Savings plans are the best way to build up assets over the long term. They allow you to invest money on the stock market fully automatically, even with smaller sums. At the same time, you trick your psyche because you don’t have to think so much and simply add to your holdings on a regular basis – regardless of the price: Sometimes there are more shares, sometimes a little less, and over decades you simply buy the average and thus, with a broadly diversified selection, the average market return. In the meantime, an increasing number of brokers and providers offer a wide range of securities eligible for savings plans. But what does this mean in practice?

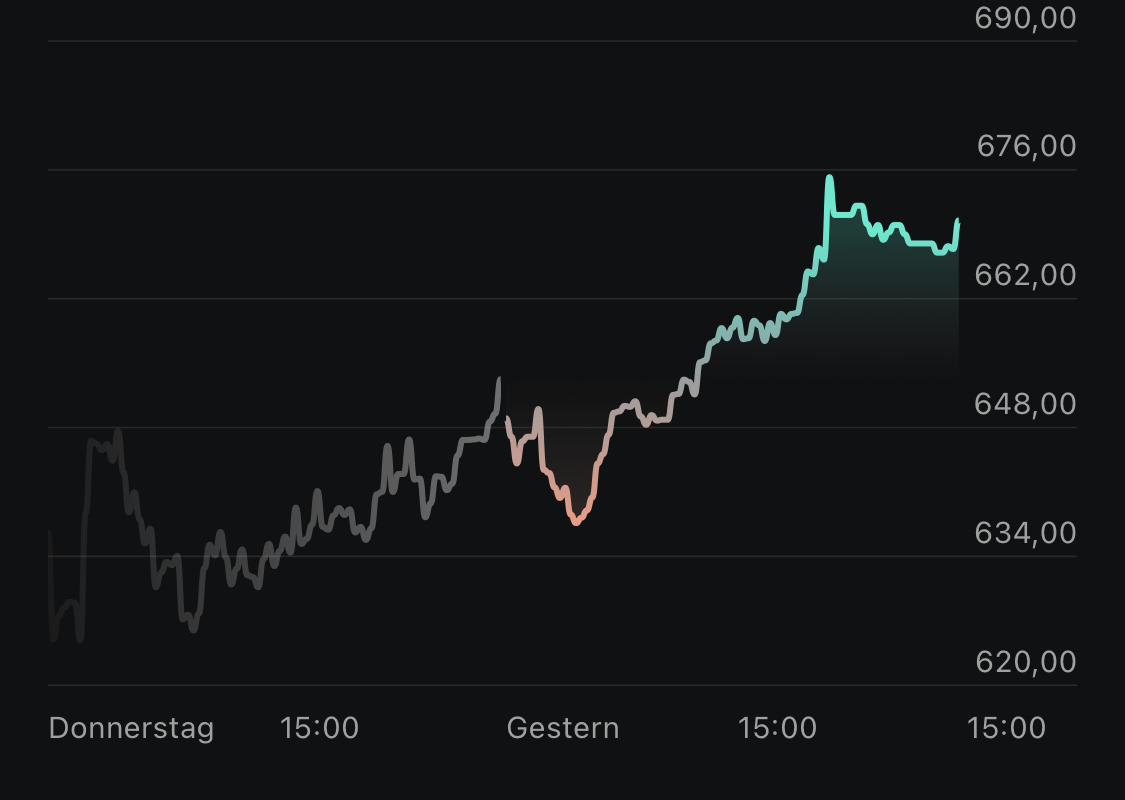

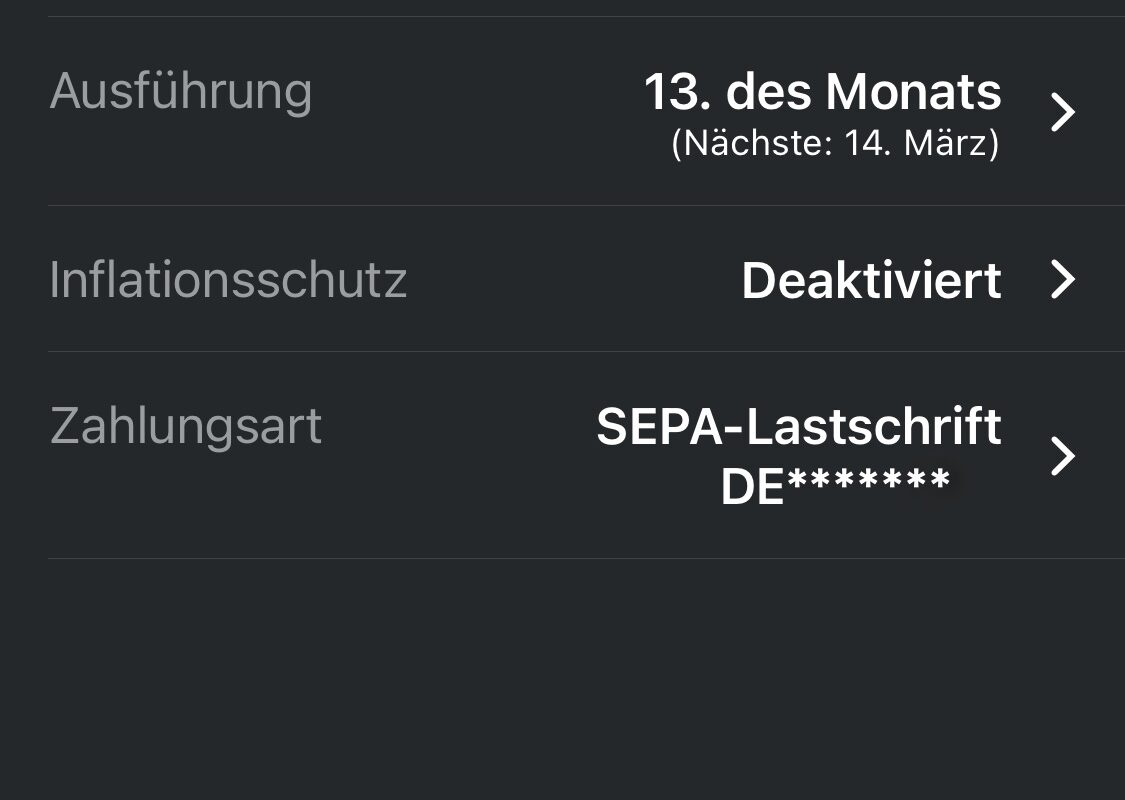

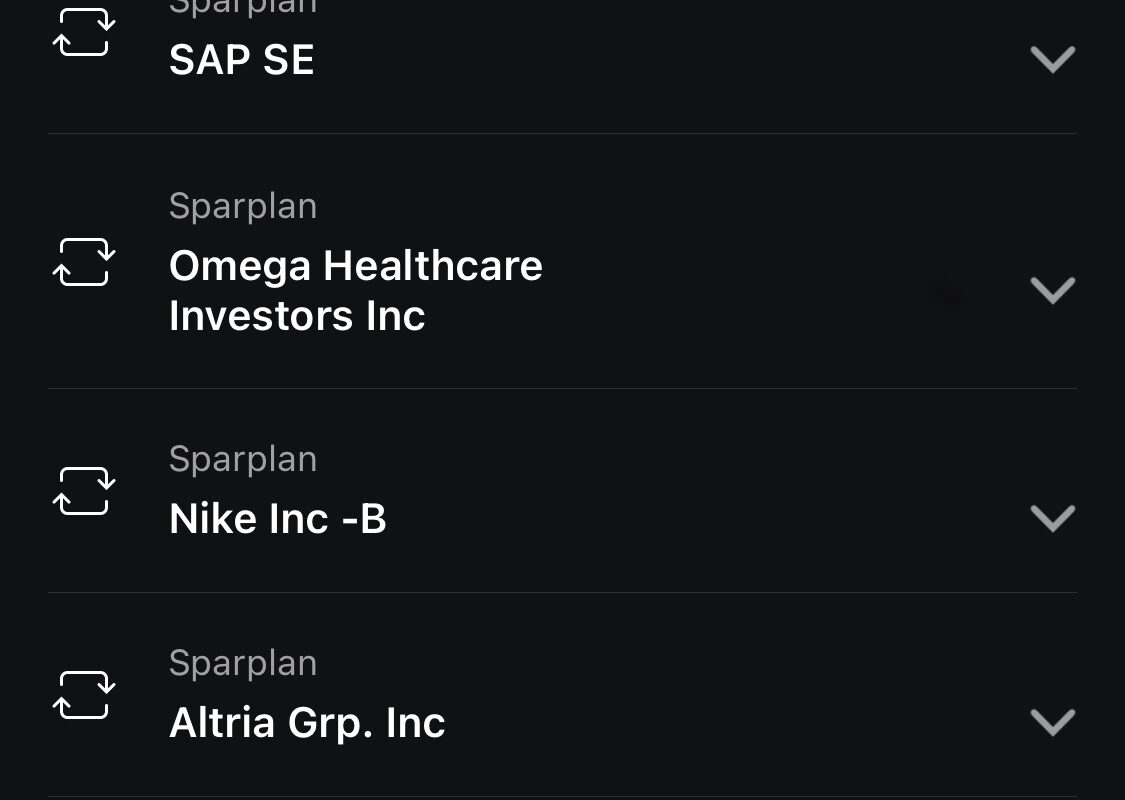

At first glance, this has many advantages for the customer. For example, if you want to participate in the success of the French luxury manufacturer LVMH, you don’t have to put 700 euros on the table for just one share, and you don’t need a full account to achieve broad diversification. Rather, one participates with a few euros month after month more and more in the company and thus builds his position regularly. With some neo-brokers, such as Scalable Capital*, you can do this for as little as one euro and get your first real share bit by bit.

Small amounts, dividends and special assets

Dividends are also paid on a pro rata basis in the case of a savings plan, which means that you already receive regular passive income. In addition, share fractions are special assets, which protects the investor. If the broker goes insolvent, the fractions of the customers must be kept as special assets. A loss can not arise therefore with the customer. However, an expenditure, because fractions can be traded only with the broker, where they were acquired. In the case of broker insolvency, the fractions have to be sold when one actually does not want to. If one moves its depot to another provider, the fractions must be sold also here first, because they cannot be transferred.

In addition, someone who does not own a whole share does not have the right to vote at shareholders’ meetings, nor is he allowed to attend them at all. Thus, one cannot exert any influence on important decisions of the management of one’s stock company. Possible dividends in kind, such as the shareholder suitcase from Lindt or the pajamas from Calida, can also only be claimed when one has saved up a whole share or the required minimum number.

Broker has extra effort and ris

The greater disadvantages arise for the broker. Not only does he have to create the infrastructure to be able to offer fractional shares at all, but he also has to assume a partial risk. Only whole pieces are traded on the stock exchange. If, for example, a customer at Scalable Capital* buys only 0.2 units of a share via his savings plan, the broker must prefinance the remaining 0.8 units and may not be able to resell them unless other customers also have a savings plan running on this share.

In the end, it will be a mixed calculation for the broker, because the more frequently customers trade, the more frequently he can collect transaction fees. So customers should still always keep an eye on the fees.

Keyfacts:

- Savings plans are the best way to build wealth

- … also suitable for small sums

- … can be automated

- … switch off the psyche

- you get dividends, but no gifts in kind or voting rights

- the broker has the additional expense

- the broker bears the risk for the remaining pieces

- fees remain important