The fact that the fees and cost structures of financial products have a significant impact on returns is something we have already looked at in detail in one of our previous articles. But what is the point of buying a product that is as inexpensive as possible if, in the end, the investment doesn’t work out or the stock company even goes bankrupt? Then we may have saved fees, but still lost everything. Such a scenario is not entirely unrealistic.

Only last year, Wirecard, a supposedly large and, above all, highly profitable Dax company, had to file for insolvency due to fraud. The share price plummeted. Other well-known bankruptcies include Vapiano, Esprit, Lehman Brothers, Schlecker, Arcandor, Air Berlin, Holzmann and Enron. But not all of them were listed on the stock exchange. However, it shows that even big companies can get into difficulties and disappear from the scene.

Every stock investor will almost certainly go through such a scenario in the course of his career. One will have to learn to deal with losses. But don’t worry, there is a pretty powerful tool to keep them as low as possible. Keyword: diversification. In concrete terms, this means spreading our risk and not putting everything on just one card. If you put all your savings into one company, you are putting your money at high risk, because everything depends on the success of that single company. If we buy ten different companies instead of one and one of them goes bankrupt, we have lost part of our money, but we still have something on the high side with which we can continue to work.

Diversification means more than just many positions

So much for the theory. But diversification means much more. In the context of our investment, we should not only rely on several companies, but also take other aspects into consideration. For example, if we only invest in German companies, we are placing our investment completely in the hands of the German economy. If the German economy is doing badly, our portfolio will not look much better. If socialism is reintroduced in this country and all companies are nationalized, shareholders will be expropriated and our retirement provision will be lost. So one should not only diversify blindly with several companies, but also make sure that the selection comes from different economic areas.

But be careful: Just because a company is based in Europe does not mean that it also drives its largest sales there. Consumer products manufacturer Unilever, for example, is headquartered in the UK but makes much of its money in Asia. The same applies to the currency with which a corporation mainly operates. What happens if we are invested exclusively in the U.S., the U.S. dollar loses value and is replaced by another currency as the lead currency? This is also a risk that we have to spread with the help of diversification.

The most important thing is that you shouldn’t be active in just one sector just because you think you know it best. You always have to keep an eye on everything; whether it is the healthcare industry, the food industry, biotechnology, entertainment or the automotive sector – just to name a few.

Diversify within an asset

Another diversification that can be done is to decide what kind of bet to make. Do I buy a large company that has already proven for decades to be able to operate profitably, or do I buy a corporation that could be predominantly large only in the future? Two very good examples here are the consumer products manufacturer Unilever and Biontech, which gained notoriety especially during the Corona pandemic.

While Unilever has been active worldwide for several decades and is profitable, Biontech faced an uncertain future for a long time. Vaccines in particular devour millions in development costs. It can take years until approval is granted, and it can all go wrong shortly before the end. The outcome of the approval can decide the future of the company. You should be aware of this risk, but theoretically you also have some profit potential. A healthy mixture of both is certainly sensible in the course of diversification. Another such diversification example would be to invest part of your money in dividend stocks and the other part in growth stocks.

If you diversify within your stock investment, you certainly aren’t making a mistake yet. But what happens when the stock market crashes? Because investors usually pull their money out of the markets, but they have to park it somewhere. They therefore put it into other assets such as gold, commodities, bonds or now also cryptocurrencies. Especially in the latter asset can be further diversified: You buy not only bitcoin, but also altcoins such as Cardano, Ethereum, Polkadot or Uni and store them not only with a single provider, but get several platforms in the portfolio. Investors in Mt. Gox had eventually lost all their deposits in 2017.

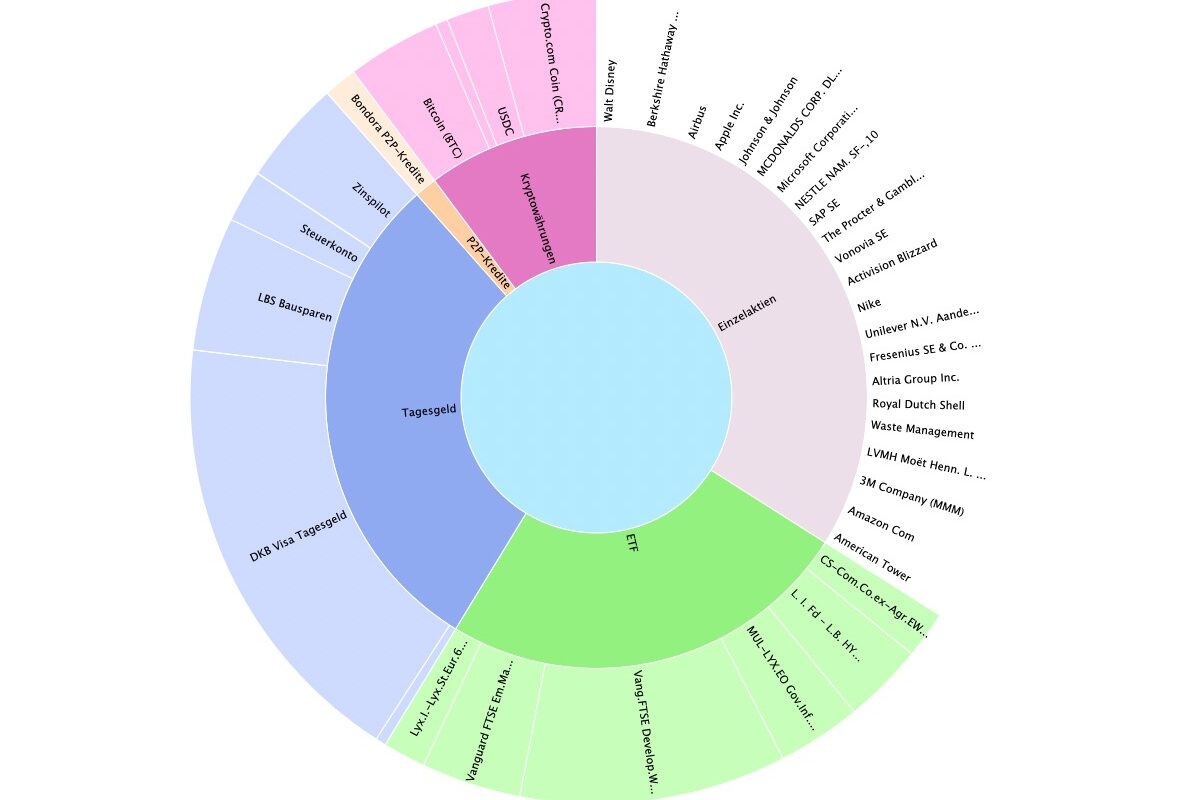

A diversified portfolio that invests in stocks, P2P loans, bonds, commodities and more is definitely recommended from a risk perspective.

The math is on our side

But there is also a mathematical plus point that clearly speaks in favor of a broadly diversified portfolio. For this, let’s go back to the stock market and set up a simple thought experiment: We buy a total of 15 different individual stocks at 1,000 euros each. Now one of our companies goes bankrupt, leaving us with only 14,000 euros of our initial 15,000 euros invested. In order to recoup this loss, the remaining 14 companies have to grow by an average of just under 7.2% in order to return to profitability as a whole. This percentage is almost equal to the average market return of a broad-based MSCI World ETF since 1970, so it is not impossible. Since we picked good companies anyway, the chance of a total loss is very low – actually a no-brainer the whole thing!

Especially because there is a simple vehicle that does the work for you inexpensively: Exchange-Traded Funds, or ETFs for short. A broadly diversified ETF, such as the MSCI World or the FTSE, invests fully automatically in thousands of companies worldwide – you won’t even notice if one of them goes bust. Therefore, there will be one or the other article about ETFs here on TradingForFuture.de…

Keyfacts

- Diversification means risk spreading

- do not put everything on one single card

- buy shares from different industries

- … from different currency areas

- … from different economic areas

- buy at least 15 different stocks

- buy not only stocks, but also bonds, P2P loans, cryptos, etc.

- use multiple providers