For many years now, we have been using various payment and customer cards with which we receive numerous discounts up to smaller cash refunds in order to be able to reduce our daily expenses at least a little, especially in times of high inflation figures. So far, American Express, the Amazon credit card, Payback and especially the Visa card from Crypto.com have been our favorites here.

With the latter, we not only got Spotify and Netflix paid for, but also 3% cashback on every payment. The credits were in the form of Cryptotokens, which you could immediately sell and turn back into euros – as long as you did not speculate on a price increase for the next higher card, as we did. Unfortunately, the perks have been scaled back considerably in recent months. Existing customers of a Jade Green now only get 2% cash back and the two streaming services are only paid back in CRO during the first six months.

However, around 2,500 euros in CRO tokens still have to be deposited for this. In addition, some crypto exchanges are wobbling or have already gone insolvent in the meantime – so a bit more diversification is recommended. In this article, we present two possible alternatives and supplements.

Plutus

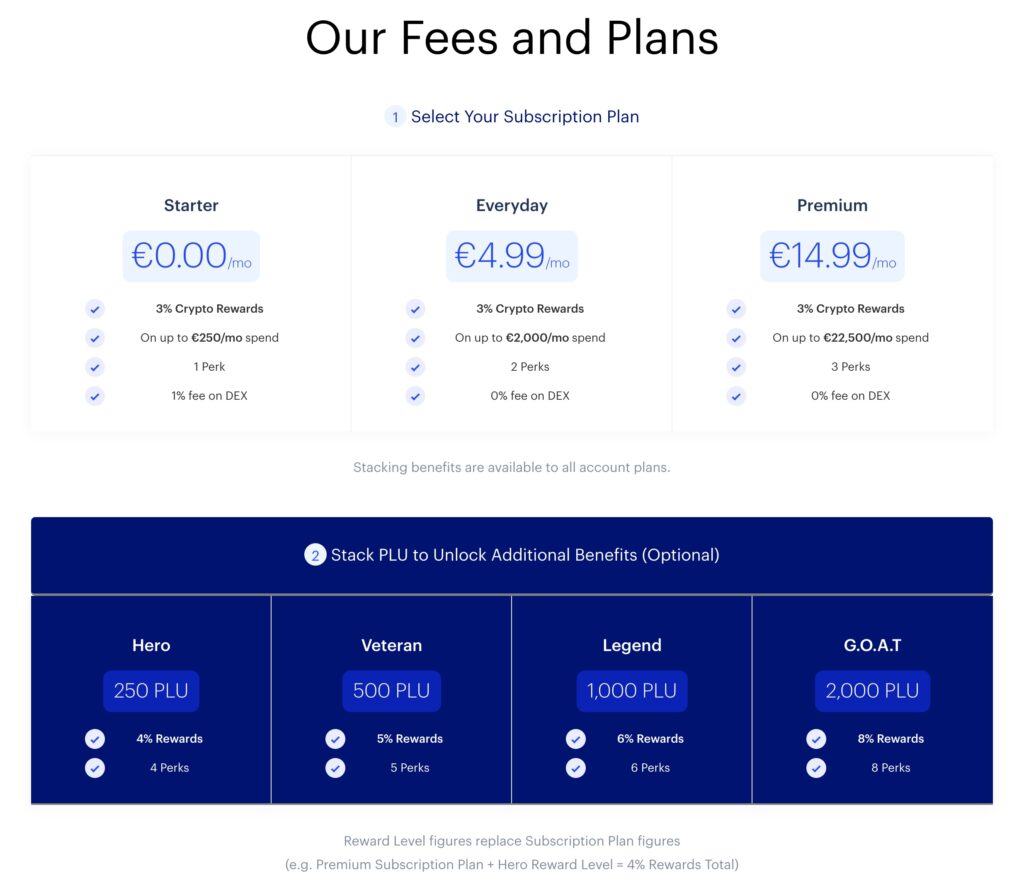

Unlike Crypto.com, Plutus* has a single plastic card that can be upgraded with various subscriptions and staking plans with an eye on rewards. In the starter version, there is already 3% cashback on all card transactions up to a sum of 250 euros per month, which is already significantly more than Crypto.com’s free card. There is also one perk a month for free, where you get a discount of mostly 10 euros at selected merchants. The merchants again include services like Spotify, Netflix or Amazon Prime, but also many retailers like Aldi or Lidl and even Shell gas stations.

Those who take out the Everyday subscription for just under 5 euros a month receive cash back for card sales of up to 2,000 euros a month and are allowed to choose two perks from the merchant offering every month. In addition, the exchange fees on the company’s own DEX are waived. The premium subscription for not quite 15 euros is the most expensive rate model. Here, the limit increases to an impressive 22,500 euros per month and the number of bookable perks is also increased to three.

All three models offer 3% cashback each. This can be increased to up to 8% by depositing PLU coins and the number of perks can be increased to up to eight. For this, at least 250 to 2,000 PLU must be deposited, which corresponds to 2,000 to 16,000 US dollars at the current rate of about 8 US dollars.

Of course, the cashback and the Perks are paid out in PLU tokens. These can be sold directly to the Euro card balance after a holding period of 45 days. Due to maintenance work, however, the company’s own centralized exchange is currently unavailable, which means you have to transfer your tokens to a decentralized exchange for the exchange.

Hi.com

The offer of Hi.com, the second provider on our list, is much closer to that of Crypto.com, which is not surprising since an ex-employee is actually behind the project here. Hi.com not only offers a Mastercard debit card, but also a trading platform for common coins like BTC and ETH, as well as a number of earn programs that allow you to earn a few percentage points for your deposited coins. However, we will focus on the card program here.

Hi.com offers a total of six different card models, all of which require Hi-Dollars, the platform’s own token, to be deposited. For the Basic card, that’s just 100 Hi, which at the current rate of just under 1.5 euro cents is equivalent to just 1.50 euros. For this, you already get 1% of your card turnover paid back in Hi tokens. If, on the other hand, you stack 1,000 Hi-Tokens, the cashback increases to 3% and, on top of that, you get a small booster for your earn deposits and, as with Plutus*, you can look at one Perk per month, for which up to 12 US dollars are reimbursed in Hi-Tokens. There are also some well-known services here with Netflix, Spotify, Apple TV+ or Disney+. The silver card for 10,000 Hi and thus around 150 US dollars increases the cash back to 5% and the number of Perks to three – certainly the most interesting offer in terms of price.

The gold card, which is then made of metal like at Crypto.com, requires the deposit of 100,000 Hi-Tokens. In return, you get 8% cash back and five perks. On top of that, there are numerous amenities at well-known luxury hotels via a booking partner. The Platinum card includes all the contents of the Gold card, but increases the cashback to 9% and the number of perk subscriptions to five. One million Hi-Tokens must be deposited for this.

The Diamond card is the most expensive and at the same time the highest quality card from Hi.com. It has a real diamond engraved in the card, offers 10% cashback and a whopping 15 perks. However, you have to stake 10 million Hi for it, which corresponds to a whopping 150,000 US dollars at a rate of around 1.5 cents at the time this article went to press.

Otherwise, the card models offer different limits and exemptions for foreign payments. Currently, registration is by invitation only. Simply enter the user name “Stegan” (without the quotation marks) in the invitation and you can start using Hi.com!

Konditionen können sich jeder Zeit ändern

Hi.com has already announced that the high cashback rates will not last long. Existing customers who were already on the waiting list before the turn of the year will receive these conditions for twelve months in any case. All customers who staked and got their card after Dec. 31, 2022, will currently still be able to enjoy these conditions as well, but for them the conditions can change at any time.

The upcoming rates have already been communicated with 0%, 1%, 2%, 3%, 5% and 8% for Gold to Diamond. At competitor Plutus*, they will regularly increase the requirements for staking rewards in the coming months and years to stabilize the token price and make staking more profitable. Unlike Hi.com or Crypto.com, however, they earn from customers on a monthly basis through the various subscription models. With both providers, the card account must first be topped up via IBAN transfer.

The conclusion of all three card providers is associated with a high risk. A total loss of these deposits must always be expected. The crypto market is extremely fast-moving.