Those who deal with trading more intensively for the first time are confronted with numerous risk warnings. Not only because trading financial derivatives is associated with enormous risk, but also because there is a possibility of suffering losses equal to or even exceeding the entire investment. In addition, most traders lose. Statistics say that 95% of traders lose, and only a very small percentage are successful on the markets at all.

Losses are clearly part of the daily business of every trader. Especially the way to become a successful stock market trader is very painful and costly. We have been dealing with this topic for more than six years now and during this time we have experienced a real roller coaster ride in terms of our account balance, but most of all in terms of our emotions. There is a reason why most day traders lose. In short, it’s perseverance, discipline and a good dose of psychology.

Only those who work hard become successful

The first big mistake is a lack of risk management. If you blindly open any positions and even buy them at a loss or simply increase the size of your position in the red, you will sooner or later drive your account into the wall. On the other hand, if you always risk only 1% of your available risk capital per trade, do this at price points where you have a statistically high hit probability and only trade with a high risk-reward ratio, you can stay in the game for as long as possible. For example, someone with an account size of $25,000 who executes a trade with a risk of loss of $200 that potentially earns him $600 can mathematically only win in the long run with a hit rate of 50%.

The other 50% are of course losers that have to be mentally endured. In such drawdown phases, you must not get emotional and simply stick to your plan and execute it like a robot. It is pure confidence, which you can only acquire with hard work. Only those who sit in front of the charts for several hours a day, evaluate their trades every day and do research by testing their strategies back in time on the weekends will be able to build up this treasure trove of experience. This experience brings the necessary security.

The strategy almost doesn’t matter

However, most trading beginners engaged in the search for the holy grail. They test a strategy that doesn’t work for them because of too frequent losses and simply hop to the next one without staying on the ball and mastering it. Meanwhile, any strategy can work for anyone if you learn it through painstaking work – whether it’s market technique, volume, or simply following simple chart lines.

The rule is: the more people recognize the same situation in the chart, the more it will be traded and the better the idea will work. Many traders act on the 4-hour chart, almost every trader keeps an eye on what is happening at the daily highs and lows. If you trade a breakout or a setback here, you have a good chance of walking out with a profit. Everyone just trades at points like this.

Many day traders are in the smaller timeframes like the 15 or even 5 minute chart and draw their support and resistance lines there or areas that have held more often. The same applies here: The more traders see these price areas and become active there accordingly, the better they work for everyone. The supreme discipline is, of course, looking at the volume. Here, with a little practice, you can see when a big player has entered or he is holding a price range to defend his position.

If you just pick one thing out of this broad spectrum of ideas and test it ad nauseam for yourself, you will become a master at it and ultimately gain the necessary experience that your ideas often work out in the long run and you will be able to regularly pull money out of the market. The rest is really just psychology. Can I handle losses? How do I act when I have lost multiple trades in a row? Here the book “Tradingpsychologie” by Norman Welz* is a good support.

- Brand: Finanzbuch Verlag

- Tradingpsychologie So denken und handeln die Profis: Spitzenperformance mit Mentaltraining

- Produktart: ABISBOOK

- Welz, Norman (Author)

Letzte Aktualisierung am 2024-07-21 at 12:24 / Affiliate Links / Bilder von der Amazon Product Advertising API

How we trade

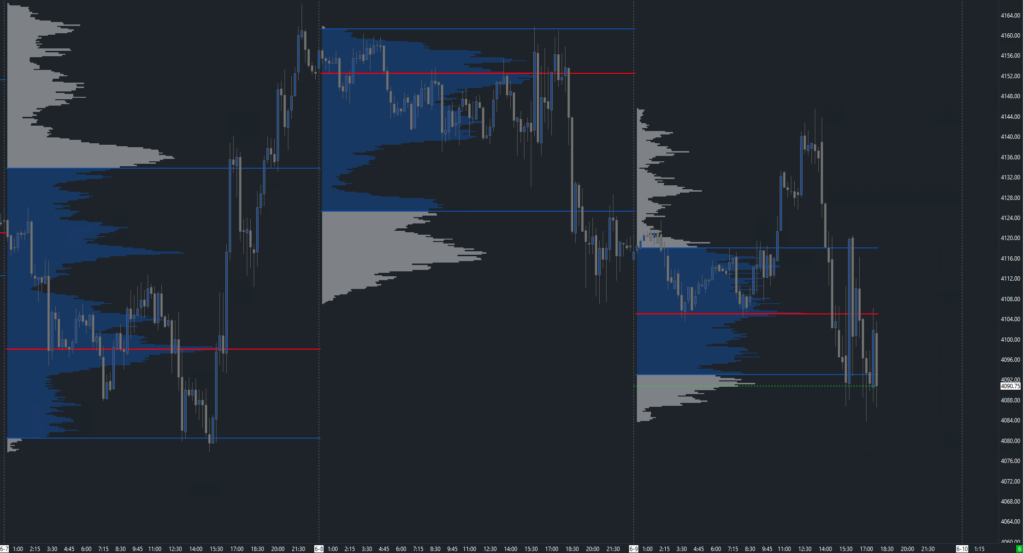

We rely on a mix of volume and market technology in our futures trading. We look for our price areas to trade at based on levels from the past: Where was there a lot of liquidity? At which price levels was there a lot of trading, leading to rejection or acceptance? We only want to be active in such price ranges and then observe the reactions on the market in a small time frame. Does the level hold or is it rejected? Do we recognize someone in the order book who is continuously adding to the price or who has simply gone in thick again?

We wait for a setup and then enter the market, provided we have the necessary space to let the price run accordingly and to get our necessary CRV. Only when all parameters fit, we go for the trade. We wait patiently and bet only as much as we are willing to lose to the maximum. However, to get there, we have spent thousands and thousands of hours sitting in front of the chart and the order book. Simply copying a trader is not possible. Everyone has to find their own style.

Keyfacts

- Trading is largely psychology

- the more people see the desired price ranges, the better they work

- the mathematics can be regulated by hit ratio and CRV

- dealing with losses has to be trained

- only the experience in one’s own doing brings the security to be able to exist in the long term

- every strategy that works in the past can be mastered in the long run

- we trade a mix of volume and market technique, but above all with a look into the order book

- we have done the hard work of researching

- …. and thousands of hours spent in front of the charts