Even though the traffic light government will lower the tax burden for savers by increasing various exemption thresholds, the German tax system is still far from good for them. Important incentives for long-term investment are still missing. For example, stock savers continue to be burdened by the solidarity surcharge. There is no sign of a reintroduction of a speculation period as in the case of real estate, which would help investors with a long holding period and thus a significantly lower risk. But if you let your money work for you in a broadly diversified way, sooner or later you will come across some tax insanity anyway. We would like to present two of them in this article.

Case 1: The limitation of loss offsetting

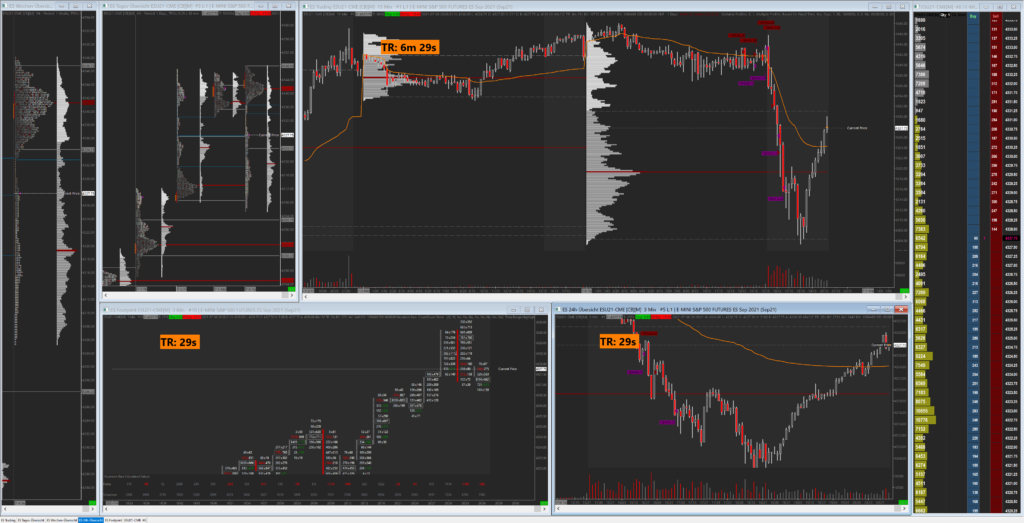

In a hair-raising action at the end of 2019, the grand coalition under the leadership of Angela Merkel (CDU) decided on a new loss offsetting for shares and forward transactions, which was partly introduced already in the following year and completely since 2021 with higher amounts. Since then, losses from forward transactions can only be offset up to 20,000 euros. Accordingly, investments that have become worthless, for example shares or futures trades concluded, can now only be offset up to 20,000 euros per year. In turn, losses that have not been offset can only be carried forward to the following year up to a maximum of 20,000 euros.

What doesn’t sound so bad at first glance has considerable consequences, especially for us traders. Anyone who trades with futures, warrants, CFDs or certificates has significant cuts here, which can sometimes even cost the existence as a professional trader.

In 2019, the calculation of the taxes due was still quite simple: at the end of the year, traders only had to pay capital gains and the solidarity surcharge totaling 26.376% on their profits, as well as church tax if applicable. Anyone who had earned 60,000 euros within a calendar year thus had to transfer 15,825.60 euros of this amount to the tax office at the end of the year.

Since last year, it depends on how the profit is made up. For this purpose, we assume that the trader has carried out 100 trades during the last twelve months. If the losing trades have not exceeded the limit of 20,000 euros, nothing changes for him. However, if they are higher, the tax burden will be considerably higher.

More loss trades mean higher tax burden

A first example: The trader made a gross profit of 60,000 euros at the end of the year as above. The profit is made up of 100 trades in which 100,000 euros were lost and 160,000 euros were gained. 20,000 euros can now be deducted by the trader from his profits per calendar year, leaving 140,000 euros of the 160,000 euros. This results in a tax payment of 36,926.40 euros. Since he had an effective plus of 60,000 euros in his account at the end of the year, he does not even have 24,000 euros left over at the end. This corresponds to an effective tax burden of almost 40% on the net profit.

If, however, the trader loses 500,000 euros on his 100 trades and gains 560,000 euros, the situation is completely different despite the same account development: once again, he can only offset 20,000 euros against his gains. At the end of the year, he must therefore pay full tax on 540,000 euros, resulting in a tax payment of 142,430.40 euros. However, his account has effectively only grown by 60,000 euros – he has to find an additional, almost 82,500 euros and transfer them to the tax authorities. The tax in this case is more than double the net profit made.

Taxes even without profits

In a bad year, the trader has won 500,000 euros and lost 500,000 euros. So gross he has not realized any profit despite trading activities. Nevertheless, he has to pay tax on the full 480,000 euros and transfer 126,604.80 euros to the German state.

| Profit trades | Loss trades | Effective profit | Amount to be taxed | Tax amount | Net profit |

|---|---|---|---|---|---|

| 80.000,- | 20.000,- | 60.000,- | 60.000,- | 15.825,60,- | +44.174,40,- |

| 160.000,- | 100.000,- | 60.000,- | 140.000,- | 36.926,40,- | +23.073,60,- |

| 500.000,- | 560.000,- | 60.000,- | 540.000,- | 142.430,40,- | -82.430,40,- |

| 500.000,- | 500.000,- | 0,- | 480.000,- | 126.604,80,- | -126.604,80,- |

The new taxation of forward transactions would mean roughly that if the tax office were to use the turnover of companies as the basis for calculation in the future, rather than the actual profit or loss. 20,000 euros may seem unattainable for many. But anyone who trades even one lot in the S&P 500 and sets an average stop of 20 ticks risks $250 per trade. With an average of three trades per day, two of which go wrong, this mark would already be reached after 40 trading days. Hedging strategies become impossible with such taxation, even though they actually serve to hedge.

Case 2: Staking vs. Hodlen

The second tax insanity concerns the taxation of cryptocurrencies, which is generally a real mess due to the inconsistent approach of the tax offices. When trading cryptocurrencies, the capital gains tax does not apply as it does with shares. Rather, they are private sales transactions. Initially, this brings two huge advantages: a tax-free limit of 600 euros applies to realized gains and the trader is also granted a speculation period. Anyone who has held a coin or token for at least twelve months may sell it tax-free. However, if you invest your coins centrally or decentrally to increase your monthly cash flow and earn additional interest, this speculation period increases to a whopping ten years. This can quickly become a tax trap.

Example: Investor Martin bought a Bitcoin at a price of 30,000 euros, the value of which rose to 45,000 euros after one year. Since he held it for more than twelve months, he is allowed to collect the 15,000 euros tax-free. Investor Klaus also bought his Bitcoin at 30,000 euros, but staked it at 6.5% interest. After one year, he has about 0.065 Bitcoin more, which are then worth a total of almost 48,000 euros, but he must now pay full tax on the approximately 18,000 euros. He would have been better advised not to punt, but simply to hold. So anyone who wants to build up a passive income with cryptocurrencies should definitely keep this in mind or go straight for coins that do not fluctuate greatly in value, such as stable coins.

In general, we would like to see the taxation of investments simplified significantly and made more attractive, especially for long-term investors who are not looking for speculation and quick profits, but want to provide for their old age. There are plenty of ways and means.