If you want to invest your money in the stock market on a broadly diversified basis and over the longest possible period of at least ten years, you don’t really need an expensive fee-based advisor, and you certainly don’t need a traditional investment or bank advisor. Investing money is not rocket science and once set up almost a no-brainer. In this article I present three simple investment strategies for everyone.

The classic 70:30 split

Probably one of the most common ETF strategies is the classic 70:30 split between the MSCI World and the MSCI Emerging Markets. This involves putting 70% of the monthly savings rate into an equity ETF. This replicates the MSCI World and is thus broadly invested in around 1,600 companies. The remaining 30% of the savings amount is put into another ETF that exclusively includes emerging markets. The reason: they are said to be more important on the world market in the coming years and thus are likely to grow more strongly than the developed industrial nations. Typical emerging markets include China, Brazil, India, Russia and Turkey. In addition, the classic MSCI World Index contains to a large extent shares originating from the USA. With a view to broad diversification, this is too U.S.-heavy for many investors.

However, the strategy is not entirely passive. Over the years, the 70:30 ratio may shift significantly, as one of the two ETFs is likely to grow more than the other, causing the actual risk ratio to shift and need to be restored through selling and re-buying. This process is called rebalancing and should be carried out regularly by the investor.

A single FTSE All-Word

Our second ETF strategy eliminates rebalancing by buying only a single ETF. The FTSE All-World is also an index that invests exclusively in shares of companies with the largest market capitalization. As of October 31, 2021, the index contained 3,752 companies from every possible industry. The largest holdings include the technology sector, non-basic consumer goods, financials, industrials and healthcare, and consumer staples and energy. The index also invests in commodity and real estate stocks. The disadvantage here is also that almost 60% of the stocks in the index are based in the USA. The gap to second place with 6.4% for Japan is huge.

ARERO – the world fund

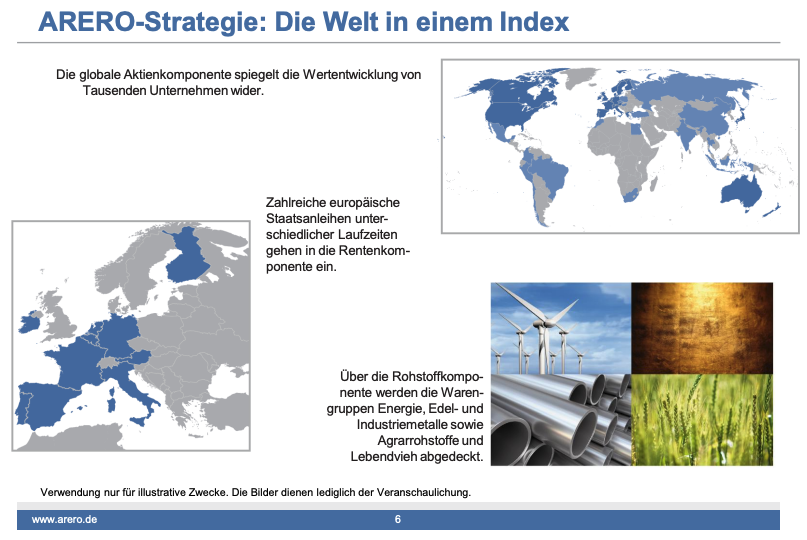

The two previous investment strategies invest exclusively in equities. If you want to stay a bit more conservative from a risk point of view and at the same time invest in bonds and commodities, you should take a closer look at the ARERO World Fund. Background: If there should be a crash on the stock market (and this will certainly happen again), large institutional investors usually pull their money out of the market and park it in other assets, such as bonds or commodities like gold. In this way, the fund absorbs possible losses in the stock market by increasing its positions in the bond and commodity markets. From a risk perspective, the global fund is therefore less susceptible to fluctuations.

The fund invests 60% in equities, 25% in bonds and 15% in commodities. ARERO is thus not a classic ETF, but a regular fund based on a passive strategy that requires little effort on the part of the issuing provider.However, the fee structure is only minimally above that of a classic ETF.There is just a flat fee of 0.45% – no other costs such as front-end load or even performance-based fees.The fund provider also takes care of the necessary rebalancing.

The ARERO World Fund is thus a completely passive financial product that, with automated savings plans, is suitable for anyone who wants to spend as little time as possible on their investments.

And which broker to use?

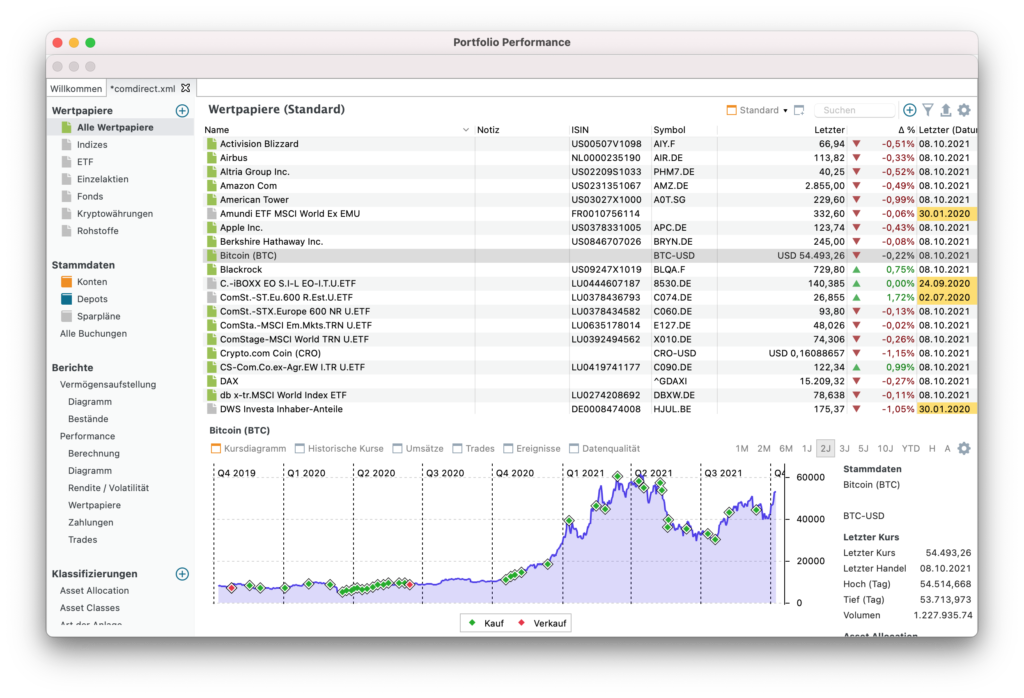

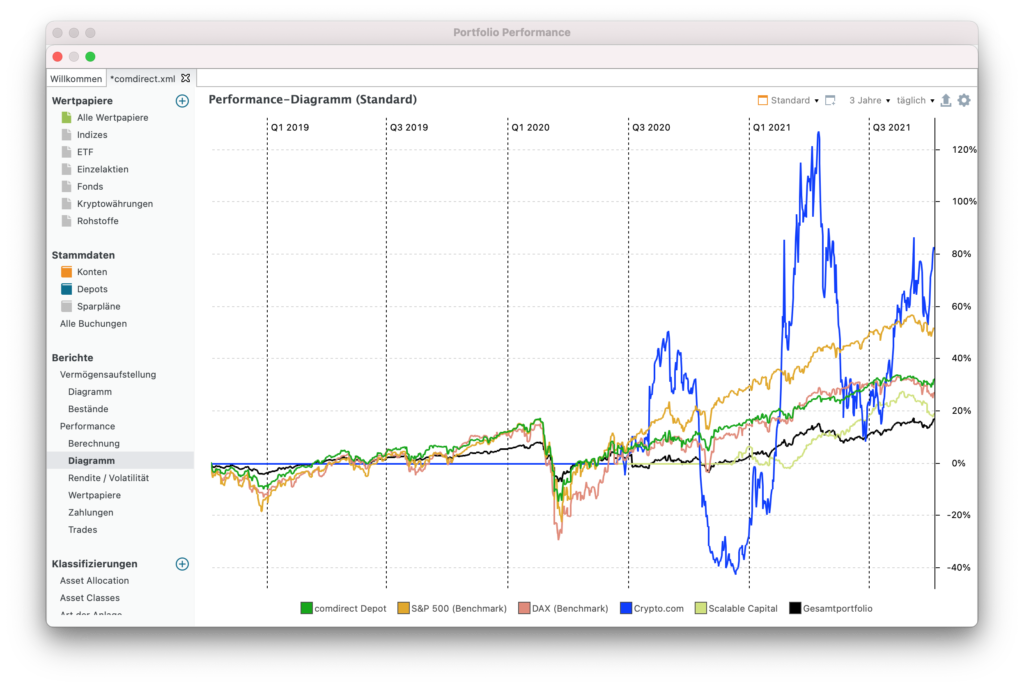

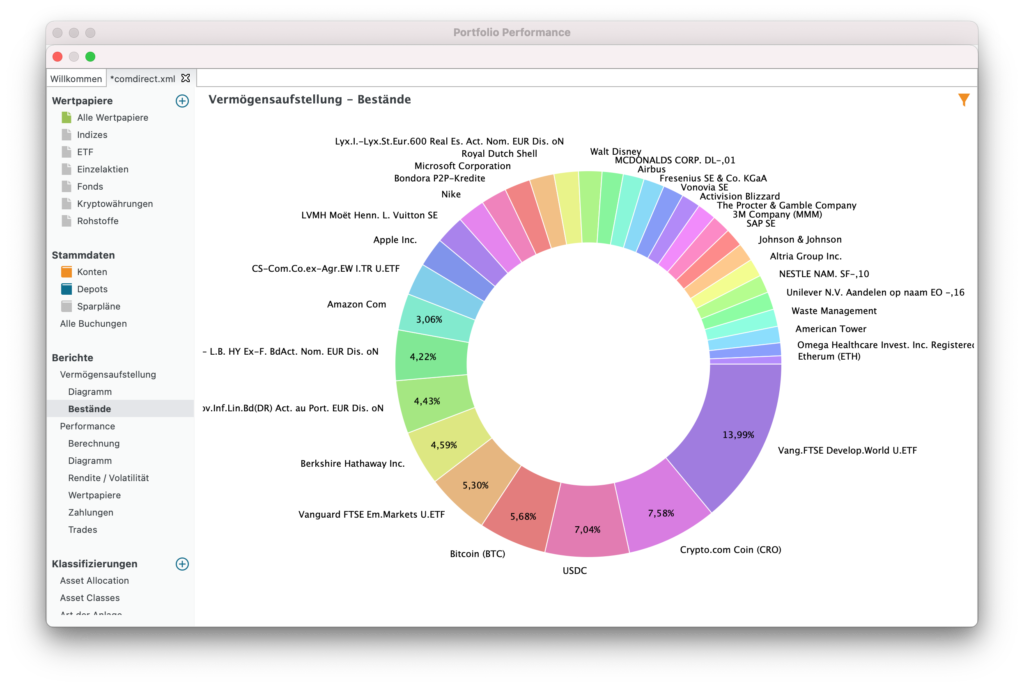

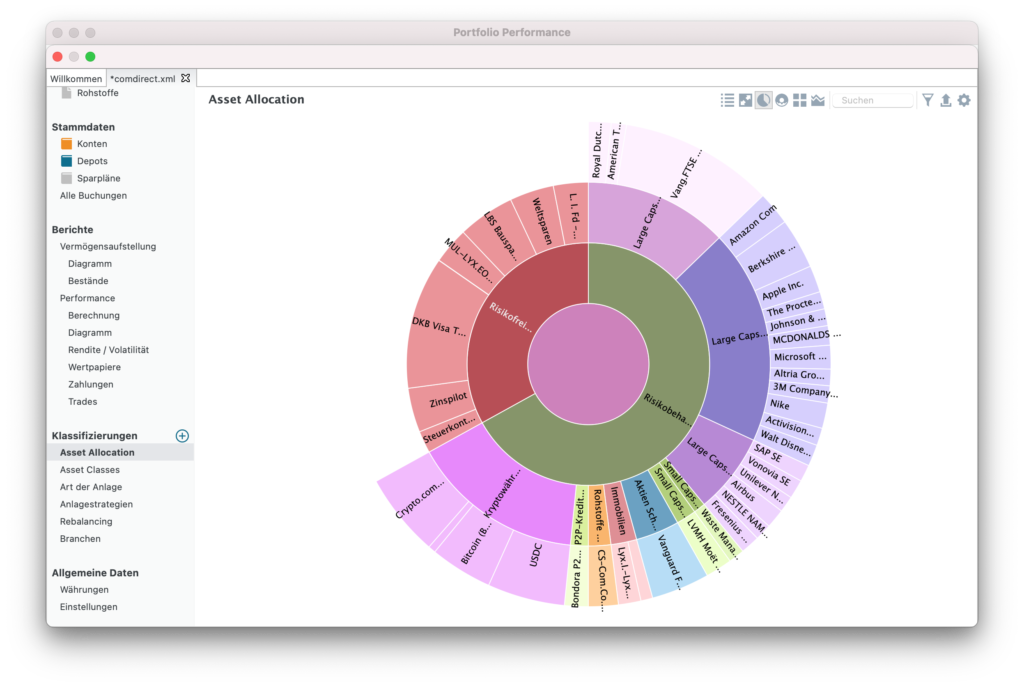

All the strategies mentioned here can be easily saved every month through the brokers that I use myself and that I always recommend. In some cases, you only pay 1.5% of the savings amount per execution or you can even save for the above-mentioned indices and funds completely free of charge. I have presented the banks and providers I use, as well as my tracking tools, in two separate articles.