Most people only put something aside if there is something left over at the end of the month. They put aside constantly changing amounts and save only irregularly. However, if you stick to the golden rule of saving, paying yourself first and only then spending on rent, cars, food and the like, you’re sure to end up with something put aside and a fixed savings rate. This is calculated from the sum of all income that flows into the account each month, minus all expenses, and is then put into perspective.

Someone who earns 1,500 euros net per month and spends 1,300 euros on living expenses can save 200 euros per month. This corresponds to a savings ratio of around 13.3%, which is the actual savings rate. Over the last few decades, Germans have put away around 10% of their monthly wages. Last year, however, the savings ratio of Germans rose sharply. According to figures from the Federal Statistical Office, the savings rate of private households climbed to an impressive 16.1% in 2020.

The reason for this is quite simple: Due to the Corona pandemic and the associated restrictions and uncertainties, many German citizens took precautionary measures. But for many, this was probably less a matter of precautionary saving, as there have been far fewer opportunities to spend money at all in recent months: Vacations had to be canceled, the weekly restaurant and club visit could sometimes not take place at all. It’s quite possible that Germans will soon be reducing their savings rate back to the usual level.

A high savings rate makes early retirement possible

But for someone who wants to provide for their old age and perhaps even retire earlier, the savings rate has great significance. One example: Someone who has managed to put aside 50% of his income over many years has also proven that only 50% of his salary is enough to finance his current standard of living. He therefore buys himself a free month every month and can thus retire early. With a savings rate of 50%, that’s about 17 years; if you save two-thirds of your income, you only have to work ten more years.

Of course, 50% is quite a figure, and it’s hard to achieve such rates, especially on a smaller income, which may already be eaten up to a large extent by rent. But you don’t need millions in your account, and even with a disciplined savings rate of 20%, you’re likely to retire early before you reach the standard retirement age.

Continuously increase the savings rate

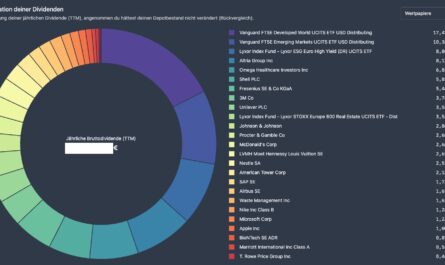

If you spend around 1,250 euros of your monthly salary of 1,800 euros, you will save 6,600 euros over the year, giving you a savings rate of 30.6%. With an average annual return of 5% and a later withdrawal rate of 4% in the pension phase, it would take 27.5 years to reach the goal of financial independence and would be able to cover their fixed costs purely through their capital assets. On the other hand, anyone who has managed to put aside 100,000 euros early on and otherwise invests on similar parameters would only need 16 years. The average 30-year-old earner who has taken the magical goal of 100,000 euros to heart could therefore retire at the age of 46, more than 20 years earlier than most Germans.

If he even manages to reduce his spending to 1,000 euros, this goal will be reached in just 10.7 years. The savings rate is then a remarkable 44.4%. Even without a cash buffer, the target is reached after 19.3 years. If you do the typical German and save only 200 euros of your 1,800 euros, which roughly corresponds to a savings rate of 10%, you will need 49.2 years.

| Net income | Expenditure | Savings | Savings rate | Duration until retirement |

|---|---|---|---|---|

| 1.800 Euro | 1.600 Euro | 200 Euro | 11,1 % | 49,2 Years |

| 1.800 Euro | 1.250 Euro | 550 Euro | 30,6 % | 27,5 Years |

| 1.800 Euro | 1.000 Euro | 800 Euro | 44,4 % | 19,3 Years |

| 2.500 Euro | 2.000 Euro | 500 Euro | 20,0 % | 36,7 Years |

| 3.000 Euro | 2.000 Euro | 1.000 Euro | 33,3 % | 25,7 Years |

Just because you earn more, you don’t necessarily have it easier

On the other hand, if you earn more, you can save more in absolute terms, but as a rule you also have a significantly higher standard of living and therefore greater expenses. The car, the apartment and the TV: everything regularly adjusts to the salary increases, even though you don’t really need the luxury leaps. This is called lifestyle inflation. If you continuously increase your spending along with it, you’re not making things any easier for yourself.

So the lever is clearly the savings rate. The goal should always be to keep spending as low as possible and thus the savings rate as high as possible. There’s a trick for this, too: save at least an additional 50% of every salary increase and bonus in the future. In this way, you can slightly increase your own standard of living, but overall you also increase your savings rate and ultimately get closer to your goal more quickly. Those who are fully satisfied with what they have, simply save the increase in income 100% and ignite their time machine!

I recommend the blog to Oliver Nölting, whose goal as a Frugalist is to be able to retire as early as possible in order to enjoy the greatest possible freedom in life. With the time freed up, he can do what he wants: be fully there for his family, or only take on projects as a self-employed person that bring him absolute fulfillment. On his blog he gives many tips and suggestions, but also reports regularly about his income and expenses as a family man.

If you’d like to run through your own scenario, it’s best to use the Frugalist calculator.

Keyfacts

- the savings rate is the amount saved in relation to income

- the higher the percentage, the more you save

- … and the earlier you could retire

- the savings rate is the biggest lever when it comes to early retirement

- lifestyle inflation should be avoided

- bonuses and salary increases should be saved additionally

- those who want to retire early do not necessarily need millions