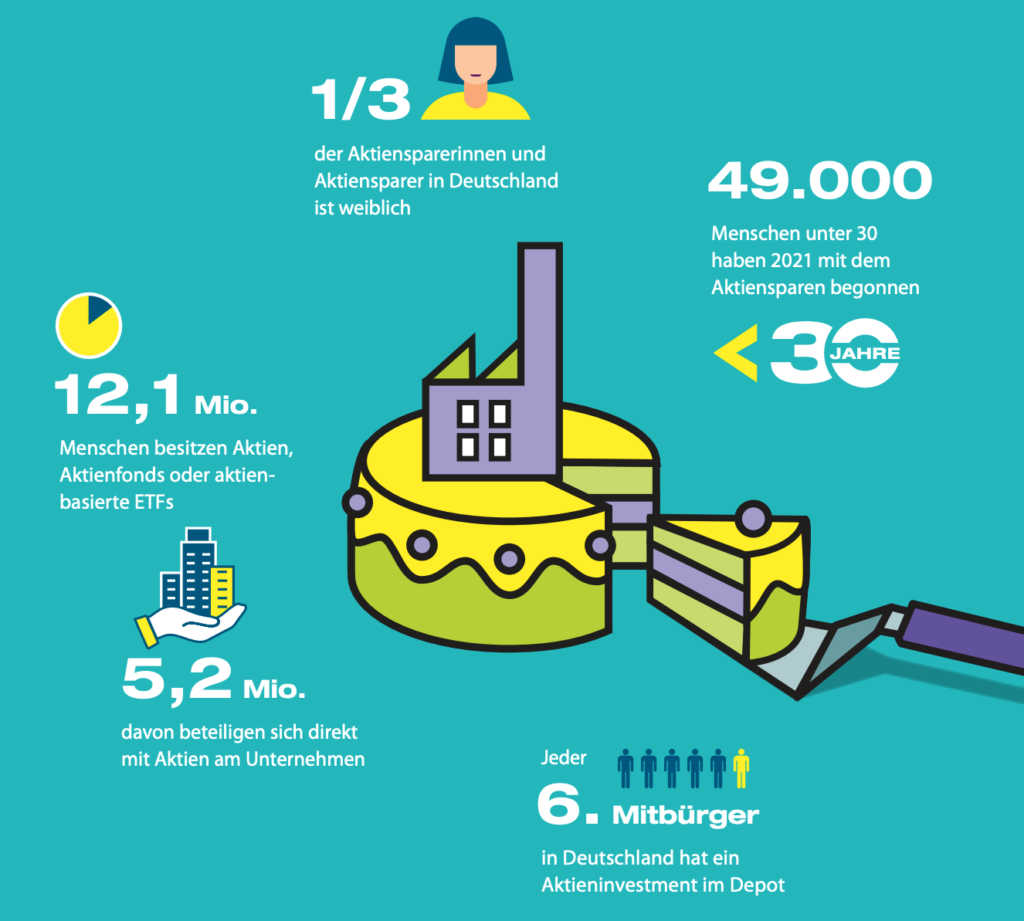

The number of shareholders in Germany has recently fallen again. In 2021, there were just under 12.1 million people in Germany who invested in shares, equity funds or equity-based ETFs. This corresponds to around 17% of the German population aged 14 and over, or one in six German citizens. At the beginning of the pandemic, there were about 280,000 more. It is the third highest level since the German Equities Institute (DAI) began its surveys in 1997.

According to the survey, the average shareholder in Germany is predominantly male and already of advanced age, with the potential tailwind of longer working hours and thus greater wealth. Almost one third is over 60 years old, only just one third is female, and this despite the fact that women in particular are more frequently threatened by poverty in old age.

High income, high level of education

The higher the net income, the greater the likelihood of investing in securities. Only around 5.4% of men and 8.4% of women with a net income of EUR 1,000 or less own a securities account. With a net income of 1,000 to 2,000 euros, the rate is almost twice as high. The proportion is even higher with a monthly income of over 4,000 euros. In this case, 51.2% of men and 26.3% of women own a securities account.

The level of education also plays a role. People with an elementary or secondary school diploma are up to three times less likely to invest in equities than people with an intermediate school leaving certificate or a baccalaureate. There is also a clear West-East divide. While only around 10.9% of people in eastern Germany own a share portfolio, the figure for western Germany is 18.6%.

According to the Deutsches Aktieninstitut, more than half of all custody account holders invest mainly in funds, while around one fifth to one quarter also buy individual stocks. Very few invest exclusively in equities.

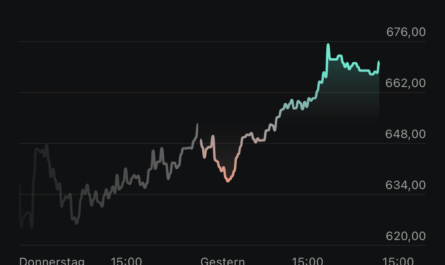

Cyclical trading is damaging

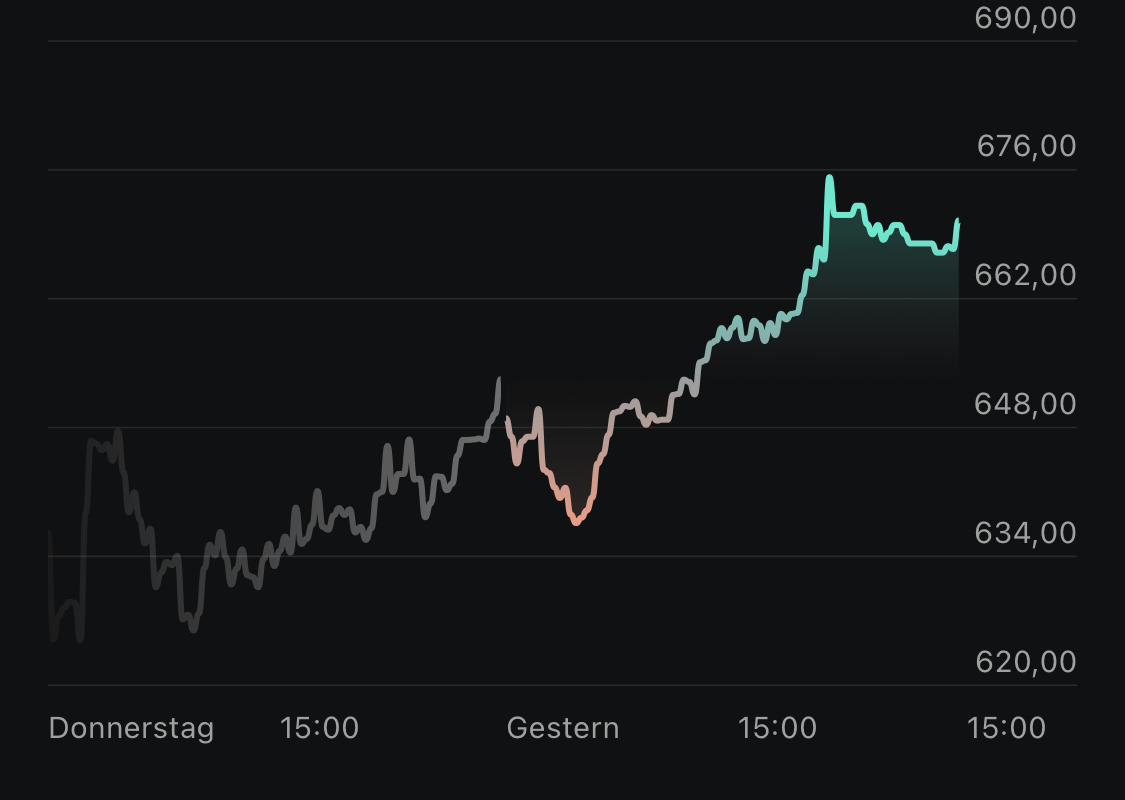

It is particularly striking that when share prices rise, the number of security owners in Germany increases. If prices fall, the number of shareholders also falls. German households therefore tend to act cyclically. This was particularly evident in 2008, when both share prices and the number of investors fell almost in step. For investors, this has significant disadvantages: they don’t even take the biggest price gains in the first place, because they get in far too late, and they tend to sell at favorable prices when they themselves may have suffered a loss. Meanwhile, it should be just the other way around: It is best to save regularly and permanently via a savings plan anyway.

After all: During the Corona crash and the following months, many securities accounts were opened in Germany and money was invested. The Corona crisis led to a sharp rise in the number of securities accounts. According to the Deutsche Bundesbank, more than 26.5 million private securities accounts have been held in Germany since then, which represents a new record high. However, this is likely to be largely attributable to neo-brokers, who are courting customers with low trading fees and/or free savings plans. On average, a shareholder in Germany has at least two securities accounts.

ETF boom continues

Above all, index funds (ETFs), which we also recommend again and again in this blog, enjoy great popularity among German investors. According to an analysis by extraETF, which includes data from 13 banks, the ETF investment volume in Germany has increased by more than 500% since 2011. In July 2020 alone, more than 1.8 million ETF savings plans were executed, representing a year-on-year increase of half a million savings plans. The trend is even clearer in terms of volume, with €309 million invested via ETF savings plans in the same month. In January, the average ETF savings plan rate was 189.92 euros, mostly this was around 150 euros per month in recent years.

It is even more difficult to find concrete and, above all, reasonably up-to-date figures when it comes to the average deposit volume. According to Consorsbank, customers had an average of around 67,000 euros in their securities accounts in 2021. Including other banks and the neo-brokers, which are particularly popular with the younger generation with potentially lower assets, this amount is likely to be significantly lower.

New generation of investors

With the emergence of neo-brokers such as Scalable Capital* or Trade Republic*, a new generation of investors seems to be positioning itself. According to a recent study conducted by DIW for Trade Republic, 70% of Trade Republic customers are under 35 years old, 85% are male, and 47% are first-time investors with no previous stock market experience. Over 80% of respondents had less than five years of investment experience. On average, they were 60% invested in individual stocks, 26% in ETFs and as much as 2% in derivatives. The vast majority of the remainder was available on a daily basis in a clearing account.

The younger generation thus appears to be more risk-averse than the average figures of the Deutsches Aktieninstitut show.

Keyfacts:

- a high income and a high level of education increase the chance of investing in equities

- ETFs and funds remain extremely popular

- ETFs in particular are booming

- On average, every equity saver has two securities accounts

- Younger savers are more willing to take risks