Even if politicians like to propagate it: The German pension system is anything but secure – as we have shown in detail in recent articles. But instead of putting the system on a sustainable footing, the state itself has contributed to shaking the construct in recent years. It is risking almost wantonly, but probably knowingly, that many population groups will be driven into old-age poverty. Many public servants do not seem to have heard the bang yet and are not exactly helping to improve the problem.

It will certainly no longer be possible to stop demographic change. However, it would be possible to create sensible incentives for private old-age provision and to raise awareness among citizens by clearly drawing attention to the pension problem. Instead, people are working against possible alternatives, glossing over many things and talking them down.

No detailed pension information

This starts with the pension information that every insured person over the age of 27 automatically receives from the German pension insurance once a year. Although it provides a rough orientation and informs about the current status, it does not go into enough detail about the most important points.

On the first page, for example, the notice mainly shows three figures: The estimated pension in the case of full reduction in earning capacity or with health restrictions, as well as the future payments in the case of a standard old-age pension, if one were to stop paying in from now on or continue to do so at the same average as in the last five calendar years. The start of the standard old-age pension is also prominently mentioned in the first place. The fact that the amounts in each case are gross amounts, from which health and long-term care insurance contributions and, if applicable, taxes are still deducted, is only referred to in a hidden way in the prose text – without really giving any descriptive figures.

Of course, no one knows how the tax burden will develop until one’s own retirement and thus perhaps only in 36 years, but a calculation on today’s basis would already help to raise awareness among contributors.

Glossing over and talking down

Instead, there is gleeful talk of possible pension increases – an annual adjustment rate of 1% and 2% sound motivating, after all. The fact that both rates of increase are below the average inflation rate is completely left out. In general, the topic of inflation is addressed far too little in the pension information. Even a rate of price increase of only 1.5% has a powerful impact on purchasing power over 30 years. Unfortunately, this is only shown on the basis of small amounts and even the 1.5% mentioned is actually too little. The problem of the pension gap is also given far too little attention in the annual pension information.

Here detailed example calculations on today’s basis are certainly meaningful. Every contributor is certainly aware of the fact that there is a need for “additional provision”. How important it really is, however, is put off by many. This cannot be in the interest of the state, which then has to spend even more money later on with even higher social benefits.

How this can look? Here is an example:

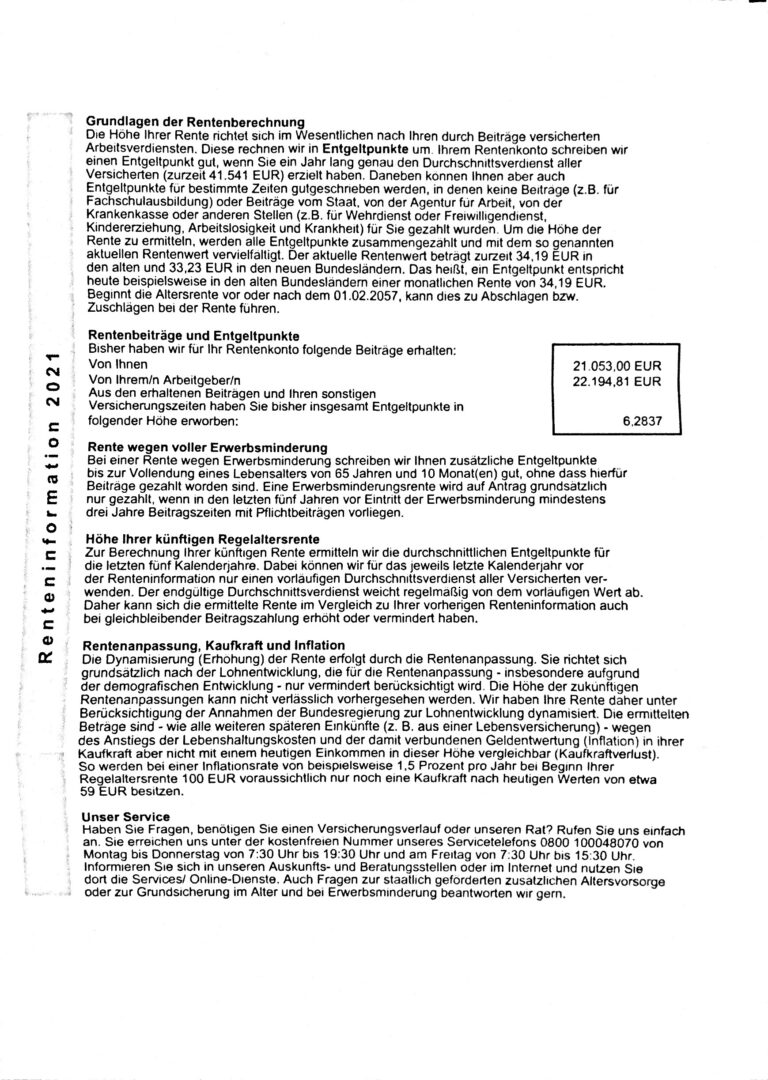

| Salary 2021 | Pension 2057 | Pension after customization of 2 % | Pension after customization of 1 % | |

|---|---|---|---|---|

| Before taxes | 2.700,00,- | 1.162,91,- | 2.370,00,- | 1.660,00- |

| Adjusted for purchasing power (2,5 %) | – | 478,07,- | 974,29,- | 682,42,- |

| – Pension insurance | 251,10,- | 0,- | 0,- | 0,- |

| – Health insurance | 213,30,- | 120,36,- | 245,30,- | 171,81,- |

| – Unemployment insurance | 32,40,- | 0,- | 0,- | 0,- |

| – Taxes | 321,- | 0,- | 187,75,- | 63,42,- |

| After taxes | 1.882,20,- | 564,48,- | 962,66,- | 742,35,- |

In this example, Peter Huber earns a monthly salary of 2,700 euros, from which not quite 1,900 euros net remain after deducting all the usual social benefits and taxes. The pension information shows a current amount of 1,162.91 euros for him, provided Peter Huber continues to pay as much into the DRV until his standard retirement pension as he has done on average over the last five calendar years. The amounts in the case of an annual adjustment of the pension amount of 1 and 2% are also shown on this. In this example, we assume an annual inflation rate of 2.5% and deduct this value from the gross pension in the first step to account for the actual loss of purchasing power.

This is followed by the deduction of social security benefits and taxes, which are significantly lower than the gross income. Currently, the share for health insurance is 7.3% (14.6% in total), for long-term care insurance 3.05% without a supplement for a child, and for taxes about 8%. After deducting these, the real value finally remains. Of his former working net of almost 1,900 euros, Peter Huber receives in real terms only between about 565 to almost 963 euros, depending on the scenario.

Does the average citizen really assume such frightening figures?

Low-wage earners are penalized twice

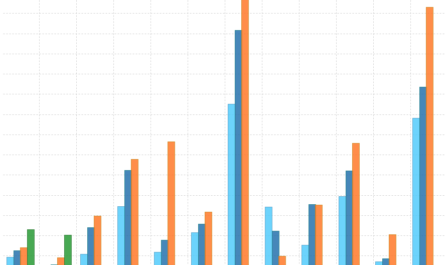

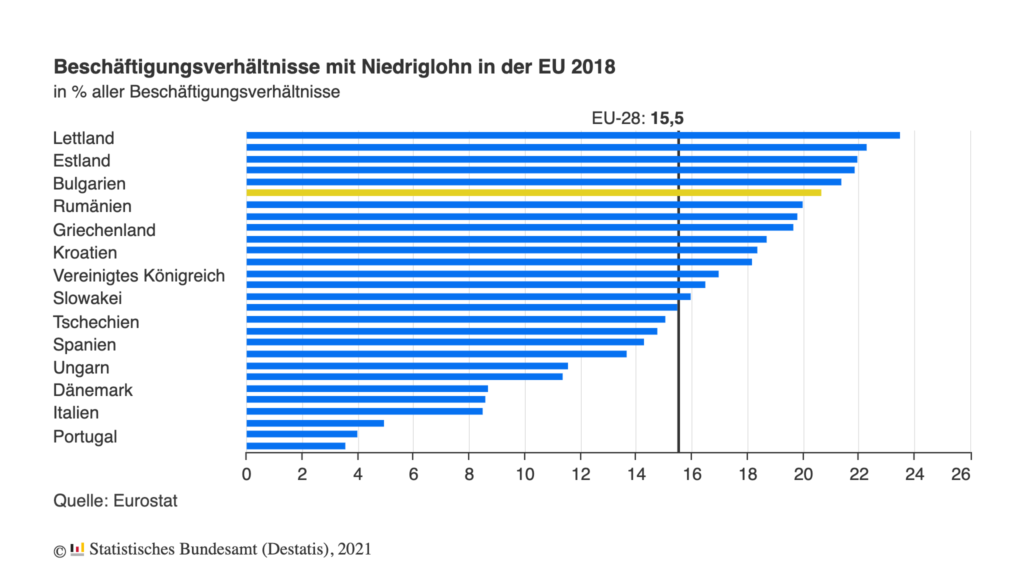

In fact, contrary to the positive adjustment rates in the pension statement, politicians have sometimes decided on zero rounds and thus ensured an inflationary reduction in the pension level. This shows that one should by no means rely on promises. Other plans, such as the basic pension, are far from helping everyone. Contributors from the low-wage sector in particular are having a hard time. In Germany, this now accounts for more than 20% of all full-time employees.

In 2017, the survey year, the Federal Republic of Germany was thus among the six countries with the highest proportion in the lower-income sector on average across the EU. This includes anyone whose gross wage is below two-thirds of the median gross wage. In Germany, according to the Salary Atlas 2021 from the salary portal Gehalt.de, the median income was 43,200 euros per year and thus a monthly gross of 3,600 euros. The threshold of the low-wage sector is thus 2,400 euros gross.

Particularly perfidious: This income class already has a hard time raising any money at all for old-age provision during working hours and is even excluded for further promises made by politicians. Not all low-income earners meet the necessary requirements for the basic pension and are left empty-handed. For them remains further only the basic safety device in the age and thus the Hartz IV for seniors. The German pension insurance recommends from an income of less than 865 euros to apply for this, with which then can be topped up, or the office takes over the costs of rent, heating, electricity and contributions to health and nursing care insurance.

But be careful: If you have saved the last few euros from your mouth while you were working, you can be penalized twice, because existing assets and other income are checked and taken into account accordingly. 5,000 euros on the savings account are already sufficient. Then the hard-earned savings pot is offset against the basic income support, which means that you get less help from the state than if you hadn’t put any money aside before. In other words, you are penalized twice. The same applies to company pensions and employer subsidies. At least money from a state-subsidized pension plan such as a Riester contract or owner-occupied real estate is not offset against basic benefits.

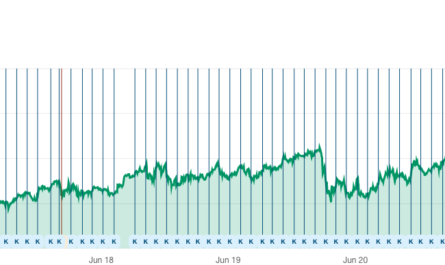

A tax-financed social system with a bleak future

Actually, the state and the insurance companies should have the greatest interest in ensuring that citizens make their own provisions so that they will be less of a burden on society later on or, ideally, not be a burden at all. For several years now, the DRV’s expenses have regularly exceeded its income, and the state has had to counteract this with taxpayers’ money. In 2020 alone, the federal government subsidized the fund with more than 100 billion euros, which corresponds to almost a quarter of the entire budget. Money that is lacking elsewhere.

If the structural problem continues to worsen due to demographic change, steadily more tax money will have to be spent. In 2019, Germany’s public debt as a percentage of GDP was 59.8%. If the state continues to increase its borrowing so diligently, we will very quickly be at 100% and even much faster at 200%. Then one of the supposedly richest industrialized countries will never be able to repay its debts…

Keyfacts:

- the pension gap contains too little detailed information

- real numbers on today’s basis would help

- inflation has a huge impact on purchasing power

- politics does too little

- low-wage earners are penalized twice