At the start of this blog, we took an in-depth look at the German pension system. In a series of articles, we not only explained how the most important vehicle of the welfare state works, but also discussed the problems of demographic change, pension information and, of course, the looming pension gap in old age. Even if this is very individual, there are figures that recommend how much money one should have on the high side at what age.

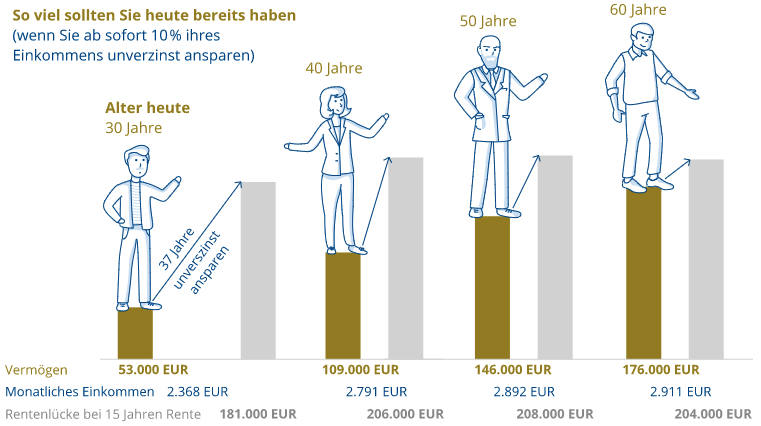

For example, the platform Weltsparen*, which we use for our overnight and fixed-term deposit accounts, published interesting figures. Based on the average salaries of various age groups and their expected pension gap, the platform determined how much savings one should already have accumulated at the age of 30, 40, 50 or 60 in order to be able to live on after retirement with a savings rate of only 10% on average without cutting back.

For the calculation, it was assumed that the unmarried and childless person lives in an old federal state with statutory compulsory insurance as well as church tax and will retire at a retirement age of 67. It is further assumed that the retirement period will last about 15 years with an average life expectancy of 81 years. Each month, 10% is put aside, which is always recommended by many financial experts, but which we would not be satisfied with.

This is how much money you should already have on hand

Accordingly, a 30-year-old with an average net income of EUR 2,368 should have around EUR 53,000 in savings to close his pension gap with a later total of EUR 181,000 and a further savings rate of 10% in subsequent years. In the case of a 40-year-old who, according to the assumptions, earns an average of around EUR 2,791 and thus has a larger pension gap, a total sum of EUR 206,000 would already mean EUR 109,000 in the savings account. A 50-year-old should have saved 146,000 euros for this, and a 60-year-old 176,000 euros. Of course, average salaries have continued to rise over time, which means that the required capital has also increased.

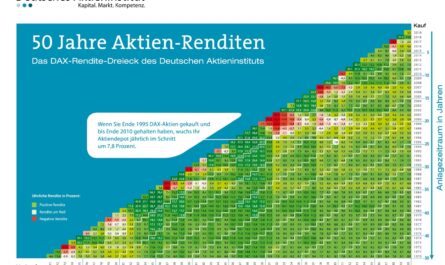

The important point here is that it is assumed that the savings sum does not earn any return. In practice, therefore, smaller sums should suffice if they are invested on a broadly diversified basis over decades.

Actual figures

In October 2020, the Cologne-based Institut der deutschen Wirtschaft (Institute for the German Economy) published figures showing the net household wealth broken down by individual age groups and different percentiles. According to these figures, a 30- to 34-year-old has around €17,800 on average. However, the lowest 10% percentile has debts of around EUR 6,200 on average. The top 10% in this age group even have around 202,200 euros. There are no more debtors in the 55-59 age group, although the lowest 10% percentile has no assets at all, at 0 euros. The middle percentile still has 121,900 euros, and the richest 10% have more than 625,400 euros.

At the age of 75 and above, the wealth decreases again significantly, as it has been continuously consumed during retirement. Then the top 10% percentile owns only 517,700 euros, the middle 112,500 euros and the weakest shoulders 800 euros.

Both statistics can be used as a rough guide for one’s own wealth and investment planning. Above all, they make it possible to set realistic goals. However, one’s own pension gap and actual financial needs for old age remain very individual. Wealth and assets are subjective perceptions.

It remains important that younger people in particular should get out of debt as quickly as possible so that they can consistently start building up assets for their old age. The state, and thus ultimately society, will not be able to absorb everyone.

Keyfacts:

- it does not take millions to close the pension gap

- the pension gap increases steadily with rising salaries

- even without a return, it can be closed with a savings rate of only 10%.

- comparative figures serve to set your own goals

- Wealth and assets are always subjective