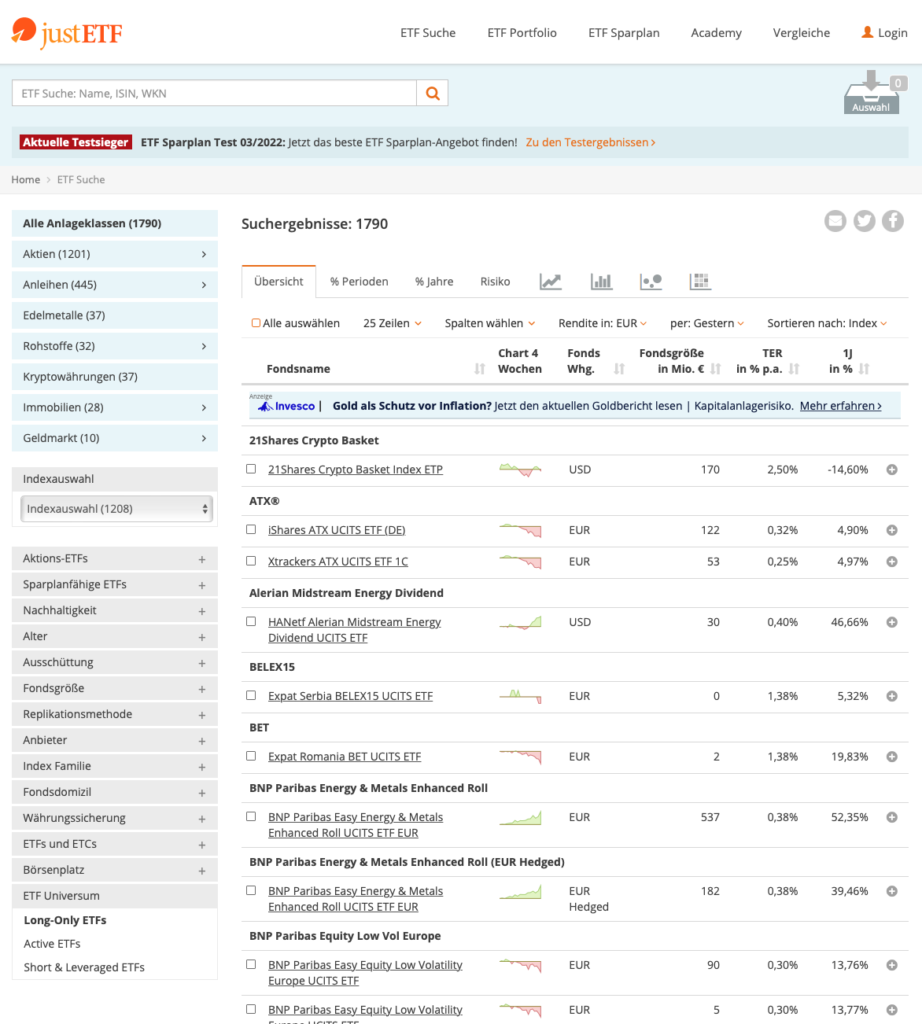

If you have decided on a long-term ETF strategy for your investment, you will quickly come up against a whole host of questions. Which ETF should I choose? What criteria should I take into account when buying? Do I take an accumulating or a distributing fund? From which company should I buy? And through which broker? There is a helpful tool for clarifying all these questions: The website justETF.

First of all, justETF is a comprehensive comparison platform for a wide range of ETFs. If you know your criteria and have already worked out a strategy, you can use it to find the right ETF with just a few clicks, so that you can buy it from your custodian bank, preferably via a savings plan.

Step by step to the right ETF

The first step is to decide which index the ETF should track. At justETF, almost 1,800 different index funds are listed, which track classic stock indices, but also consist of bonds, precious metals, commodities, real estate and now even cryptocurrencies. So first of all, you should be clear which index strategy you want to follow. In our example, we start from the classic “MSCI World” strategy in combination with an “Emerging Markets” ETF, weighted according to 70/30.

In the next step you should set the replication type at justETF. Here you can distinguish between a physical replication and a synthetic one. If an ETF is fully physically replicated, the securities contained in the index are bought one-to-one. In the case of the 1,600-stock MSCI World, this would be the same number of companies. In the case of physical replication using the sampling method, the securities are replicated using a computer-based optimization process. In concrete terms, this means that not all 1,600 MSCI World stocks are purchased, but only those with the greatest impact on performance. This reduces costs for the provider.

Bei der synthetischen Replikation findet hingegen ein Tauschhandel zwischen beispielsweise einer Investmentbank und dem ETF-Anbieter statt, womit auch hier nicht alle Titel des Indizes gekauft werden. Um das Risiko gering zu halten, empfehlen wir die physische Replikation – ob vollständig oder per Sampling spielt jedoch keine allzu große Rolle.

Working through the list of questions

In the next step, investors should consider whether they want to buy a distributing ETF or a security that reinvests (accumulates) its profits. This decision is very individual and has advantages but also disadvantages. While one person – like us – wants to build up an additional, passive income and is thus dependent on the regular cash flow of the profit distributions, the other investor wants to benefit maximally from the compound interest effect with an accumulating ETF and reinvest the profits automatically without tax deduction.

The next look should be taken at the TER. This summarizes all costs that are incurred annually for the management and operation of the ETF. For a traditional ETF, these are around 0.1% to 0.6% per year – depending on how exotic the index is. A popular MSCI World is less expensive than an ETF specifically focused on gaming or water. The cheaper an ETF is to maintain, the more return you can end up with. Even the smallest fees are known to have a big impact on long-term returns.

The fund volume should also be taken into account in the decision-making process. This is the total amount of money invested in the ETF by all investors. If the fund volume is rather low, the ETF may be discontinued by the provider, as it can hardly make any profits in absolute terms due to the TER. The rule of thumb is a fund volume of at least 50 million euros, better one from 100 million euros. ETFs with higher volumes usually have a lower expense ratio.

All these criteria can be conveniently clicked together via the website justETF. The site also provides practical information on where the individual ETFs can be purchased from which broker under a savings plan or as a one-off purchase once the search has been completed.

Keyfacts

- justETF helps in the search for the right ETF

- many questions have to be answered in advance:

- Strategy, replication, accumulation, fund volume, TER, etc.