Anyone who wants to invest in shares has long since ceased to need a large amount of start-up capital. The best and, above all, simplest vehicle for participating in the stock market is savings plans. They have a number of advantages and can contribute to the fact that the supposedly small savings sum can accumulate over decades to a huge fortune, which is easily sufficient to be able to arrange the own retirement in the pension carefree.

They are inexpensive

First and foremost, savings plans are very inexpensive. Whereas a few years ago you had to pay transaction fees of around 10 euros to acquire even one share certificate, savings plans quickly developed into a low-cost alternative. They were levied on a percentage basis on the savings amount, thus allowing direct entry without having to wait until you have the money together for an investment in order to keep the transaction costs at a bearable level in percentage terms. In the meantime, savings plans are completely free of charge with many brokers – such as Scalable Capital* or Trade Republic* – and are sometimes even possible from a savings amount of one euro.

They allow high diversification

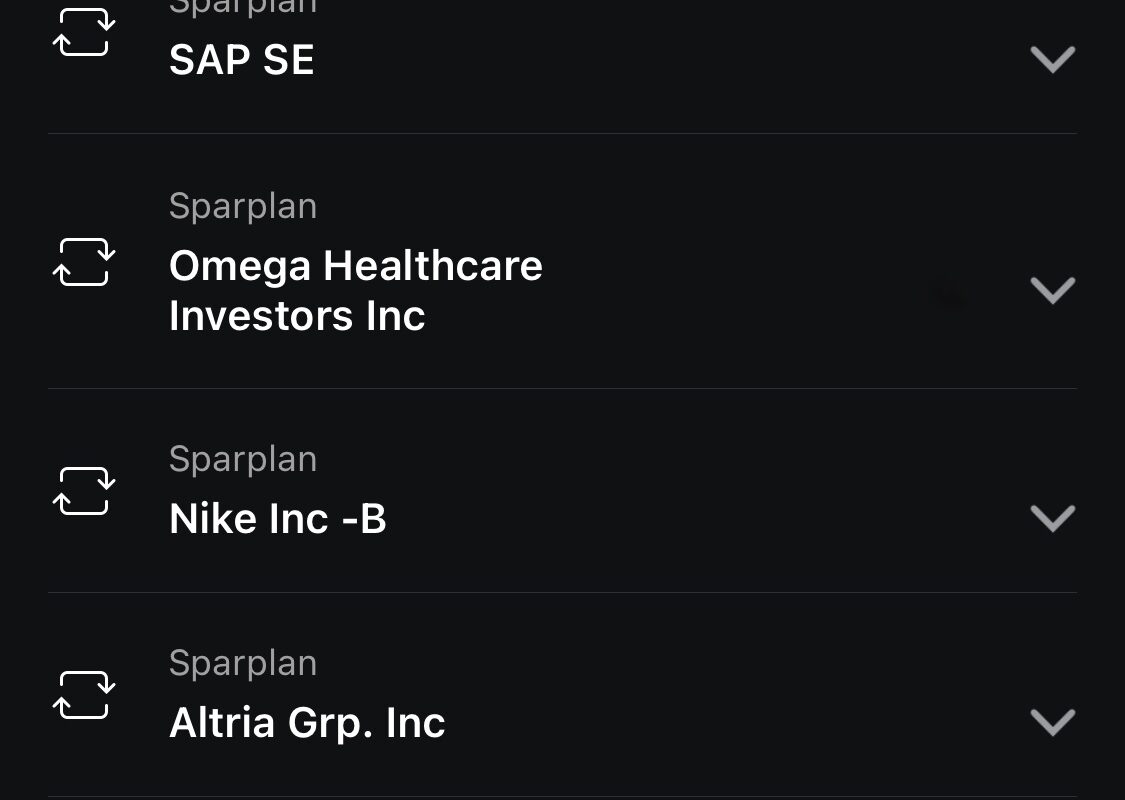

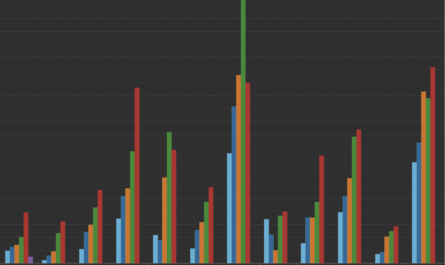

The favorable fees make it possible to build up a broadly diversified stock portfolio. With just 20 euros, you can buy 20 shares in companies from a wide range of industries, currency zones and countries, which already allows for a high level of diversification and thus a manageable risk.

They can be automated

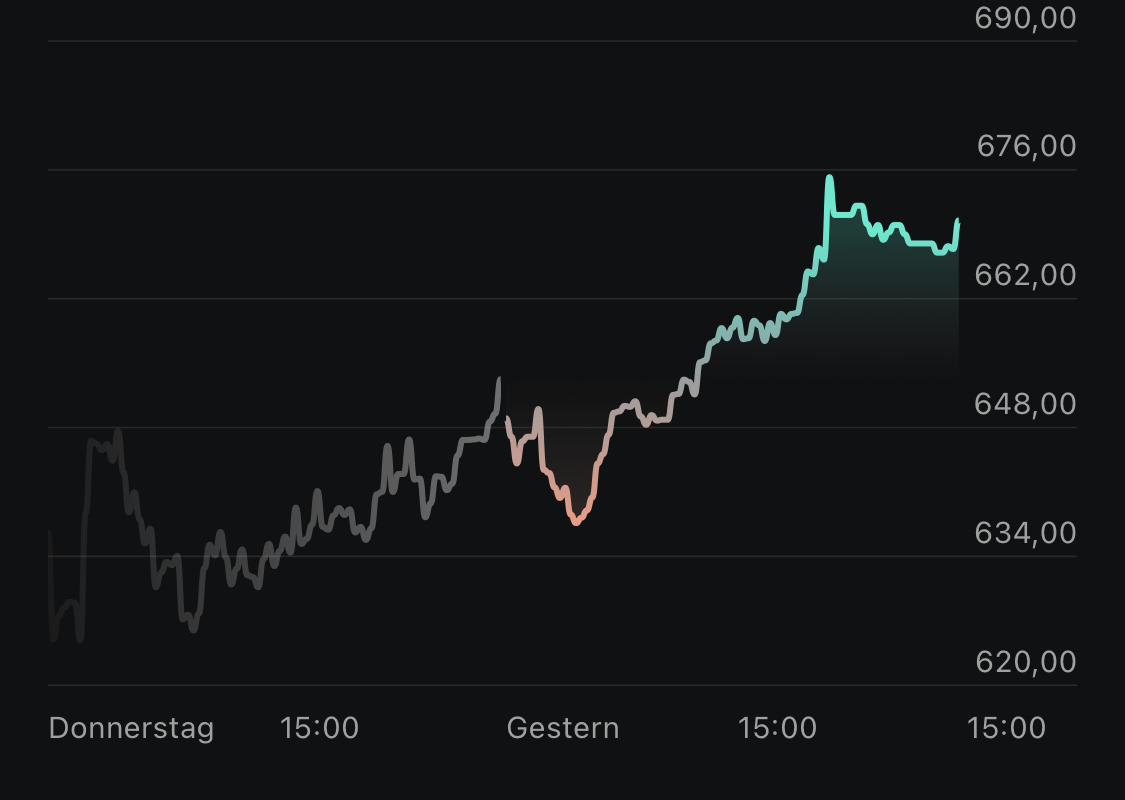

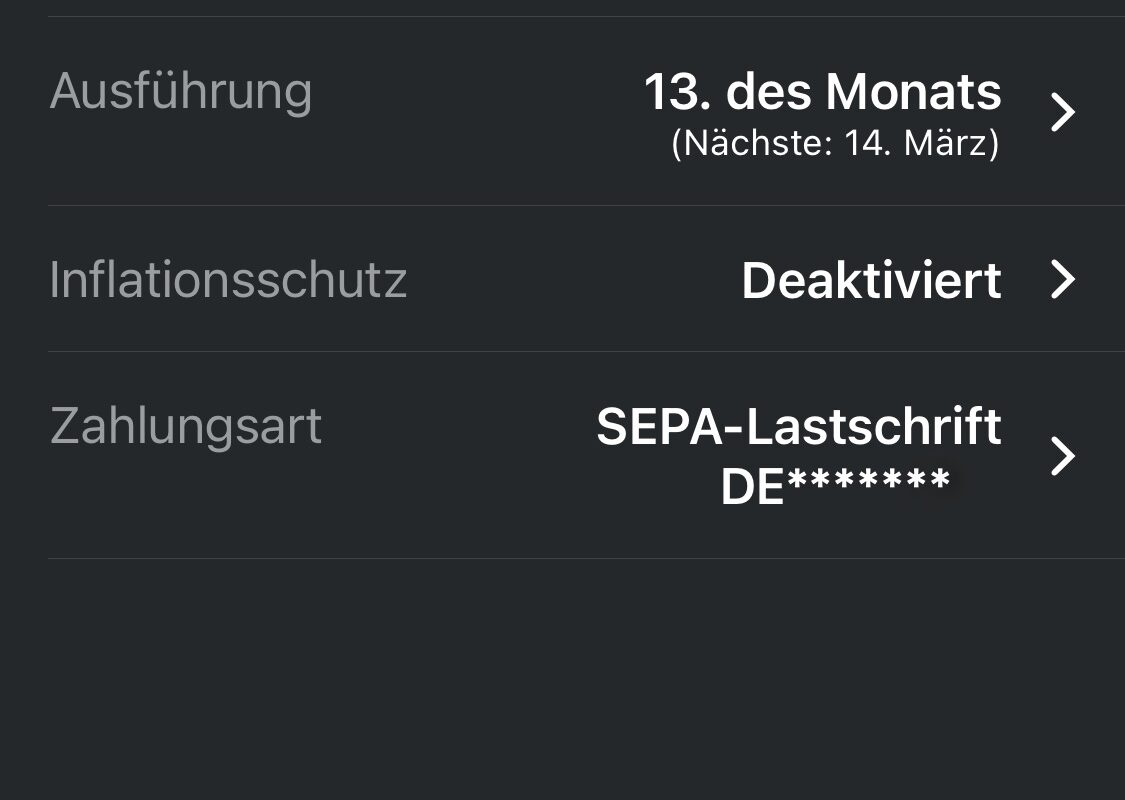

Once set up, savings plans run completely without the saver’s intervention. The broker automatically debits the account and invests the savings amount once a month on the desired date. This has a further advantage: the automatism means that you simply buy regularly and do so without having to keep a constant eye on the prices. Sometimes there are more shares for the savings amount, sometimes a little less. Over decades, one buys so simply the average price.

You simplify the psychology

Due to the automation one must look less frequently into the depot and remains even in the Crash with larger probability at the ball, because one does not become simply active. The human factor can thus be removed. You act more or less like a robot that does the same thing over and over again every month without any action on your part. Above all, however, savings plans make it easier for everyone to get started. If you invest all your savings in a stock today and it crashes tomorrow, you will have a very hard time emotionally, because a large part of your savings will have suffered a book loss.

However, if you invest gradually via savings plans, a price reduction suits you, since you buy more shares the next time you execute a savings plan, thus lowering your average price and theoretically getting back into the profit zone faster. However, in the long run, according to many statistics, the one-time investment is the most profitable, because when the market is rising, you have invested most of your money from the beginning. Mentally, however, savings plans are a blessing.

They can be suspended at any time

Another advantage of savings plans is the fact that they can be changed or even suspended at any time. If there is a need for more money elsewhere, the savings plans can simply be frozen and resumed when the financial situation has improved again. This is a very big advantage, especially compared to buying real estate, where you have to service the bank every month, and it makes for a more comfortable night’s sleep. One is more carefree and free.

Keyfacts

- Savings plans are…

- … favorable

- … automatable

- … mental support

- … contract-independent