While Olaf Scholz may only have generated a few euros of interest in cash flow with his savings account investments, the Norwegian sovereign wealth fund has brought in billions in income from dividends, interest and real estate. In the first half of 2022, distributions for the world’s largest sovereign wealth fund amounted to more than NOK 13.3 billion, the equivalent of about EUR 1.35 billion.

However, that is only half the truth, because the bottom line was that the fund posted a record loss in the first six months of the year. The market value fell by NOK 1.68 trillion, slumping by 14.4%. While the fund managed NOK 12.34 trillion at the end of 2021, it was down to NOK 11.66 trillion at the end of June. This is the biggest half-year loss since the fund was established in 1996. The war in Europe, high inflation and rising interest rates hurt the fund.

Mainly the weakening stock markets were reflected in the result, which alone were responsible for a decline of almost 17%. The technology sector with Meta, Amazon and Apple, but also with Microsoft and Alphabet was the main culprit. There were also strong returns in the consumer goods, industrial and financial sectors. Only the energy sector was able to provide gains and reduce the minus somewhat. However, this is not surprising in view of the high commodity prices. In addition, the exchange rate of the Norwegian krone weakened and depreciated against several major currencies.

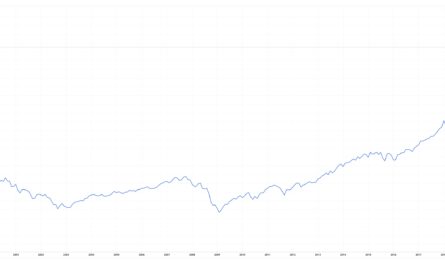

In the long term, the fund yields a lot of return

Overall, the result is nevertheless remarkable. According to the semi-annual report, the fund’s return was still 1.14 percentage points above that of the benchmark index. Moreover, in terms of market value, the Norwegian sovereign wealth fund has grown by more than 6% per year on average since 1998. 2021 was the second best year ever, surpassed only by the record year 2019. At that time, the fund generated a return of 14.5%.

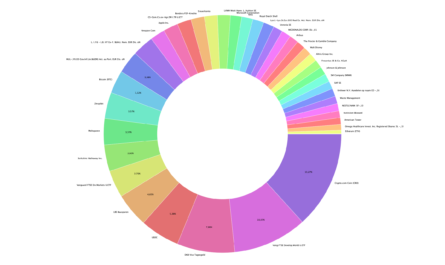

As of June 30, 2022, the fund had a value of NOK 11.656 trillion, equivalent to approximately EUR 1.18 trillion. Of this, 68.5% was invested in equities, 28.3% in fixed-income securities, and 3% in unlisted real estate and 0.1% in unlisted renewable infrastructure energy. The investment strategy is set and regularly adjusted by the Norwegian government. Most recently, investments withdrew from Russia due to the war in Ukraine, and investments in the coal industry were also gradually reduced.

The fund was established in 1996 to ensure that the Norwegian state would be able to finance its oil and gas resources even after they dried up. Among other things, government revenues from the country’s oil business flow into the fund. It holds around 1.5% of all listed shares worldwide and has stakes in more than 9,300 companies from 70 countries. Due to the recent market recovery, the value of the Norwegian sovereign wealth fund has meanwhile broken through the NOK 12 trillion mark again.

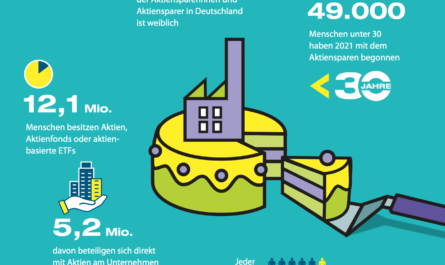

Germany needs something similar

In view of demographic change and the fact that the German state’s social spending has increased exorbitantly in recent decades, we as Germany must ask ourselves the same question of financing in the medium term and should therefore take Norway as a model and install something similar. We should all participate in the global economy and let the big successful companies like Apple, Amazon or Meta contribute to our pension. Billions of taxpayers’ money will have to be spent to set this up, and the system will only pay off in decades, but it would be an investment in the future of our country, an investment in young people and our future generations.

In the traffic light coalition, there seems to be a first, cautious step in this direction in this legislative period. The government, led by the FDP and Johannes Vogel, is planning the share pension. In the future, 2% of the employer’s gross salary will flow into a stock fund organized by the state, which will invest in the capital market on a long-term and globally diversified basis. Employers and employees are to pay 1% each, while the traditional payments into the pension insurance system are to remain largely unchanged.

Keyfacts

- Norway’s sovereign wealth fund generates billions in cash flow

- … thus supports the financial budget

- … secures the financing of the state in the long term

- … invests broadly in equities, bonds and real estate

- … has achieved an average annual return of 6%.

- Germany needs something similar!