It’s no secret that we are big fans of stock and ETF savings plans, at least since our article at the beginning of the month. They allow you to participate in large stock groups for just a few euros and some can even be saved completely free of charge. Due to the low minimum savings amount, it is possible to build up a broadly diversified stock portfolio in the long term and, on top of that, tricks psychology, because due to the automatability, the investor has fewer doubts and buys regularly even in a crash. Sometimes there are more shares, sometimes less – depending on the current share price. In this article, we want to show that this can actually lead to great things.

A strong company is a prerequisite

One of the shares in our portfolio is Berkshire Hathaway. The company was founded in 1955 in Omaha, USA, and invests in large stock corporations as a holding company. Its chairman is Warren Buffett himself, one of the most successful and well-known investors of our time. Its holdings include positions in Apple, American Express, Coca-Cola, Kraft Heinz, Chevron, Visa and Mastercard, Wells Fargo, UPS or Mondelez and Verizon.

More than $276 billion was turned over by Berkshire Hathaway last year, and the company’s investments stripped out a net profit of $89.8 billion. It was the most successful year in the company’s history. No wonder Warren Buffet and co-founder Charlie Munger are among the richest people with billions in assets.

50 euros per month for six years

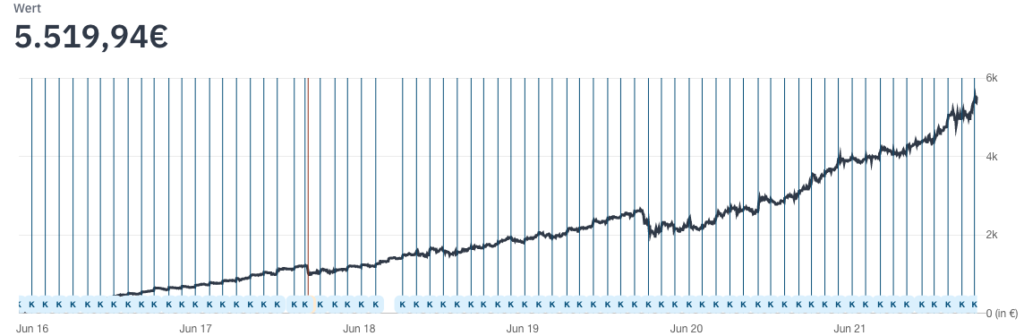

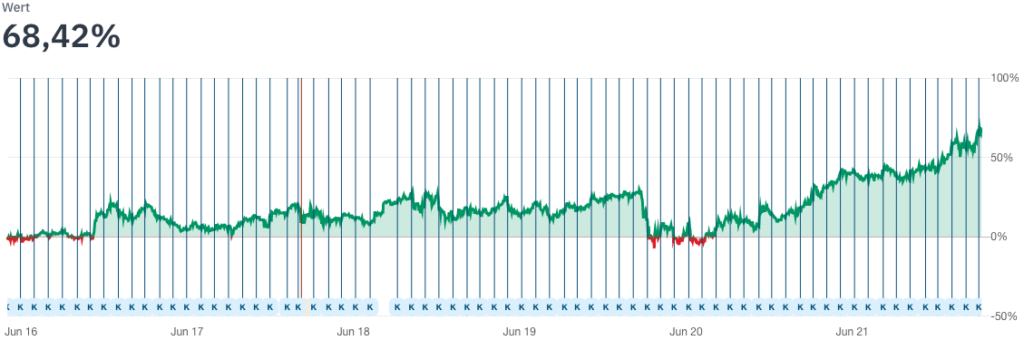

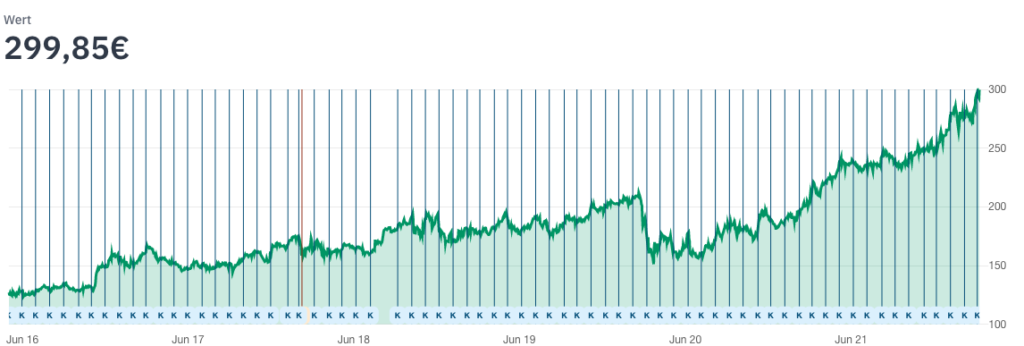

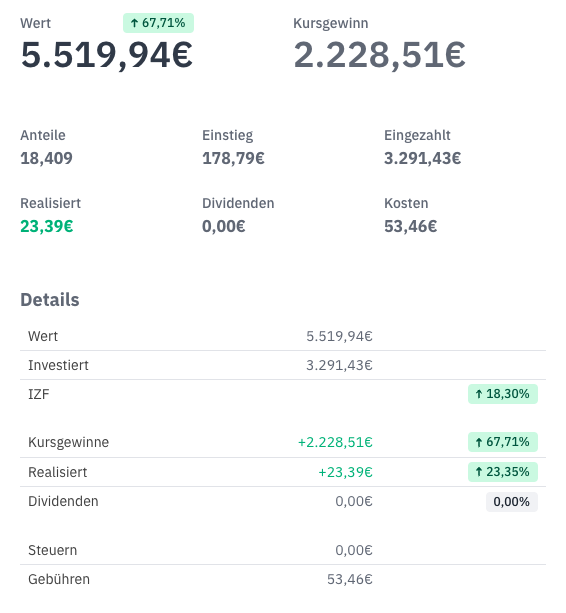

We have been investing in Berkshire Hathaway via a savings plan since 2016. Month after month, we put 50 euros into the company. After almost six years of continuous execution and only one short interruption due to a portfolio move in 2018, we have thus invested around 3,300 euros in the company of the major investor and own not quite 20 shares, which were purchased at an average price of around 179 euros. At the time of going to press, the share price stood at almost 300 euros, bringing the total position to over 5,500 euros. We were thus able to collect price gains of around 2,230 euros and are almost 68% up with this position alone. Since we execute our savings plan at 1.5% fees at comdirect*, we have accrued around 55 euros in fees over the six years, which have now more than paid for themselves.

Not always in the plus

Over our investment period, the share performed well from left to right. But there were also stronger kinks in the share price that led to sharp setbacks. At the Corona Crisis in February and March 2020 alone, we had to accept a whopping slide in the share price. It went from a positive return of almost +30%, back to a minimal loss of about -2% at the peak. At the time, the crash had not only eaten up all our gains, but also pushed the position into negative territory. However, we still firmly believed in the success of the company and continued to run the savings plan month after month.

In retrospect, the share prices at the time were a real bargain. Due to the quick recovery, we climbed back into the profit zone much faster, also because of our regular re-buying. In the meantime, the position is at a new all-time high and has more than doubled the gains before Corona.

Conclusion: If you regularly invest in well-positioned companies with positive prospects with a savings plan like a robot, regardless of the price, you can accumulate a considerable fortune in the long term, even with small sums, which will help you not to have to worry, at least financially, when you retire. Our supposedly small 50-euro savings plan on Berkshire Hathaway has now become over 5,500 euros after almost six years.