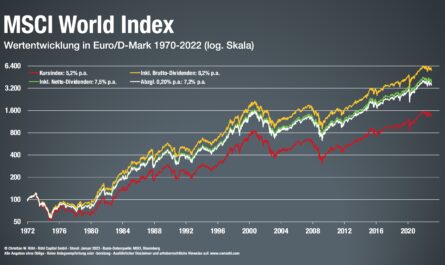

We have already reported in detail on the requirements for futures trading in this blog. For most traders, the biggest obstacle is certainly the question of capitalization. Because if you want to trade in the ES future and thus the regular S&P 500, you not only need expensive software, but also have to reckon with a tick value of 12.50 US dollars. In addition, there is a margin requirement of at least 400 US dollars for day trading or several thousand US dollars for overnight trading.

If you only want to risk 20 ticks up to your stop, you already have to have 250 US dollars available for this and deposit another 400 US dollars as security. If you then assume that you will never risk more than 1% of your capital, you would need an account size of at least 25,000 US dollars.

In the meantime, therefore, micro futures are offered, which were brought to the market in competition with the CFDs and manage with significantly smaller tick values as well as margin requirements. With MES, the little brother of ES futures, the smallest price movement amounts to only one tenth. Per lot and tick, only 1.25 US dollars are moved, and the margin requirement amounts to only about 40 US dollars in daily trading, depending on the broker. With a 20-tick stop, this corresponds to a risk of only 25 US dollars, and the required account size would be only about 2,500 US dollars, if one also wants to adhere to the 1% rule here.

Liquidity through debt providers

But there is also a possibility in futures trading to be able to trade the large futures contracts without any equity capital and thus even almost risk-free: Via debt accounts. Providers such as OneUp Trader, Leeloo Trading* or TopStep provide their traders with capital with which they may trade.

The profits are then usually split according to the 80/20 principle. The capital provider receives 20% of the profits and the trader 80%. Losses are borne entirely by the capital provider. In order to get such an account, you first have to prove to the provider of outside capital that you can trade and that you have your risk and emotions under control. In most cases, you have to trade a demo account for one month under the supervision of the provider and adhere to numerous rules. Depending on the provider, for example, no position may be held overnight, not traded at news times and of course the maximum drawdown must not be reached. In some cases, even a scaling plan must be adhered to. In this way, the lenders protect themselves.

Evaluation phase as a test

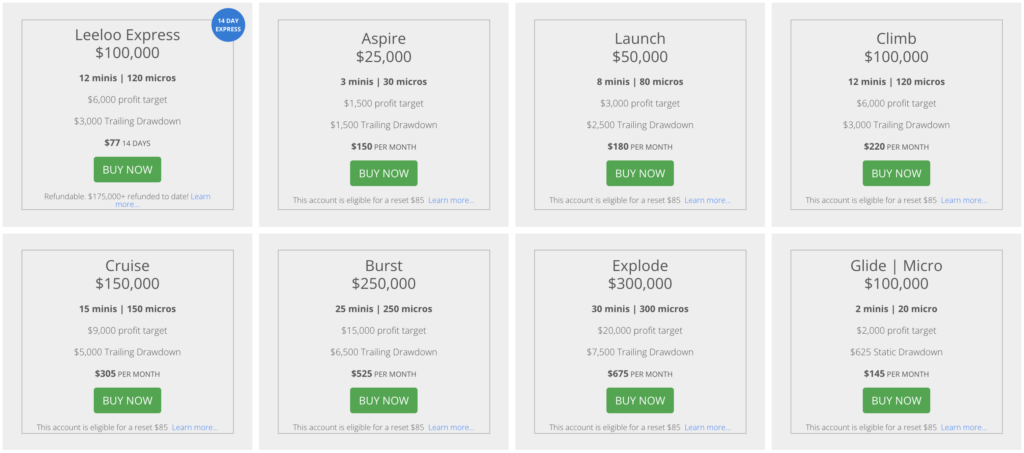

For the evaluation period, you have to pay a monthly fee depending on the account size, the maximum position size and the allowed trading instruments. At Leeloo, one pays for 30 days and a $100,000 account with an automatically trailing drawdown of $3,000 with a maximum size of 12 lots $220 for that month. After breaking the rules, one can either apply for a new account at the same price or reset it for a fee of about $85.

Trading with borrowed capital has another advantage: Since the later profit payments are booked as commissions and one must have registered a trade for it, one can escape in such a way the loss set-off of 20,000 euro in the year and thus one of the largest tax insanity.

It is not easy

However, practice shows that it is not quite that easy in the end. It is a win-win situation for the providers of external capital. Either they find capable traders who bring them regular profits, or they earn from their failure and their constant new attempts via the monthly and reset fee. The risk for them is kept within limits in view of the sometimes very strict rules. In addition, automatic monitoring algorithms ensure early exit to protect the account.

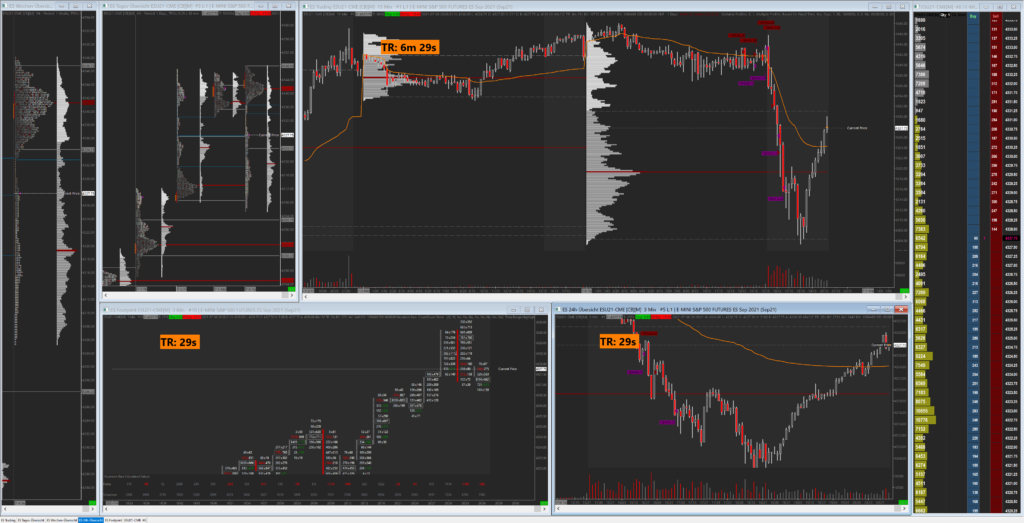

Only those who have really disciplined several months traded up a demo account or have already increased a small live account should dare to try. We started the application phase at Leeloo ourselves three weeks ago and are already in the evaluation phase. After eleven trading days, we have already successfully traded just under $2,000 and are thus well on our way to capitalization! On our Instagram channel we post our daily performance excerpt!

Keyfacts:

- a large equity account is not necessary for futures trading

- you can also do it through debt accounts

- then you share the profits with the capital provider

- … but you have to go through a difficult testing phase

- the rules are partly very difficult

- it requires a lot of discipline and perseverance

- trading through debt accounts also has tax advantages