In recent weeks, there have been several signs that the profitable times on the crypto markets may soon be over. For example, numerous platforms reduced the returns on deposits of coins and tokens. Crypto.com*, a platform we often use, slashed interest rates neatly and introduced a tier system that provides different return figures depending on the size of the deposit.

In short, those who invest higher sums get significantly less from the next month. In some cases, the interest rates are reduced by more than two-thirds, and that already from an investment amount of the equivalent of only 3,000 US dollars. Crypto.com* also revised its card program and cut the cashbacks and interest rates for all its Visa cards. It will be harder to increase one’s coin count in the future.

As if the trouble for investors wasn’t already big enough, they also had to cope with a considerable drop in prices on the stock exchanges this week. Bitcoin alone dropped more than 25% at times this week and, as the lead currency, is already more than 60% away from its November highs. It is the sixth week in a row in which Bitcoin investors have had to accept losses.

The stock market quake has a very special reason and it is so far unique in the young history of cryptocurrencies: A coordinated attack on the Terra ecosystem and the stablecoin TerraUST, which had lost its peg to the U.S. dollar in recent days, losing over 90% of its value at times. Whether Coin and Blockchain will survive this is questionable.

TerraUSD has lost its dollar peg

This was preceded by massive sales of UST in the millions on centralized and decentralized exchanges such as Binance or Curve. And this at a time when liquidity was rather low. This was followed by massive shorts on LUNA and hundreds of Twitter posts with FUD content on the Terra ecosystem. At its peak, short positions of more than $4.2 billion were open by Wednesday, and at the same time, a huge amount of UST that had previously been sourced over-the-counter was additionally brought to the market, which finally threw the supply-demand interplay into turmoil and caused the price of the stablecoin to drop rapidly.

This, of course, had an impact on LUNA. The price dropped by more than 98% within a few hours and is now only trading at junk level. On some exchanges, the tokens are no longer tradable. At its peak, the coin was trading at over $120, with a market capitalization of more than $21 billion and UST’s at another $18 billion.

The reason why both tokens on the Terra blockchain lost value so quickly is due to the architecture of TerraUSD (UST). This is because, in order to be able to map the value of the US dollar, the US dollar price and the price for the LUNA token are compared. If the price of UST exceeds the real dollar price, LUNA tokens must be burned and new TerraUSD must be created. By increasing the supply, the price of the stablecoin should fall again. If the price fell, new LUNA tokens had to be created and UST burned. This happened completely automatically via an algorithm and was supposed to kick in at a deviation of just one percent.

As UST fell due to the supply overhang and the simultaneously steadily decreasing demand, new LUNA tokens had to be generated and TerraUSD burned. The result was a huge supply inflation of LUNA, the price could only fall. In the end, billions to trillions of tokens were created every day. The downward spiral took its course.

Sale of reserves pulls down bitcoin price

The Terra Luna Foundation (TFL) originally had the plan to additionally secure TerraUST with Bitcoin and therefore bought Bitcoin for about 10 billion US dollars in the last months. However, the system was under construction and could not automatically absorb UST’s massive price drop on Sunday. The expensively purchased Bitcoin had to be thrown onto the market cheaply, which had an impact on Bitcoin and dragged it down as well.

As bitcoin hits new lows for the year and struggles to reach the $30,000 mark, TerraLUNA is fighting for mere survival. A contingency plan is in place to bring the UST back to its dollar peg and save the entire ecosystem. Even if that succeeds, trust is likely gone among many users. At times, the blockchain has been halted completely. The signs are bad that TerraLUNA will survive this.

Rumors sporadically surfaced that Blockrock and Citadel were behind the attack, i.e. one of the largest traditional asset managers and the creators of USDC, another popular stablecoin that actually requires US dollars to be deposited as value. However, both companies denied this.

USDT, the most widely used stablecoin with a market cap of $75 billion, also faltered shortly after, plummeting nearly 5%. This is not the first time this has happened to USDT (Tether). The coin has always been criticized for not having fully secured its users’ deposits.

Heavy losses for us as well

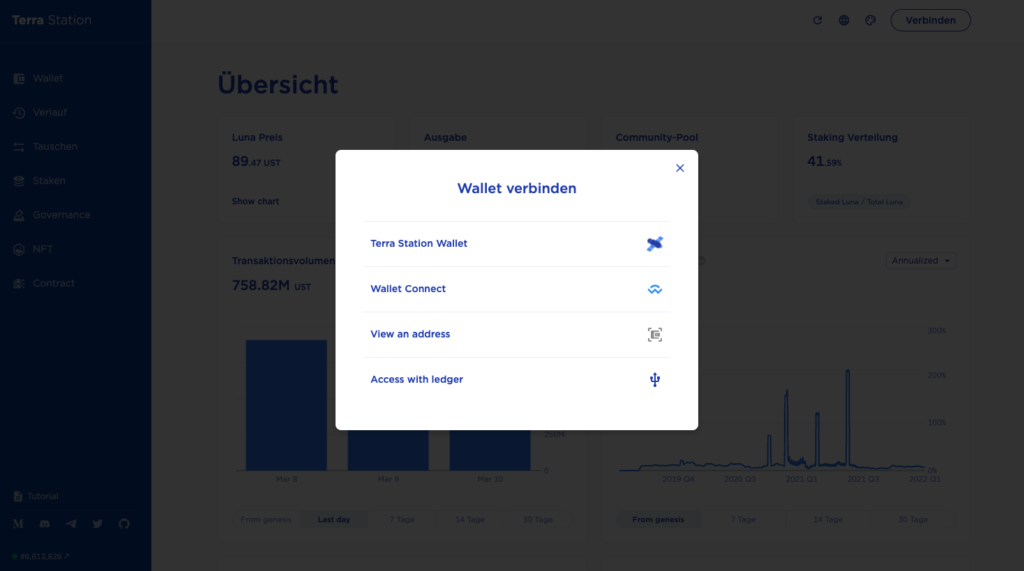

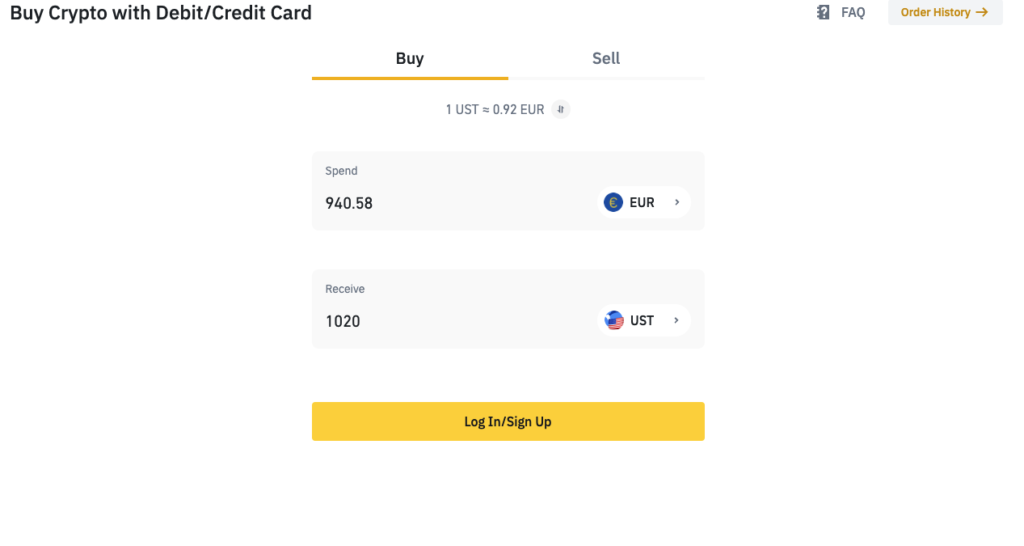

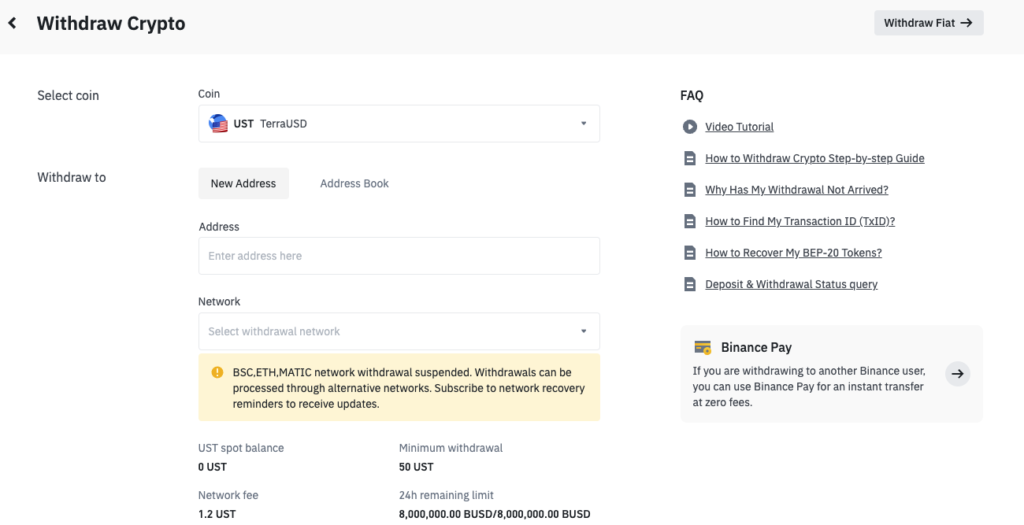

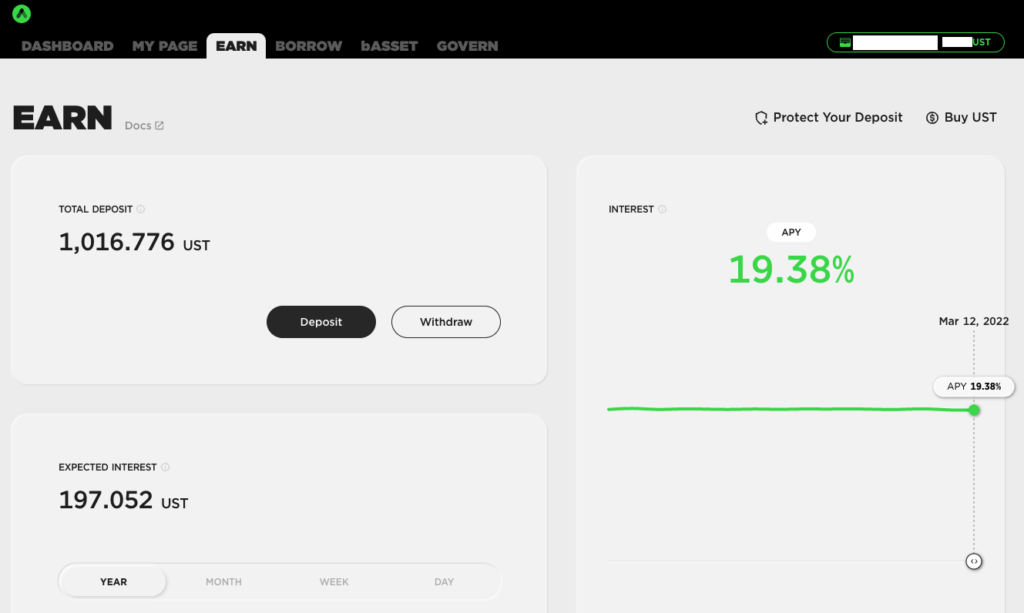

We were also invested in UST and LUNA and had even discussed the deposit into Anchor’s savings protocol in this blog. Since we had deposited coins as collateral to receive more, we acted leveraged so to speak and took a big risk. These positions have already been liquidated in the course of the massive price drop in the night to Monday, so that we had lost our entire LUNA holdings. Also our deposits at Anchor are currently still in the log.

If the Terra Luna Foundation (TFL) does not manage to support the price of UST in the coming days and bring it back to one U.S. dollar, we will also have to withdraw these deposits at a loss via decentralized exchanges – if the blockchain is still running at all by then, or if transactions go through at all in view of its utilization.

Specifically, we have already fully written off all of our investments in the Terra ecosystem.

Keyfacts

- a coordinated attack shook the ecosystem on TerraLUNA

- the stablecoin UST lost its peg to the US dollar

- the network was temporarily paused, trading was suspended

- the Bitcoin price was also dragged down by the sale of reserves

- the outcome is still open

- high losses already, total loss possible