Away from long-term investing, which is predominantly based on shares, ETFs, P2P loans and cryptocurrencies, we will be covering the topic of “futures” in this blog. This is a financial product that is traded directly on the stock exchange – for example in Chicago (CBOT) or Frankfurt (Eurex) – and whose roots go back to ancient times. The future celebrated its triumphal march above all in the 17th century when the utopia of trading in tulip bulbs reached its peak in Holland.

A future belongs to the group of financial derivatives and is basically nothing more than a forward contract on a specific commodity, index or currency. The basic idea dates back to ancient times and originated mainly in the agricultural sector. A futures contract is a contract that obligates the seller to deliver a commodity to the buyer at a fixed price on a predetermined date in the future. Since the price in the real economy is always made up of supply and demand, in practice it can constantly change and fluctuate.

With the help of such a contract, the seller (and/or the buyer) can hedge against these price fluctuations and will actually get rid of his product later at a fixed price, even if the price has fallen significantly later. The buyer and seller can calculate more easily and do not need to worry about the later price development.

In this example, the risk of price fluctuation lies with the buyer of the futures contract. He commits himself to take the commodity from the seller at the agreed price. If the price is later below the level of the futures contract, the buyer makes a loss. If, on the other hand, the price has increased, the buyer can immediately sell the product at a higher price on the market as a whole and book a profit.

Raw material, recycler and speculator

A practical example: Beer brewer Huber needs wheat for his production. Of course, he can always buy this raw material directly on the overall market, but then he runs the risk of constantly changing prices. Sometimes he buys cheaply, sometimes he has to dig deeper into his pockets. This can lead to problems: Either he cannot afford the usual amount of wheat and may have to brew less beer, or he has to pass on the increased prices directly to his customers later on and runs the risk of upsetting them and lowering his sales. He can avoid this risk on the futures markets by looking for someone there who will supply him with the desired price and the required quantity in the future on a binding basis. He passes the risk on to the other contract participant.

These individual, so-called futures contracts can then be resold and traded on the exchange. The original contract participants can thus avoid their actual obligations by reselling the contract. However, if the contract reaches its scheduled end, the last contract holders must redeem the agreed contents. The exchange of goods and money must take place.

Brewer Huber then receives his wheat and must pay for it at the agreed price. If the seller has no wheat in stock, he must procure it immediately at the usual market price and hand it over to Bierbrauer Huber. If the price is under the agreed upon sum, then the salesman makes profit and Bierbrauer Huber would have gotten away more favorably at the market. If the price has risen, Bierbrauer Huber nevertheless retains his price stability; the difference is paid to him by the seller, who thus makes a loss.

Future Trading: Trading and Obligations

Whoever buys such a contract is not necessarily interested in the exchange of goods, but wants to profit from the so-called cash settlement. This is the difference between the entry and exit price. Many brokers are aware of this and sell the position in time for a high penalty fee or do not offer physical delivery at all. To make things easier in practice, each futures contract is firmly defined by the exchange in terms of quality, quantity, underlying and expiration date, which can be found in the respective contract specifications.

In concrete terms, this means: Anyone who trades a futures contract on the exchange is providing price stability for others or hedging his own transactions through his speculation. This means that beer does not necessarily become more expensive just because the price of the basic raw material has risen. A transfer of risk takes place. Profits, but also losses, can be realized through the difference between the entry and exit price.

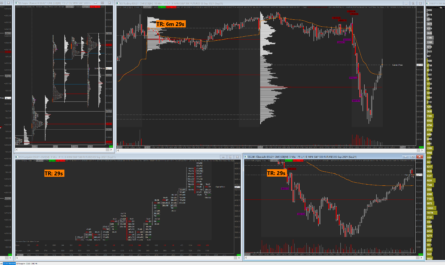

We try to generate additional income with futures trading, which we then transfer to the long-term investment.

Keyfacts:

- a future is a forward contract

- Seller has to deliver goods after expiration of it

- Buyer must pay fixed price and accept goods

- quality, quantity, strike price and term are fixed

- the contracts can be traded on the stock exchange

- difference between entry and exit price provides for profit or loss