To cope with the Corona pandemic, Olaf Scholz (SPD) had loosened up a few billion euros and taken on around 470 billion euros in new debt for the years 2020 to 2022. To repay this, some parties are calling for the introduction of a wealth tax. Leading the way is Die Linke, which wants to tax assets by up to 5% per year. But the SPD and the Greens are also in favor of introducing such a tax, although they are more modest with a maximum of 1%. In this way, all three parties want not only to settle the crisis bill, but also to narrow the gap between rich and poor in Germany. The idea is to redistribute wealth from top to bottom.

Many countries have experimented with a wealth tax in recent decades and have always abandoned it, such as France, Sweden, Denmark, the Netherlands, Austria and Ireland. Even in Germany, a wealth tax was levied for decades until 1997, but had to be abolished again after a ruling by the Federal Constitutional Court in 1995. At that time, real estate was clearly favored in the wealth tax due to outdated valuation standards, which is why the court had vetoed it.

Even 1% increases the tax burden enormously

A tax levy of 1% on net assets may not sound like much to many, but it has a significant impact on the overall tax burden, especially if a low return is earned on the money available, which is not uncommon in the current low-interest environment. This can be illustrated by a simple calculation, as made by the non-profit Family Business Foundation in a study published in August.

A saver invests 100 euros, with which he earns a constant return of 3% per year. He pays a constant income tax rate of 30% on the profits accruing thereon, and the total capital is taxed annually with a one percent wealth tax. In addition, in this example we make the simplified assumption that all exemption limits have already been exhausted, which means that the calculation is based on the marginal tax burden.

While the differences are marginal in the first year, the curves diverge widely over the years. After an investment horizon of ten years, the saver has made about 111 euros from his 100 euros with 1 % wealth tax and 30 % income tax. If the state only collects the income tax, as is the case today, the figure at the end of the term is around 123 euros. Without taxes, it would have been around 134 euros.

This makes it clear that a wealth tax of just one percent places roughly the same burden on savings income as an income tax of 30 percent. In this example, the combined burden is 64%. Or to put it another way: for every euro of return, the saver gets to keep only 34 cents in the end, while the state grabs 64 cents.

| 3,0 % p.a. | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Without taxes | 103,00,- | 106,09,- | 109,27,- | 112,55,- | 115,93,- | 119,10,- | 122,99,- | 126,68,- | 130,48,- | 134,39,- |

| Income tax only 30 % | 102,10,- | 104,24,- | 106,43,- | 108,67,- | 110,95,- | 113,28,- | 115,66,- | 118,09,- | 120,57,- | 123,10,- |

| Income tax 30% and wealth tax 1% | 101,08,- | 102,17,- | 103,27,- | 104,39,- | 105,51,- | 106,65,- | 107,80,- | 108,97,- | 110,14,- | 111,33,- |

The lower the return, the higher the burden

Wealth taxation is even more significant if the return achieved on the deposit is lower. If only 1.5% is earned per year on the above-mentioned 100 euros, 116 euros remain at the end without taxation. With regular income tax, the figure would be 111 euros, and with additional wealth taxation, the figure would remain at 100 euros after ten years.

The combination of income and wealth tax has the confiscatory effect of an income tax of almost 100%. So the state takes the complete return!

| 1,5 % p.a. | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Without taxes | 101,50,- | 103,02,- | 104,57,- | 106,14,- | 107,73,- | 109,34,- | 110,98,- | 112,65,- | 114,34,- | 116,05,- |

| Income tax only 30 % | 101,05,- | 102,11,- | 103,18,- | 104,27,- | 105,36,- | 106,47,- | 107,59,- | 108,72,- | 109,86,- | 111,01,- |

| Income tax 30% and wealth tax 1% | 100,04,- | 100,08,- | 100,12,- | 100,16,- | 100,19,- | 100,24,- | 100,28,- | 100,32,- | 100,36,- | 100,39,- |

If the return is as low as 0.5% per year instead of 1.5%, the available capital will fall to just over 93% after ten years, which means that the effective tax burden will be over 100%. The state thus pockets every euro of income and, what’s more, helps itself even further.

| 0,5 % p.a. | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Without taxes | 100,50,- | 101,00,- | 101,51,- | 102,02,- | 102,53,- | 103,04,- | 103,55,- | 104,07,- | 104,59,- | 105,11,- |

| Income tax only 30 % | 100,35,- | 100,70,- | 101,05,- | 101,41,- | 101,76,- | 102,12,- | 102,48,- | 102,83,- | 103,19,- | 103,56,- |

| Income tax 30% and wealth tax 1% | 99,35,- | 98,69,- | 98,05,- | 97,41,- | 96,77,- | 96,14,- | 95,51,- | 94,89,- | 94,27,- | 93,65,- |

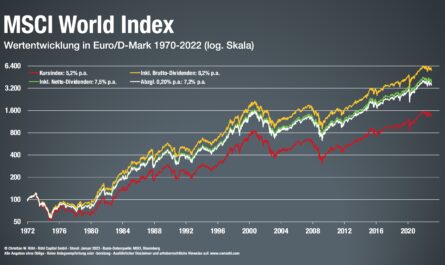

Even a return of 0.5% is not realistic today without risk. On the call money account there is usually only about 0.001 to 0.1% and thus clearly less than the 3% with which the saver would still have made a profit on his deposit at the end even with wealth tax. If the annual inflation is also taken into account, this is also an absolute negative deal for the saver. In order to achieve a return of more than 5%, he has to go into the stock market and thus always expose his money to a total loss risk. Is that really what the state wants? Taxing the net assets enormously inhibits the willingness to invest.

Exemption limits do not always help

Of course, one could now say that the parties only consider wealth tax for high assets, usually over two million euros, so as not to place an additional burden on small savers. But anyone who already owns a property in expensive major cities such as Munich, for example, or who has had a high savings rate for more than 35 years, is already scraping against this limit. But farmers also have to fear for their farm, their machines and their arable land. Irrespective of this, everyone should ask themselves whether a tax burden of over 64% up to the complete consumption of income on the part of the state can really be a desirable goal.

A large part of the wealth is not just lying around in current accounts anyway, but is often in companies or investments such as shares. The founders of BionTech, for example, have not yet received any cash flows in the form of share sales or even dividends via their company shares, which have of course increased in value considerably with the success of the company and its Corona pandemic vaccine. In order to pay the wealth tax, the founders would either have to spend other money, sell shares or complete a utopian profit distribution, which would cost BionTech important liquidity. The bureaucratic effort is enormous for all sides.

Effects of a wealth tax

But even if small savers are unlikely to be affected by a wealth tax during their savings phase under plans by the SPD, the Greens and the Left, such a tax would have a significant impact on the economy as a whole and thus on all of us. This is shown in a study by the ifo Institute, which is close to the economy and was published back in 2017 and thus before the Corona pandemic and the parties’ tax ideas.

According to this, with a wealth tax of just 1.2%, GDP would fall by 7.28% over eight years. Each year, Germany would have 0.45% less growth, which would currently correspond to one third. Investment would fall by 14.23% – investors prefer to go abroad and create new jobs there. Overall, employment would fall by 2.94%, resulting in higher unemployment.

Since assets and thus equity capital will be unprofitable for many under a wealth tax, according to the ifo calculations the leverage ratio will rise by a whopping 5.67%, which would fuel the risk of numerous corporate insolvencies in the event of another crisis. In the household sector, the willingness to save would also drop enormously: wealth alone would fall by a whopping 33.32% within eight years under a wealth tax of 1.2%, and household savings by as much as 56.14%.

For the state, the wealth tax would generate revenue of around 17 billion euros. Overall, however, the introduction of such a tax would cost 38 billion euros due to the losses in revenue from other taxes. The wealth tax therefore means a loss for all parties involved and should therefore definitely be considered by voters on September 26. Much in politics is window dressing from election period to election period. Truly sustainable and long-term content is rare, or cannot be sold to the voter as easily as a good-sounding and only low wealth tax of 1%…

Keyfacts:

- 1 % wealth tax has the same tax burden as 30 % income tax for a 3 % return

- the lower the return achieved, the higher the impact of a wealth tax

- at a low return of only 1.5%, the effective tax burden is around 100%.

- if the return is very low, the tax burden exceeds the return

- exemption limits may not affect real estate owners, farmers and small and medium-sized businesses

- assets are often held in companies and participations and are not available in liquid form

- high bureaucratic effort for all sides

- Economic growth is strongly slowed down in the long run

- Investments decline

- Assets decline, debts rise, which feeds crises