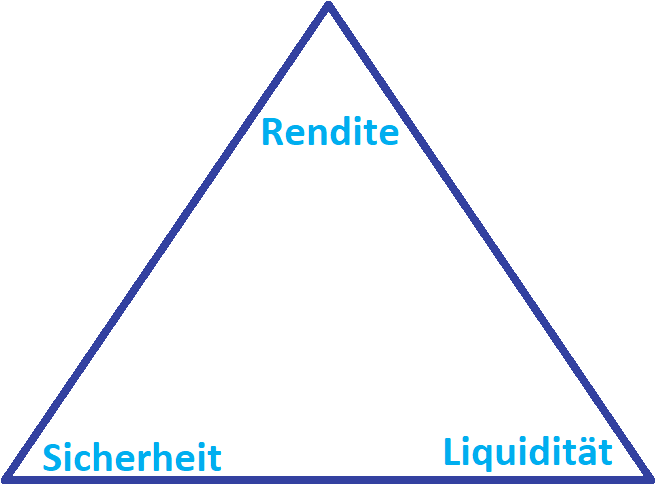

Anyone who invests their hard-earned money naturally wants to increase it as quickly as possible with a high return, but also wants to be able to fall back on it at any time and, of course, to get it back in full at the end. It should be clear that this sounds more like the dream of every investor and can hardly be realized in reality – all three wishes are faced with a conflict of objectives. The easiest way to illustrate this is to use the magic triangle of investment.

Return comes from risk

The model summarizes the three most important goals of an investor – return, security and availability – in a triangle. If you select one of these three goals, the other two are automatically affected and you have to lower your expectations there. First of all, the return describes the success of the investment in percent. Depending on the investment, it is sometimes fixed, fluctuating or can only be fixed at the end of the investment. The higher the return, the greater the compound interest effect, but the higher the risk, which influences one of the other two goals.

Security means receiving at least the full amount of the money at the end of the investment, while risk means foregoing this security. Shares are the best example here. They allow a high return, but can become completely worthless, or give the investor a negative return and thus a loss at the end of the term. On the overnight deposit account, the return is minimal, but at the end of the day the investor gets back the entire deposit – not to mention the development of the real return with a view to inflation.

Liquidity is often underestimated

The third argument, which is in conflict with return and security, is liquidity. It describes the availability of the money. The more liquid an investment is, the faster one can access the money. A property must first be sold in order to access the money. This is also true for a stock, but selling it is much easier and can usually be done within a few hours. A share is therefore more liquid than real estate. On the other hand, it is exposed to the risk of price fluctuations. One will not be able to predict whether at the desired liquidation and thus the conversion into real money, a positive return will remain. Liquidity is often underestimated, plays however with view of the investment horizon in the investment of funds a large role.

The optimal investment is preferably in balance of all three objectives. Depending on the duration of the investment or the risk profile of the investor, the objectives may shift. The magic triangle of investment is therefore always individual.

Keyfacts

- the magic triangle of investing comprises three goals that are in conflict with each other:

- Return, security and liquidity

- all three goals influence each other

- one has to find a balance individually