The stock market is not only a playground for long-term investors who are concerned about their old-age provision, but also for those who hope to make high profits in the shortest possible time through a wide range of speculations. Those who buy shares for eternity have usually chosen solid companies that have already proven in the past that they are economically well off and can handle money excellently – after all, the investment should still exist in a few decades.

However, the stock market is also a playground for speculators who are looking for high short-term profits. These can be collective actions, as recently in the Gamestop stock on Reddit, or short-sellers, as in the Wirecard case, who repeatedly uncover negative aspects of companies through their research and therefore bet on falling prices. The last group is large institutions that move money and ensure price stability and high liquidity in the market through their speculation. Speculation and short-term trading need not be a bad thing per se.

The stock exchange is also a playground for speculators

In recent years, the topic of “trading” has become more of a focus for private investors. Thanks to simple apps and, above all, a favorable price structure, more and more investors are trying to earn some extra money with a little play money. The advantages are obvious: Thanks to high leverage, which allows you to borrow money from the broker, you can take significantly larger positions and buy ten Amazon shares instead of just one, which currently stands at over 3,500 US dollars. This means that considerably smaller stakes and significantly higher price movements are possible, which in turn attracts quick profits for the investor. On the other hand, the high leverage means a high risk of loss, because the price movements always have an impact on both sides.

Thanks to the apps, you can theoretically trade from anywhere: Whether from the beach via smartphone, or on the sofa on the notebook. You don’t have to go to work first and enjoy free time management on top of that. Trading on the stock exchanges is possible almost around the clock thanks to worldwide availability. Europeans trade at night on Asian exchanges, in the morning on their home exchange and in the afternoon on American exchanges. With cryptocurrencies, this is even possible on weekends, because there are no days off here, trading is possible throughout.

For many, short-term trading, where trades are held for only a few hours or even minutes, is an exciting speculation – either it works out with a high profit, or you lose everything.

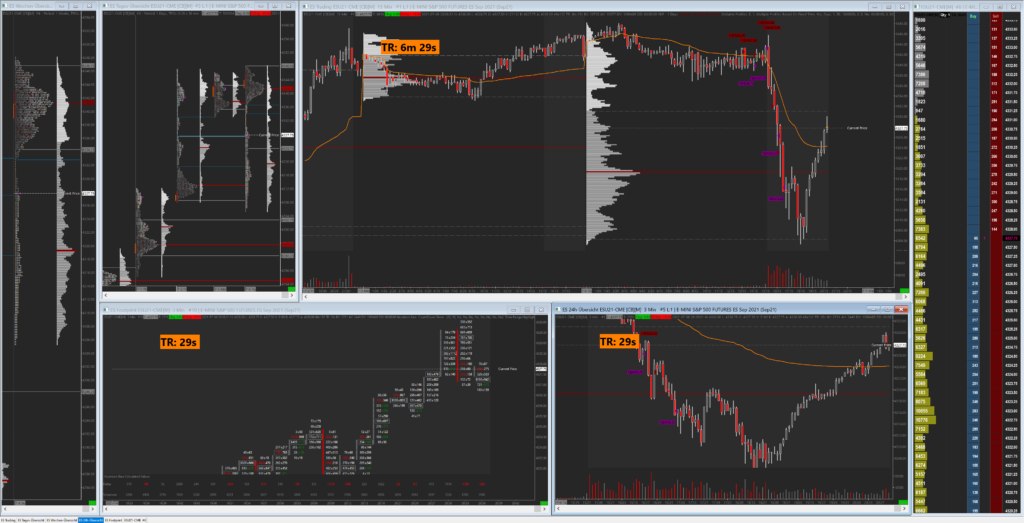

We trade futures…

In this blog we will also deal with the topic of (day) trading in detail and focus mainly on the futures market. Here you usually hold positions for only a few hours, close your own trades within the day and can use high leverage via a margin account. It is the Champions League of the trading markets. You act together with the professionals, who either have been doing this for many years or move the market themselves anyway with their huge position sizes. These big fish are the ones to identify and get in line behind. But more on that in due course….

Keyfacts:

- High leverage allows for high profits with low stakes, but beware: high losses are possible as well.

- Trading is possible almost around the clock

- Trading is possible anytime and from anywhere thanks to simple apps

- Free time management

- Exciting speculations can be appealing

- High liquidity