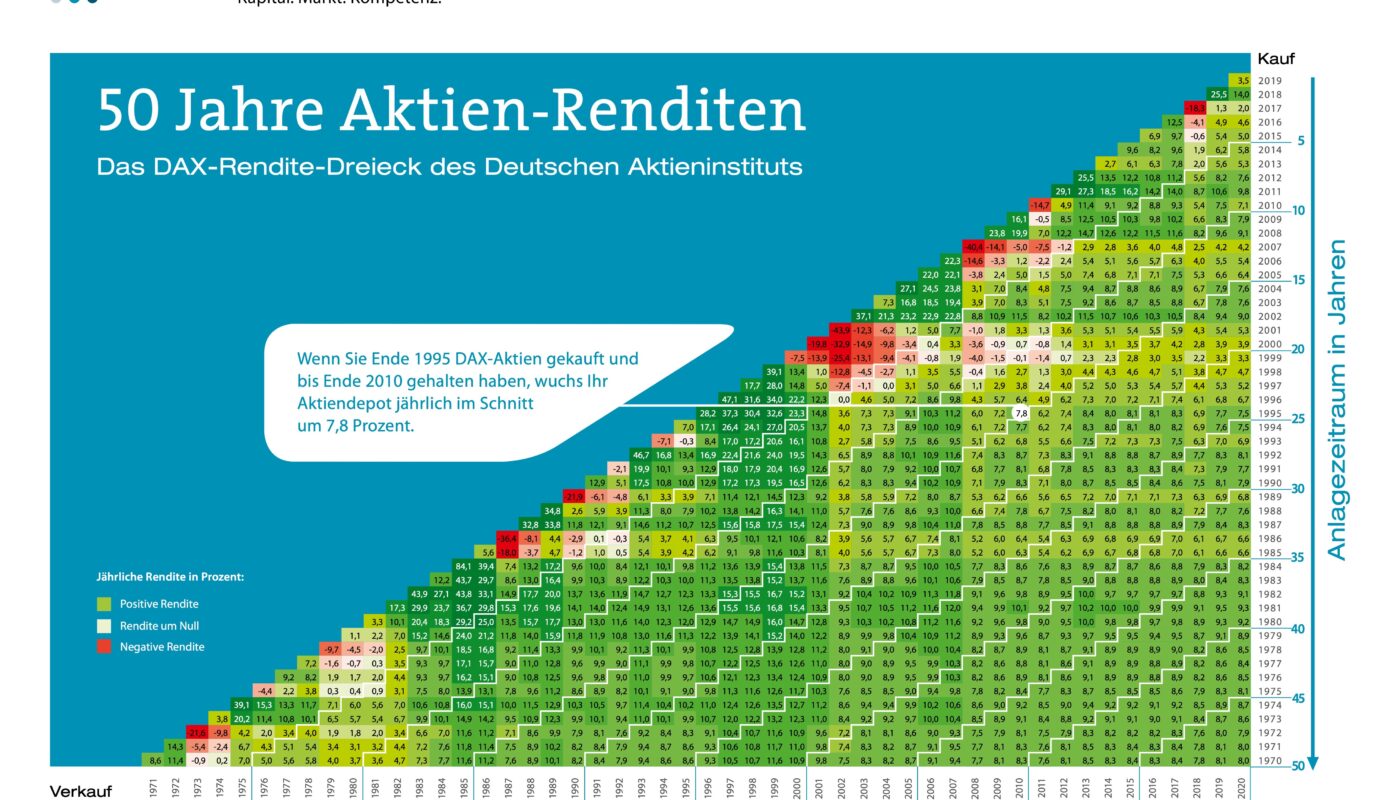

The look into the past

Statistics are on our side! The stock market has survived quite a few crises and even entire world wars and has always come out of them stronger. If you invest your money for several decades and save regularly, you have an extremely small chance of making any losses at all – no matter what period you look at from the past. The longer you hold, the greater the chance of a rate The DAX return triangle proves this time and again.

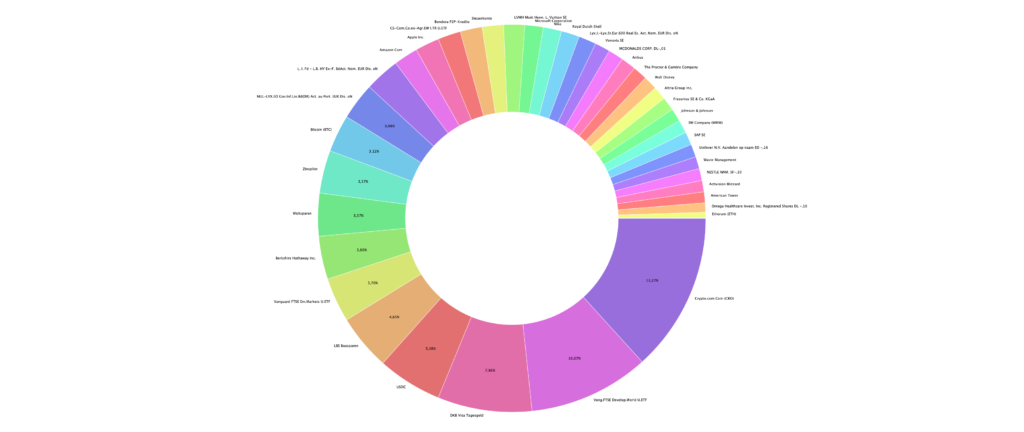

Diversification is on our side!

If you spread your investments as widely as possible, you can absorb individual losses more easily. A global ETF invests in over 1,500 companies. If one of them goes bankrupt, you have lost only a very small amount and one of the remaining 1,499 companies has certainly made one or the other return, which easily makes up for the loss. Diversification is a great support!

Invest, don’t speculate!

If you stick to the golden rules of investing and speculate less, you will feel better in the end. Instead of just putting all your eggs in one basket, position yourself as broadly as possible. Instead of investing in companies that are on the verge of bankruptcy, it is better to invest in solid and strong companies. If you’ve done your homework, you’re prepared!

Take advantage of the discount promotion!

In the supermarket, you quickly pack a little more when the prices are low. You should do the same on the stock market! If you invest regularly via a savings plan, you get sometimes more, sometimes fewer shares for your savings plan rate and buy the average over the long term. Each phase with larger setbacks enables us to accumulate more shares, which then brings us back into the profit zone faster when prices rise!

Have a nest egg!

If you have enough money lying around on the edge that you can quickly fall back on in an emergency, it is easier to cope with major setbacks in your portfolio. One is not dependent on loans or can even compensate for a job loss in the recession. From a financial point of view, everything can continue for a while, as before!

Generate tax losses!

If a company does go belly up in a crisis, you should not be afraid to throw the company out of your stock portfolio. You can offset this loss against your profits in the next year and thus save some taxes.

Cashflow is king

When prices on the stock markets are falling, dividend payments can provide psychological support for the share holder. As the companies steadily report back with smaller one-off payments, this can show the owner that the companies are still there after all and are sending out a sign of life despite the crisis. Because of this little psychological trick, I like to invest in dividend stocks!

Always be frugal!

Those who spend as little money as possible even during the crisis have fewer liabilities and remain more flexible. We don’t always need the latest smartphone, the fattest car or a new notebook every few years. Conscious consumption!

Request a salary increase!

Even if inflation and increased costs affect the companies and thus the employer, it is advisable to negotiate a salary adjustment at regular intervals. Only through them can we increase our regular savings plan rates in the long term and create assets for our retirement!