There are many ways to increase your own monthly income. For many employees, unions fight for regular wage increases for their members. Most recently, ver.di achieved 2.8% more pay for state employees from December 1, 2022, plus a tax-free payment of 1,300 euros. The collective agreement negotiated in mid-October is to run for 24 months. After that, it will presumably be renegotiated. This means that employees of the federal states with a ver.di collective agreement will receive a wage increase of 2.8% over two years.

But third parties do not worry about regular salary adjustments in every employee relationship. Employees regularly have to negotiate their salaries themselves and ask their boss to pay more. Sometimes this succeeds to a greater or lesser extent. But whether it’s 2.8% through the union or 200 euros more calculated over four years: These small salary increases often only compensate for inflation and are not a real increase in real wages.

Buying passive income

If you buy dividend stocks every month through a savings plan, you are investing in passive income and buying additional income month after month through your savings. Although companies can decide from one day to the next to stop paying dividends or to reduce them, anyone who has once achieved the status of a dividend aristocrat will not want to give it up again so quickly. Companies may call themselves dividend aristocrats if they have continuously increased their payouts from year to year for at least 25 years.

In fact, the increases are much larger than those paid to salaried employees, since in absolute terms the dividends paid per share are quite small. An increase of a few cents is therefore much more noticeable per share. Added to this is the fact that the dividend saver acquires more and more shares through his regular payments and can thus further increase his personal earnings. This really gets the snowball rolling.

2-digit percentage increases possible

As a quarterly payer, Coca-Cola distributed $0.42 per share to its shareholders last year, increasing its payment by one U.S. cent year over year, an increase of about 2.3%. Over the years, the increases were even more significant. Over a five-year period, Coca-Cola increased its dividend by an average of 3.2% per year, and over ten years by as much as 5.6%. Nestlé saw its dividend rise by almost 2%; over five and ten years, the increase was as much as 3.9% to 4.5%.

Adidas rose by an impressive 10.7% over a five-year period and by almost 13% over a ten-year period. At the time of the Corona crisis, however, the Group suspended its annual dividend completely, only to pay 3 euros per share again in May 2021. Before the pandemic, the dividend was raised from 2.60 to 3.35 euros, an increase of almost 28%. At Microsoft, the average increase over a decade was 12.6% and at Deutsche Post 7.6%.

As you can see: Increases in the high single-digit or even low double-digit percentage range are often possible!

Personal experience

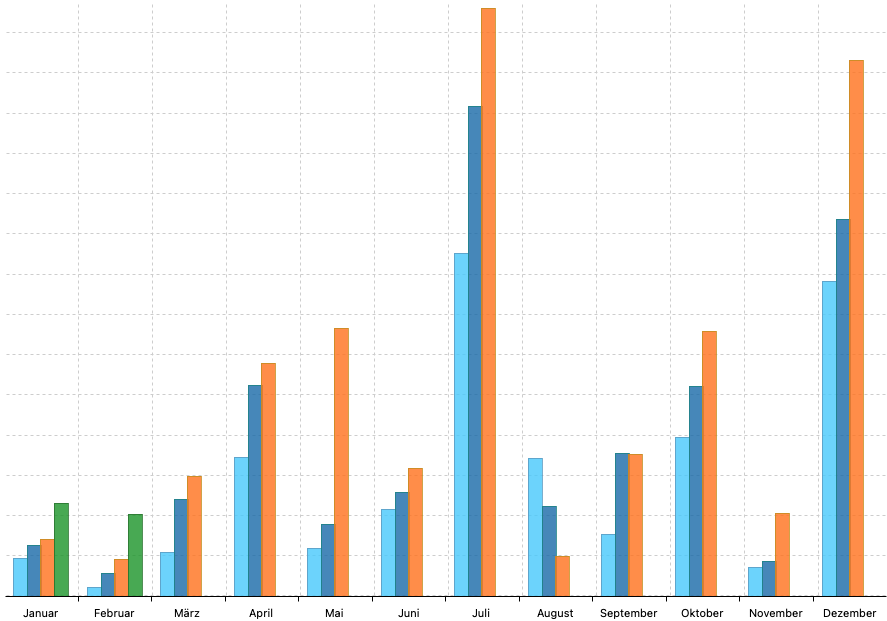

My distributions had also improved considerably recently. In January alone, my passive income climbed through dividends, interest and P2P loans and well over 50%. Year-on-year, I was able to receive as much as 25% more distributions from 2020 to 2021. In the meantime, I can cover my fixed costs for almost three months with this and thus continuously get a little closer to financial freedom.

Keyfacts

- investing in dividend shares can also increase your income

- dividend payers stay that way for decades

- from year to year the dividends are significantly increased

- high single-digit, or low double-digit increases are realistic

- through the steady purchase by savings plan, the distributions increase