Anyone who invests their money on the capital markets is exposed to constant fluctuations in value. Continuous trading on the stock markets means that securities are constantly bought and sold, causing the price to rise and fall. Depending on when you get in, you profit or lose. This is in the nature of things. But if you spread your risk, diversify widely and hold your investments for as long as possible, you are very likely to make profits in the long term. This is shown by a number of statistics from the past.

The DAX return triangle

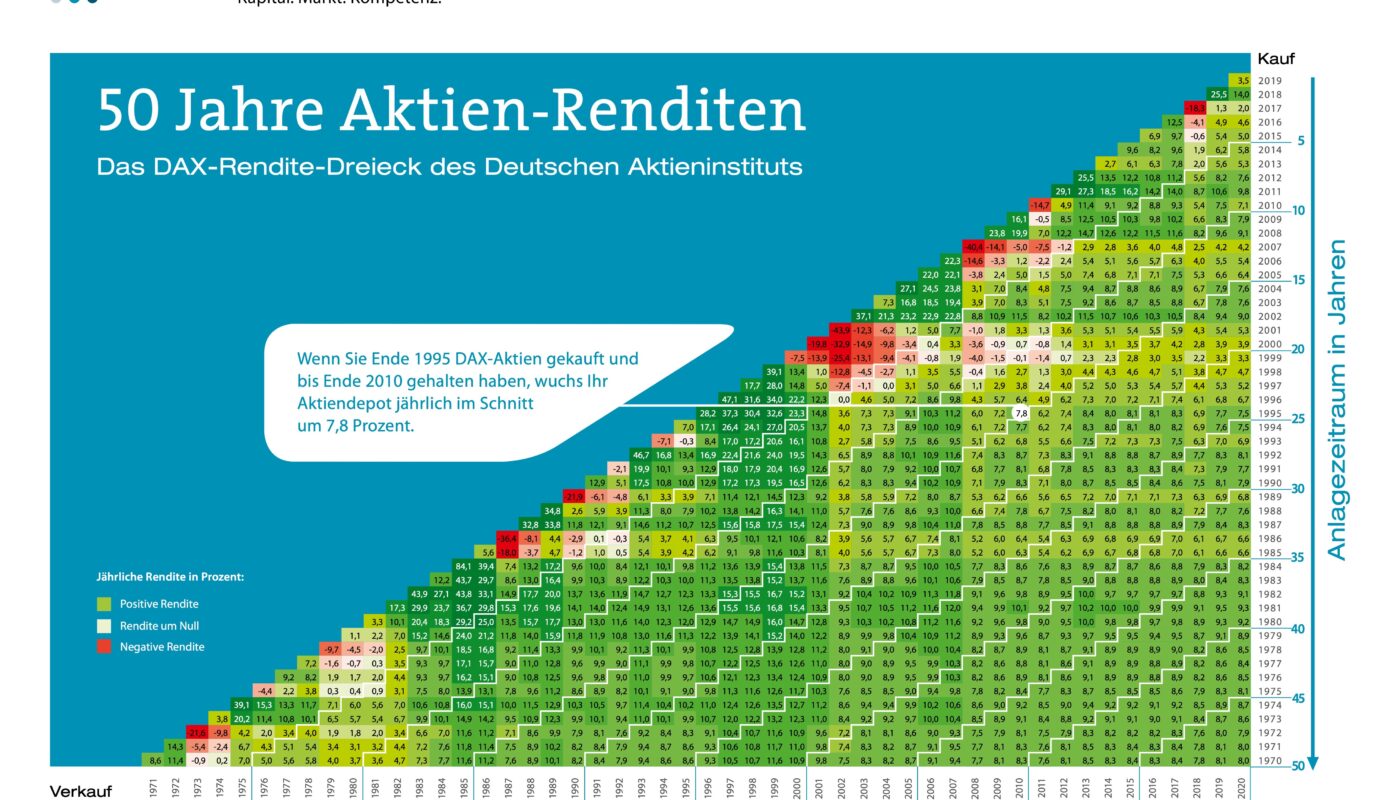

A good example of this is the DAX yield triangle of the Deutsches Aktieninstitut (German Stock Institute), which is updated from year to year and visually depicts the annual stock returns of all companies from the leading German index over the last 50 years. It shows retrospectively the annual average return according to arbitrary purchase dates and holding periods. The darker a green field is displayed, the higher the average annual return was within the selected time period. For white fields, the percentage average gain was marginal, while for red fields it was negative. On the y-axis you select the year in which you invested in the DAX, while on the x-axis you select the year in which you sold. Where both axes intersect, the number of the average annual return is shown.

Example: If you bought DAX shares at the end of 1995 and held them until the end of 2010, the value of your portfolio grew by an average of 7.8% per year. If, on the other hand, you had bought in 2000 and sold just twelve months later, you would have suffered an average annual loss of -19.8%. If the position had been held and not sold until 2020, the average annual return would have been 7.6%.

The return triangle clearly shows that it is possible to incur losses with shares over certain periods, but if you hold your positions for the long term and don’t sell them after just a few years, there is a high probability that you will be able to sell them at a profit in the end.

Less losses with a long holding period

With an investment horizon of 20 years, an investment in the DAX has generated an average return of 8.7% per year over the last 50 years. In the worst case, the gain was 3.3%, in the best case even 15.2%. By contrast, those who sold their DAX position after just one year made 10.8%, but also exposed their portfolio to the risk of losing up to 43.9%. In the best case, one could collect 84.1% in profits after the one-year holding period. Short-term investments have great potential on both sides and can mean substantial gains, but also exorbitant losses.

For our retirement provision, we want to avoid losing money as much as possible, and one way to do that is to delay the holding period of our stock investments as long as possible. Once again, it is clear that those who start early profit the most.

Those who are in it for the long term profit the most

To return to the return triangle: Investors who held their DAX investment for 25 years generated an average annual return of 9.1%, 13.5% in the best case and only 5.4% in the worst case. For a holding period of 30 years, the figures were 8.8%, 10.9% and 6.8%. Even after 15 years, there has not been a single period in the DAX over the last 50 years during which losses could have been made – regardless of when one entered. An investment of at least ten, preferably 15 years is therefore always recommended.

If you save regularly, you also benefit in the long term: In times of crisis, you get more shares for your monthly savings installment, which will then be worth more after the recovery, providing a yield boost. In expensive times, on the other hand, you simply continue to build up your savings position. Due to the permanently growing values, one will build up assets in the long run.

Only the 30 largest German companies are listed in the DAX. Soon, due to a changeover, there will be 40. In the course of a broad diversification, however, this is still too little. With a globally diversified ETF, which invests in more than 1,600 stock corporations from a wide range of currencies and economic areas, one can reduce the risk of losses even further. Incidentally, the well-known dividend investor and book author Christian W. Röhl has compiled such a yield triangle in his blog.

And what about the future?

What was in the past does not necessarily apply to the future!

That is absolutely correct! Nobody knows where our investments will stand in few decades! Maybe the stock exchange was abolished, or mankind has extinguished itself by a nuclear war. But maybe things will go on as before. We do not know. However, the probability is high that we will not destroy ourselves and the economy will continue to grow! There are several reasons for this.

The urge to innovate and the shift in needs

It is human nature to constantly make things and processes better, simpler, cheaper and thus more accessible to everyone. Today, many manual tasks are performed by machines. The machines themselves have become steadily more efficient or even more sustainable with regard to environmental protection. At the beginning, hardly anyone could afford a car, but now almost every household owns one. Here, too, further development is progressing: Driving a car has never been as safe and sustainable as it is today. The combustion engine has become much more efficient and less harmful to the environment – electric motors will probably replace it soon anyway. Of course, people’s motivation to improve things is also a monetary incentive. There is a lot of money to be made from new developments. As an owner of shares, you will always profit from this innovative power.

In addition, people’s needs are almost infinite, or will always shift. Twenty-five years ago, none of us would have thought of needing a smartphone at some point. Today, when a mobile phone contract expires, a new one is usually purchased after just two years, thus creating demand. The same thing happened with the market maturity of the computer, the games console or the revolution brought about by the Internet. Only global networking created the need for mass package ordering, video streaming, gaming, social exchange across continents, and so on.

In the next few years, some resourceful mind is sure to come up with the next big thing that we’ll be dying to have. Instead, we may no longer need a smartphone – our needs will shift again. As shareholders, we will see companies die, but new ones will shoot up as if from nowhere, and in the end we will profit from all of them

Inflation and demand development

And then there is inflation. It also plays into the hands of us shareholders and has a positive impact on our returns. Rising prices for raw materials and labor are simply passed on to the end customer by companies and – provided the profit margins between input and output could be maintained – have no impact on our equity investments. They simply rise along with them to the same extent. It’s a different story if you just leave your money in overnight money. Here, you have to rely on the good will of the banks to compensate for inflation.

A few years ago, access to the capital markets was denied to most. Today, trading is easily possible from the comfort of your smartphone with just a few euros. This will steadily attract new investors in the coming years, who will then naturally bring new money into the markets and thus ensure increasing demand and thus rising share prices. After all, everyone wants a piece of the pie! The populations are also growing exorbitantly, less developed countries will eventually catch up with the industrialized nations.

Conclusion: Stock markets will continue to rise in the future with a high degree of probability. This is essential for our retirement provision.

Keyfacts

- The past and the future have been and will be good for stock investments

- the DAX return triangle shows an excellent return history

- the longer one is invested, the greater the probability of not making losses

- short-term investments are very risky

- shifting needs and innovation drive further growth

- more and more people want to invest, which brings new money into the markets

- it is best to start today!