Word has long since spread among my friends and acquaintances that a solid financial investment for my own retirement provision has become quite important to me. Whenever I point out the pension problem to others or tell them about the opportunities offered by the capital markets, I often meet with great interest and get the feeling that the person opposite wants to do the same as quickly as possible. But if I ask just a few days later, nothing has happened.

No excuses! Just do it!

I’ll start tomorrow!

That is probably the most frequent answer, which is brought to me then! But what is so difficult about opening a securities account, transferring a few euros to the clearing account and simply buying the first shares? The opening of the securities account is done after a few clicks, the transfer as well. Only the verification with the broker may take a few days. Especially at the start, I find it important to simply start trading. The right ETF can still be selected later, the most favorable depot as well.

The first own experiences are priceless. If you already have shares, then you are already on the fast track and have a lot ahead of others!

I don’t know my way around well enough!

Knowing what you are doing is certainly right and important in many areas of life. But when it comes to investing, you can’t really make any mistakes. You merely gather new experiences and learn from them. If you let your bank advisor talk you into an expensive fund at the beginning, you’ve just paid a few euros in fees too much, but you’ve probably still made more returns than if you’d parked your money entirely in a call money account. You gain experience, learn from it and make adjustments.

Even after years, you will (want to) optimize your investment again and again. My strategy has been set for years, but time and again I find myself adding more companies to the portfolio instead of just adding to the existing positions. I have too much fun reading through business reports, evaluating companies or discovering new business ideas. We save for decades, so it’s natural to rethink previous positions at some point.

A lot is accomplished with the opening of a deposit account and the first position. Any adjustments will almost certainly follow later. The flood of information is enormous: you can read thousands of books on the subject of money, attend numerous lectures or watch hours of relevant videos on YouTube. One will never finish acquiring all the knowledge. However, if you try, you will lose valuable time.

Soak up the knowledge along the way and just buy your first security: whether it’s a fund, ETF or a single share of your favorite company. It doesn’t matter!

I’m waiting for the crash first!

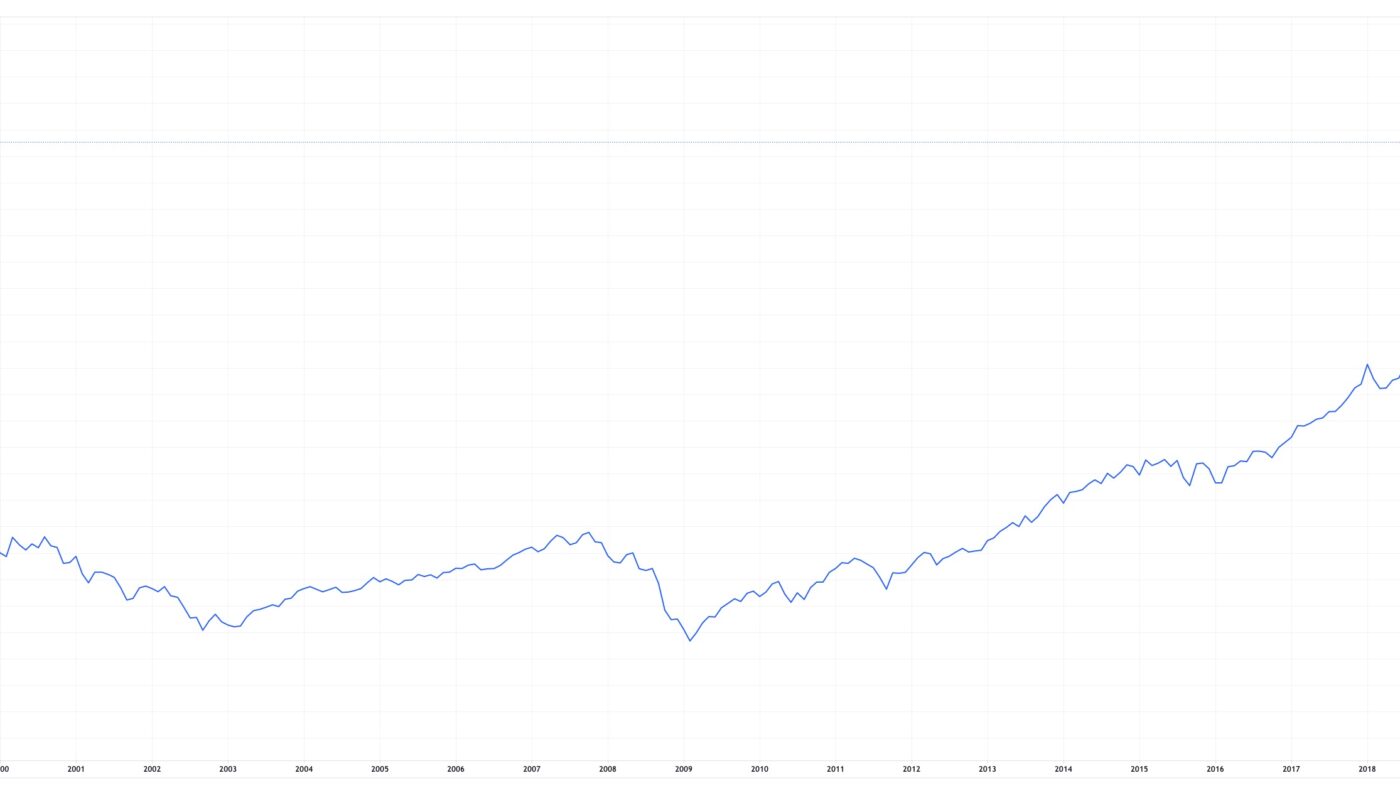

I also hear this relatively often. While it is laudable to wait until you get a discount for the same product and thus either save money or buy more of it, in practice this is not feasible in the capital markets.How does one know that a stock crash is imminent?There are stocks that have only risen for decades and there were market phases that lasted for years until a correction occurred in the other direction.Even if the crash is there, how do you know that the bottom has been reached and that prices won’t drop even further the next day? If you wait too long, the recovery may have already happened.You miss potential returns with every day you wait.

The optimal entry point can only be found by looking at the chart after the fact. In the long term, we always have a high probability of exiting the market with a profit by the time we retire. If you have invested in the DAX within the last 50 years and held your investment for at least 15 years, there was not a single entry point during which you would have made losses!If you have invested directly before a crash or a stronger setback, you just stupidly push your monthly savings rate into the depot, buy more shares at a cheaper price and profit even more in the recovery.

Just zoom out of the chart and you will see that this has always worked!

Being there is everything!

That should really be the motto! Those who are there not only have their first experience, but also take potential returns with them every day. In 2019, a study by Hamburg-based Sutor Bank found that anyone who missed the best 13 days in 31 years would have lost half of their return. Exiting at times of crisis or simply not being there has serious consequences for returns. Investors who would have taken all stock market days in the DAX in the period from 1988 to 2018 would have received an average return of 7.16% per year.

Those who are in for the long haul always make a return

Without the best ten days, the return would have shrunk to just 4.32%, and without the best 20 days to just 2.21% per year. If you had missed the 40 best trading days in the DAX within this period, you would have made a loss of -1.24% per year; without the 60 best days, it would have been -3.98%. In other words, anyone who was not invested for only 0.4125% of the decisive trading days made a loss.

The topic of “market timing” is therefore difficult to assess in the long-term view for retirement planning and should therefore be better neglected. Simply remain continuously in the market and top up with regular savings installments. Then you get more for your money in times of crisis, and in normal times you simply keep adding to your savings, thus building up your assets.

Conclusion: The best day to start was yesterday! The second best day is today! So let’s get going!

Keyfacts:

- don’t look for excuses, just start!

- You will always adjust your investment anyway.

- you cannot make mistakes, you learn from your experiences

- in the long run you have a low probability to lose money

- develop yourself continuously and absorb new knowledge along the way

- whether possible crash, losses or wrong products: Nothing should stop you!