Anyone starting to build up assets and their retirement provision must clarify not only what they want to invest in, but also how.As a rule, there are two possible options: one is to invest in a one-off purchase and the other is a regular savings plan. Both have their advantages and disadvantages, which will be discussed in more detail in this article.

We have already made it clear several times in this blog that we are big fans of monthly savings plans. But especially when unexpected windfalls occur or you have perhaps already accumulated a few years a handsome fortune, you are also in the position to let this fortune immediately work for you on the stock market. From a scientific, statistical point of view, the one-time purchase is clearly better.

Statistically better, psychologically more difficult

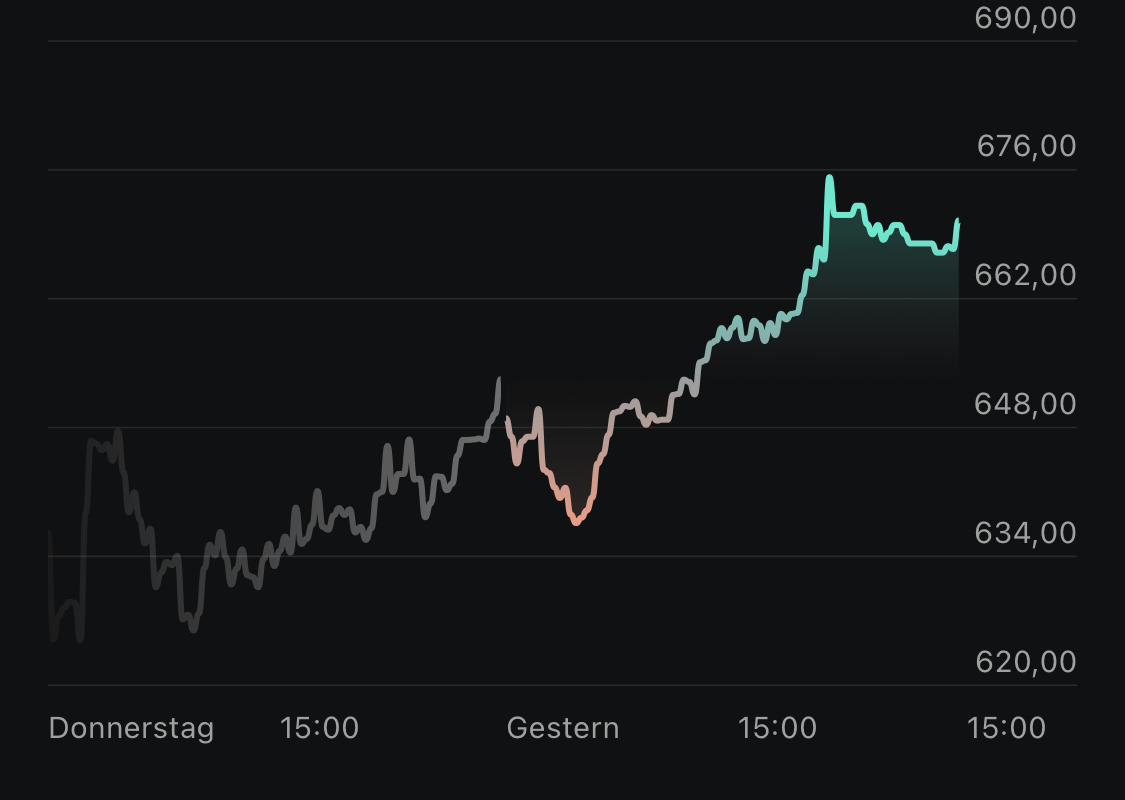

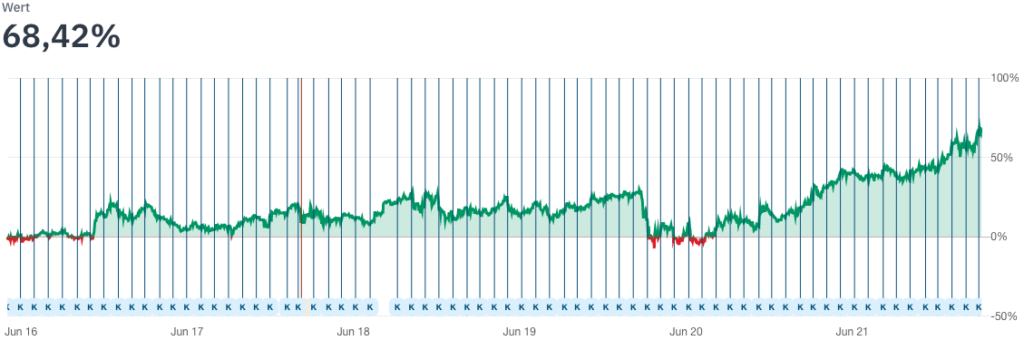

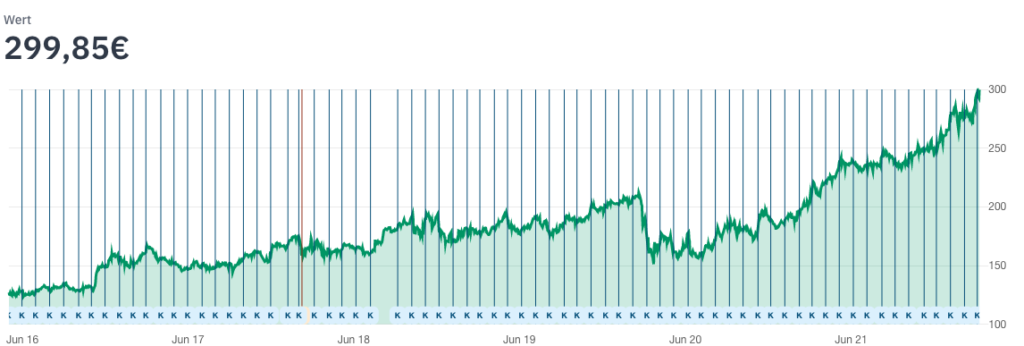

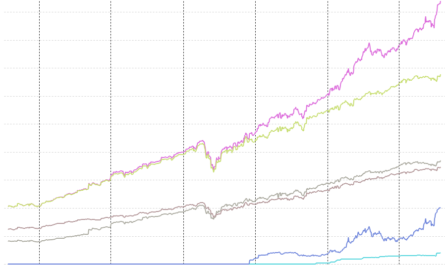

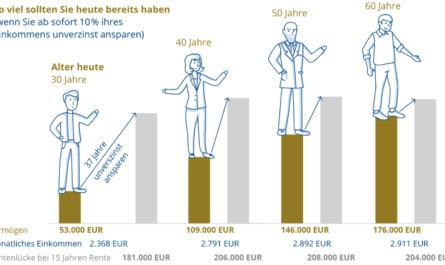

The past has already proven that stocks and ETFs rise in the long term and those who have held them for at least 15 years have been able to earn a return no matter at what time they entered. This is shown by the return triangles of the German benchmark index or the S&P 500 from year to year. Consequently, it only makes sense to have invested the highest amount at the beginning of one’s stock market career, since this is when the average return, including the compound interest effect, is most effective. If you even catch particularly low prices by investing in crises, for example, you can even achieve an excess return and thus significantly more than the long-term average.

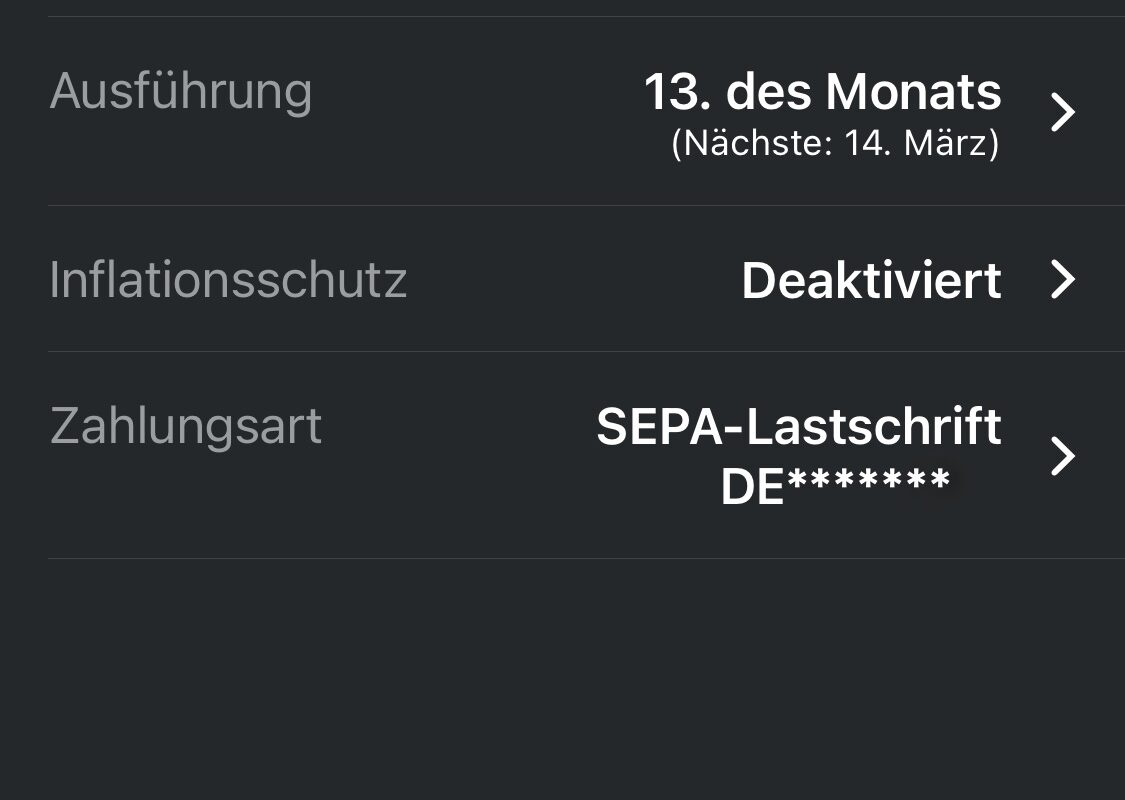

In addition, a one-time investment does not incur recurring OR costs, as may still be the case today, depending on the broker. At least with Scalable Capital* or Trade Republic*, this is now also possible completely free of charge. In addition, with a one-time investment, you always have control over the price, since you can buy at a pre-determined or even more favorable price with a limit order, while with savings plans you are exposed to the price setting of the provider. Particularly in the case of very early executions during the day, sometimes high spreads can occur, as there is hardly any liquidity on the market. Timing is not possible here, because theoretically you will buy even if the price is too high.

However, whether today or yesterday was the best time can always be predicted only in a few months or even never.

Excess return and fluctuation risk

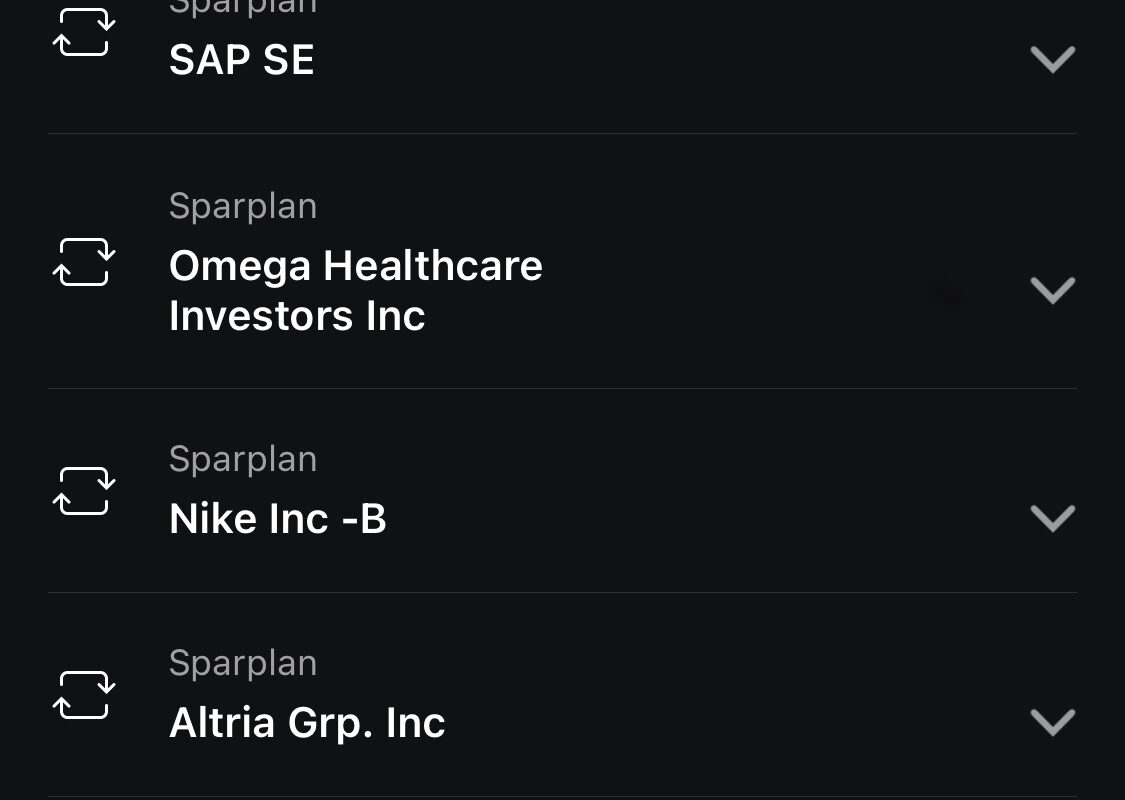

However, with a one-time investment, the full stock market risk exists immediately, whereas with a savings plan, this risk is divided up and thus smoothed out by distributing the entry points.This is much easier from a psychological point of view. In addition, a large capital stock is needed to be able to achieve broad diversification if one does not want to invest in ETFs in particular, but would like to achieve investment in individual stocks, such as dividend stocks. With savings plans, you can start from as little as one euro per stock and thus achieve a broad diversification even with smaller savings rates.

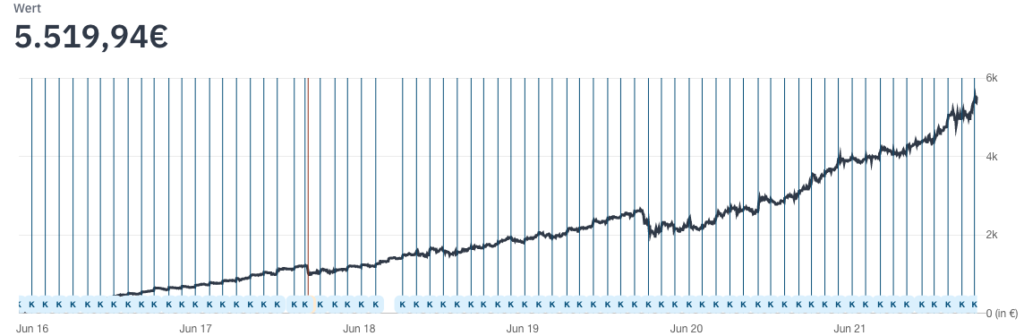

With the savings plan investment, on the other hand, no excess return is possible even with often good entries, since over the long term one always buys the average and thus the typical market return over the years. Due to the cost-average effect, savings plans are psychologically much easier to handle and one gradually gets used to the ever increasing fluctuations and amounts in the portfolio. With a one-time purchase, you have to cope with these immediately.

In addition, a savings plan disciplines you to buy even when the stock market is not doing so well. Through the automated process, you no longer have to worry about anything and intervene rather rarely. A large starting capital does not have to be available with the savings plan investment either.

Advantages and disadvantages of the one-time purchase:

- statistically a higher return is possible

- even an excess return can be achieve

- done is not dependent on the execution times and price setting of the broker

- one has no regular order costs

- you need a large starting capital

- you are immediately exposed to the full market risk

Advantages and disadvantages of a savings plan:

- it is psychologically easier by splitting the entry points

- one buys the average market return in the long term

- Fluctuations are smoothed over the long term

- diversification is more feasible

- one can start immediately even with small amounts

- Automatism disciplines and creates habituation effect for fluctuations

- no excess return possible

- one is exposed to the price setting and the execution times of the broker

- possibly recurring order costs possible

This is how I operate

I mainly use savings plans for my asset accumulation and retirement provision, because here I have to be active the least. In the event of a sharp decline in individual stocks, however, I also like to make additional purchases and, depending on the amount, choose an additional savings plan or a one-time purchase. Occasionally I can invest larger sums at once, as I did at the Corona time. Then I buy also times whole position again into the depot.

So I make a mix of both worlds, but always pay attention to a broad diversification and above all long-term.