To counter rising prices, the central banks have turned the interest rate screw sharply in recent weeks and months. Whereas commercial banks had to pay money for their deposits with the central banks until recently, they now receive a few percentage points of return again in return, which they can pass on to their customers and thus to end consumers.

The key interest rate in the U.S.A. is currently 5.13%, almost the same level as at the time of the banking crisis in 2007 and 2008, but has not yet marked a new all-time high. The situation is similar in Europe, although the key interest rate here is still a good deal lower at 3.75%.

It stands to reason that banks are currently outbidding each other to get the highest possible deposits from their customers again. Of course, they are not passing on the key interest rate in full to their customers, in order to earn a bit more from the deposits themselves. But there are banks that are still very stingy when it comes to interest payments. Isolated savings banks hold on to interest rates below the 1.0% mark or even pay no interest at all on credit balances. Users of call money accounts and short-term flex and time deposits should react.

A comparison can be worthwhile

While well-known major banks usually stop at around 0.6% to 1.5%, fintechs such as Scalable Capital* and Trade Republic* are courting new customers and offering interest rates of around 2.0% to 2.3%*. It is particularly profitable for customers if they switch their overnight deposit provider as a new customer. ING, for example, pays 3.0% p.a. for six months to new customers* or customers who had not used their call money for a long time and want to reactivate it. At Barclays, you even get 3.11% when you open a new overnight deposit account*.

It is worth taking a look at our call money calculator, which takes into account both new customer promotions and regular offers from some banks for its comparison.

Continue to think about interest rate staircase

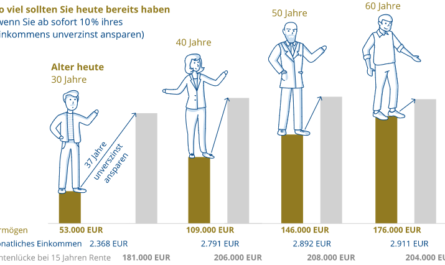

However, if you plan to invest part of your reserves for a longer period of time, you should not necessarily go to the trouble of jumping from offer to offer. It is still advisable to build up an interest rate ladder. This way, you can benefit from interest rates that are likely to rise even further, just as with a regular savings plan, and still remain flexible without having to put all your money at the bank’s disposal for a longer period of time.