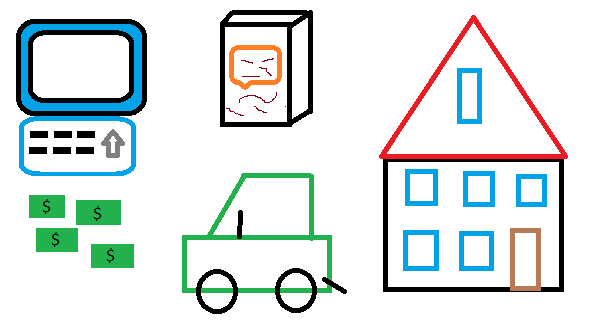

There are many reasons why you should always make sure that you don’t squander all your available money, but also put some aside. Only in this way can you pay your fixed costs, such as rent or insurance, without having to resort to the expensive overdraft facility of your bank. That saves on top of that also still costs. You no longer live from hand to mouth and don’t immediately notice increased prices in times of high inflation in your monthly budget.

In addition, you build up a certain money buffer from month to month, which can then be used for unforeseen events. If once the refrigerator gives up the ghost, one must be annoyed only briefly and buys simply over its reserves a new one. If you already have to take out a loan for this, you tie additional fixed costs to your leg every month and have to constantly remind yourself of the annoying event when making the monthly installments. One is constantly confronted with it.

A cash buffer is essential

The same applies to major purchases or well-deserved vacations. It’s always better to pay for the next smartphone or the new notebook out of the petty cash you’ve set aside for it than to borrow money from others for this purpose or simply pay it off every month via the mobile phone contract that you’ve tied to your leg for 24 months. You have to be able to service the costs every month. That starts my cell phone contract, goes beyond subscription services like Netflix or Spotify, and extends to the car lease. Every expense on the credit card is a potential risk of accumulating additional costs.

At the same time, you can use your savings to regularly reward yourself for being frugal on a day-to-day basis and simply take a weekend trip to the countryside or a city break with your loved ones. The money on the high side makes this possible.

Frugality starts in the mind

But having a bit of wealth also makes itself felt at an earlier age. If you saved your earnings for a vacation or a part-time job in your youth, you can leave your parents’ house more relaxed or easily pay for all the furnishings for your first apartment. You become more independent from your parents. If you also save for retirement, you reduce your chances of falling into old-age poverty later on, given the ailing state of our pension system. In most cases, the pension gap can be closed through thriftiness, so that one does not have to make any cuts in old age and can continue to participate in social life. Those who have accumulated a real chunk of assets may even be able to do without state benefits altogether.

From a tenant’s and employee’s point of view, it is also easier to live with a large deposit. You don’t have an expensive home loan to worry about, and the dividends might even cover the monthly rent payments for your apartment. If the landlord announces once own need and terminates properly, one moves simply somewhere else and lives there further as up to now. If there is trouble with the boss, you can confront him more confidently or even risk being fired. The assets on the high side help to get by for a few months without a salary.

All of this actually results in one thing: If you have money lying on the side, you live more carefree and make yourself less dependent on others. Be it from parents, family, employer, banks or even the state. Money is printed freedom! We had already covered the seven steps to financial freedom in detail in this blog.