If you work with fixed stops and take profits in short-term trading and always risk the same amount of money, you have two options in the end: Either the trade works out, or it doesn’t. In other words, you always have a 50:50 probability of winning.

You will make short-term profits, but you will also lose several times in a row. It’s like the coin toss, where it’s heads or tails. The more often you flip the coin, the more evenly it will be distributed between heads and tails, and the closer the probability will settle at 50:50. If you take an additional factor to heart, even a hit rate of only 50% will be enough for a positive trading result: The risk-reward ratio, or CRV for short.

The CRV improves the chances of winning

If you always bet 100 Euros to win 100 Euros, you will not make money in the long run with a win probability of only 50%. On the contrary, due to the trading fees at the stock exchanges, he will constantly lose. However, if you always bet 100 Euros to get 300 Euros, you will get a CRV of 3:1, which means that you always bet less than you can potentially win. With a probability of 50:50, he will earn three times more in case of a win than he was willing to lose.

With every win, the trader thus buys two more losing trades, which he can use risk-free, since he does not have to use his own money. Since statistically he loses only every second trade, he cannot avoid making profits in the long run.

Theoretically, a trader can flip a coin before each trade whether to go long or short now, then set his stop loss and TP with a CRV of 3:1 and just let the trade run. If he does this with a high frequency, he will not lose money in the long run. In practice, however, it does not look quite so simple:

As Aristotle said so well: “Probability also includes the improbable”.

In our example, despite the 50:50 probability, only the opposite can occur over a longer period of time and thus, for example, only the number at the top can remain on the coin toss. Stochastically, this can happen 27 times in a row in extreme cases. This automatically raises the question of whether the trader really still believes in his strategy after 27 losing trades and is prepared to enter the 28th trade. If it is not the head that is the problem, then perhaps it is the account. Does the trader still have enough money left to enter the 28th trade?

It will always be our head and therefore our own psychology that play tricks on us in trading and make life difficult. Even if we stick to the above mentioned “Fill or Kill” method and always enter a CRV of 3:1, a longer loss phase can make us doubt and possibly look for other trade ideas. The search for the supposed holy grail begins again.

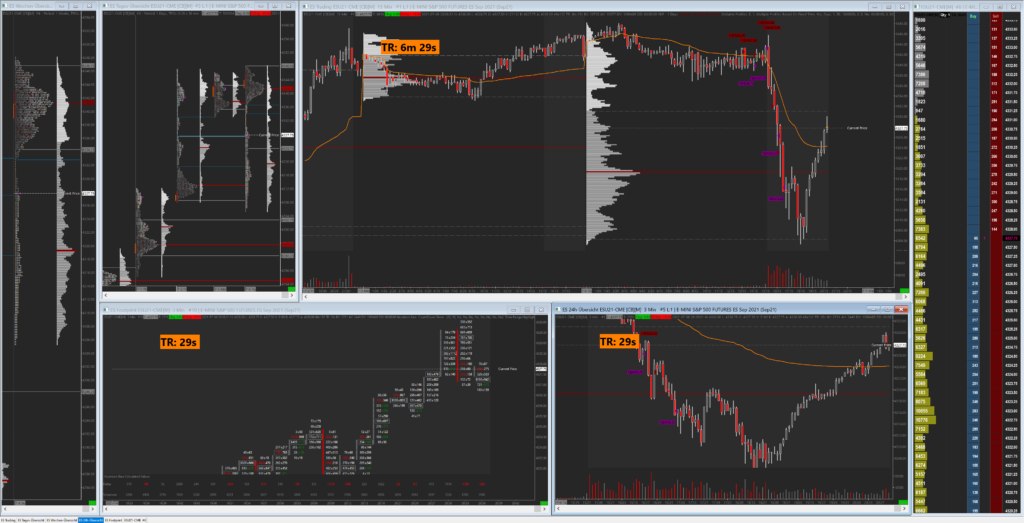

If the trader continuously monitors his trades and watches how they develop, he may end them prematurely because they are either close to the target or about to run into the stop. In both cases, he changes the probabilities by his intervention and acts out of pure emotion. He is not sticking to his strategy and plan.

We need probability increasers

The goal in trading should therefore not only be to have a positive CRV, but also to increase the probabilities of one’s own trades. You should not let the coin toss decide whether to take a long or short position, but trade exclusively at price ranges and levels that have a proven high chance of working in the past.

You can only find such levels and price ranges by doing your own research. You will have to spend hours, if not weeks in front of the charts to find such levels and internalize them for yourself. However, this research will also give the trader the certainty that one’s own strategy will work out in the long run with a high probability, thus making it easier for the trader to be able to execute the plan stupendously like a robot and thus almost emotionless.

This is all easier said than done. Not every trader will overcome this hurdle, let alone work on them at all. Trading is super simple and rationally logical to explain in theory. In practice, however, you are constantly confronted with problems that make you doubt or even give up. It’s not for nothing that 80% of traders lose money on the markets….

Keyfacts:

- even with a probability of winning of 50% money can be earned in trading

- but the CRV should always be positive

- every premature termination of a trade has an impact on the probabilities

- even with high probability the opposite can always happen

- head and psychology play with us in every trade

- can we cope with 27 losses in a row?

- … financially and emotionally?

- we need a strict plan, which we implement like a robot

- our own research gives us additional security