In addition to the long-term investment for retirement planning, we deal a lot with short-term trading. The goal: The monthly profits from futures trading should be additionally put into the portfolio in order to be able to reach the financial goals even faster. After we had already introduced the derivative in its basic features, we want to dedicate ourselves today to the necessary conditions. It is not enough to simply place an order via your securities account.

The Software

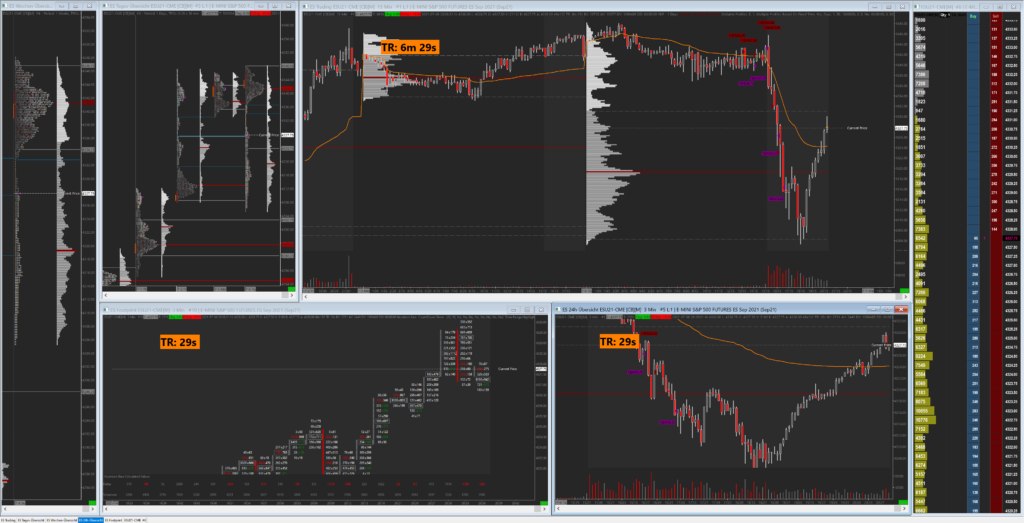

If you want to be active on the futures markets, you have to take some precautions, some of which cost a lot of money. This starts with the software that processes the data from the exchange to make the analysis and execution clearer for the trader. For our trading, we use Sierra Chart for this purpose, a trading software that is currently only available for Windows systems. It is programmed in a resource-saving way, but its feature set is extremely powerful.

It not only allows to display an order book or a classic candlestick chart, but also does important calculations like the trading volume, the delta development, shows the limit orders in the market or logs the market orders from the bid and ask in the footprint. In addition, the market and volume profiles are supported, just like many indicators, but we do not use them. We rely on the cleanest chart possible, where we only draw in our zones and price marks ourselves. The use of Sierra Chart requires some training, for which there are some support documents on the website.

Sierra Chart is only available as a subscription, for which you have to pay between 26 and 56 US dollars per month, depending on the necessary range of functions. An alternative, which is clearly simpler from the handling, for it not completely so extensive, is ATAS. Here you pay at least 69 Euros per month, but you also have the option of purchasing a lifetime license for just under 1,800 Euros.

The Data feed

In order for the software to perform its calculations and do the graphical display, it must be populated with data. A direct connection to the futures exchanges is a mandatory requirement. We use the Denali feed, which costs 10 US dollars per month, depending on the subscription of Sierra Chart, is partly already included. In addition, an exchange fee must be paid. We mainly trade the crude oil future, the S&P 500 as a stock index and the gold future as well as occasionally the copper market. These futures are mainly traded on the CME and COMEX in the USA, whose connection costs a further (in each case) 10.40 US dollars for private traders. If you want to trade the DAX or the Bund future on the German EUREX, you have to pay another 25 euros per month.

The data feed and especially the software are the most expensive hurdles in futures trading.

Der Broker

You cannot simply place a futures order via your house bank. For this you need a special broker. I use AMP Futures from the USA because it is one of the cheapest futures brokers worldwide and has very low margin requirements. Here you pay in the ES (S&P 500) for the opening of a 1-lot position 1.75 US dollars, for the closing another 1.75 US dollars and thus Roundturn 3.50 US dollars. Those who open and close the trade at peak trading hours must deposit a security deposit of 400 US dollars per lot, although this can be increased by the broker at any time depending on volatility.

For Cruide Oil (CL), a minimum of $1,000 in margin must be deposited, and the roundturn fee per lot is $4.06, or $2.03 per side. With this, one should have an account size of at least 5,000 US dollars. If you want to trade larger positions or run several trades simultaneously, you will need more capital. The same applies if you want to hold your positions overnight, because then AMP Futures has completely different margin requirements for the trader.

The Contract

In order to trade a future, a market and therefore a contract is required. This should always be adapted to the account size, because not every future can be traded with every account in view of the margin requirements or the tick size. The ES future, and thus the S&P 500, moves in points, with each point consisting of four ticks. Since the tick value is $12.50, this means that the smallest price movement will result in a loss or gain of $12.50 for us.

Depending on the market phase and level, we may need a stop loss of ten to twelve ticks to even take the risk. We therefore have to accept a loss of 150 US dollars for one lot, which should be taken in relation to the account size. It is said that you should never risk more than 1% of your capital per trade. In this case, that would entail an account size of $15,000.

For a few months, however, there have also been micro futures, which came onto the market in competition with CFDs. Here the tick value amounts to only one tenth and thus to 1.25 US dollars in the S&P. Profit and loss are thus much smaller, but also require a much smaller account. 64 US cents are due per lot and round turn for AMP futures, the margin is usually only 40 US dollars. This makes the micro futures especially suitable for beginners and all those who do not want to risk a lot of capital.

The contract specifications of each futures can be found directly at AMP Futures.

Keyfacts:

- Software such as Sierra Chart or ATAS is mandatory.

- Data feed directly from the exchange must be subscribed to

- Exchange fees are additional depending on the futures exchange

- you need a special futures broker

- depending on ticksize and stop a corresponding account size is required