During the 1987 federal election campaign, Dr. Norbert Blüm, the then CDU Federal Minister of Labor and Social Affairs, made a strong case for the German pension insurance system, repeatedly emphasizing that “the pension is secure.” A sentence that burned itself into the minds of many German citizens. At the time, no one could have imagined that just a few legislative periods later this could no longer be true and that it would be better to look after one’s own old-age provision today. But before we go into these details in a multi-part series of articles, let’s first take a look at how the German pension system roughly works.

The statutory pension insurance in Germany is one of many points of the social system and certainly one of the most important parts of the welfare state at all. It is used by some occupational and personal groups for old-age provision and is intended to provide financial security for the time in well-earned retirement. Every employee in the private sector makes mandatory and automatic contributions via his or her gross salary and is entitled to monthly payments after retirement. In addition to retirement pensions, benefits are also paid in the event of reduced earning capacity or survivors’ pensions.

The German pension system: a pay-as-you-go system

The system is based on a pay-as-you-go system: Each generation finances the pensions of the older generations by paying in. The money paid in is directly apportioned and paid out. Those who work today pay the pensions of others and have their claims settled later by the following generation of children and grandchildren, which is referred to in politics as the intergenerational contract. How high the pension entitlement will be later depends on the duration and amount of the payments.

In concrete terms, this means: Those who pay in longer and earn more will receive a higher pension in old age. However, those who earn excessively will have their payments in and later payments out capped.

Earning points in the pension system

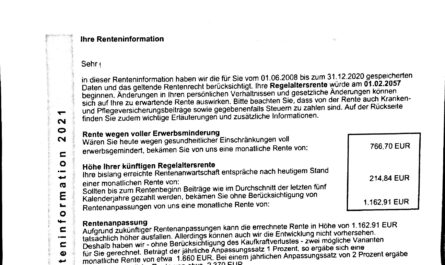

Over the course of a working life, the annual salary of each contributor varies, and so do the payments into the pension scheme. To take this into account, the amounts are converted into so-called remuneration, or pension points. Such a point is accumulated if the contributor earns as much as the average of all contributors in each calendar year. The individual annual income is therefore divided by the average income of all insured persons, whereby the average salary is determined annually by the German Pension Insurance. In 2020, this was 40,511 euros gross per year. Those who were exactly on average received exactly one point for 2020, while those who were above or below were credited points on a pro rata basis.

Example: In 2020, Peter Huber had a gross monthly salary of 2,700 euros and thus an annual gross salary of 32,400 euros. He thus earned less than the average of all contributors. The 32,400 euros correspond to 0.7997 points pro rata of the 40,511 euros. (32.400/40.511)

All accumulated earnings points are then collected each year by the DRV on the contribution account and multiplied by various factors at retirement to determine the final pension amount. For the year 2020, a contributor from Western received 34.19 euros per full earning point at regular entry. So someone who always earned as much as the average for 40 years would receive a standard retirement pension of 1,367.60 euros in 2020.

Example: Peter Huber accumulated 36.2837 pension points during his 38.5-year career. As a contributor from one of the new federal states, he receives 33.23 euros per pension point and thus a retirement pension of 1,205.71 euros. (36,2837*33,23)

However, it quickly becomes very complex

However, the German pension system is much more complex than shown in the simplified illustration above. For example, since 2021 there has been a theoretical entitlement to a basic pension, which provides a top-up to the statutory pension for people who have worked and paid in for many years but earned below average. Those who have cared for relatives or raised children during their careers will also be credited with earnings points under certain conditions. Others who had to retire earlier for health reasons are also entitled, depending on the degree of reduction in earning capacity. In addition, there are deductions for pensioners who retire before the standard retirement age of currently 67. Possible additional earnings in old age can lead to changes, as can the death of a partner.

Each pension is therefore always individual. Contributors can contact the German Pension Insurance directly if they have any questions. Every year, all insured persons over the age of 27 are automatically sent their pension information with a list of all payments made to date and the status of the earnings points accumulated to date.

Keyfacts:

- the German pension system is based on a pay-as-you-go system

- Insured persons pay the pensions of the elderly

- Contribution years and amount determine the pension rate

- Contributions are converted into earning points

- for each earning point there is a certain contribution rate later on

- Reduction in earning capacity, care, education and place of work have an influence on the pension

- the German pension insurance helps with questions