If you want to minimize the risk of your investment, you have to spread your investments as widely as possible. This is not only done within an asset class, but also beyond it. You can invest your money not only in securities, but also in P2P loans, real estate or even cryptocurrencies. The latter have become increasingly popular with the huge rise in the value of bitcoin and have turned into a real goldmine for many investors. We were also quite skeptical at first, but then started investing part of our savings rate there as well just under a year ago. There is a lot that can be done with cryptocurrencies, as we will show in this article using Crypto.com* as an example.

Established platform with a high need for security

Crypto.com is first of all a trading platform through which you can buy a wide variety of cryptocurrencies. It has existed since 2016, but was only renamed Crypto.com in July 2018. According to estimates, the domain alone cost around 12 million US dollars at that time. Originally, it operated under the name “Monaco Technologies”. Today, the company’s offerings make it one of the established providers on the market, with branches in Bulgaria, Malta, China, Hong Kong, Singapore and the United States.

In the strategic orientation, a lot of emphasis is placed on transparency and security, so that one would like to comply even with the strict regulations of various countries, which should ultimately create trust. Thus, not every product from Crypto.com is available in every country due to the different regulations from country to country. In Germany, for example, the credit function is not available, while Swiss citizens are denied access to Crypto Earn. One works closely with regulators. A KYC process (Know your Customer) with legitimation of the customer is thus a mandatory requirement to be allowed to use the platform.

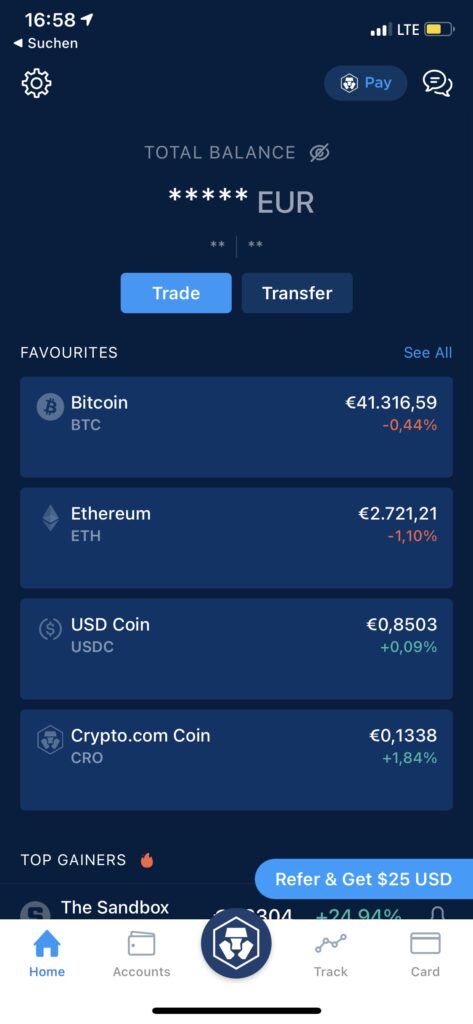

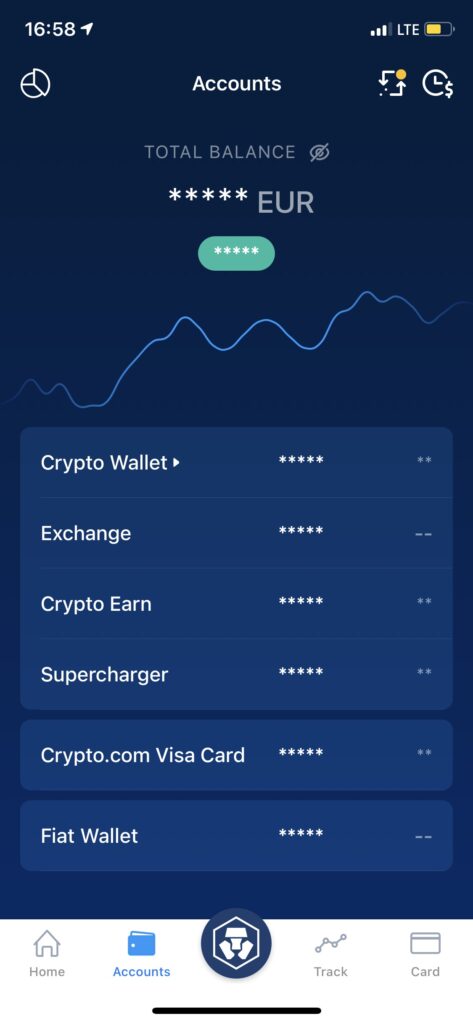

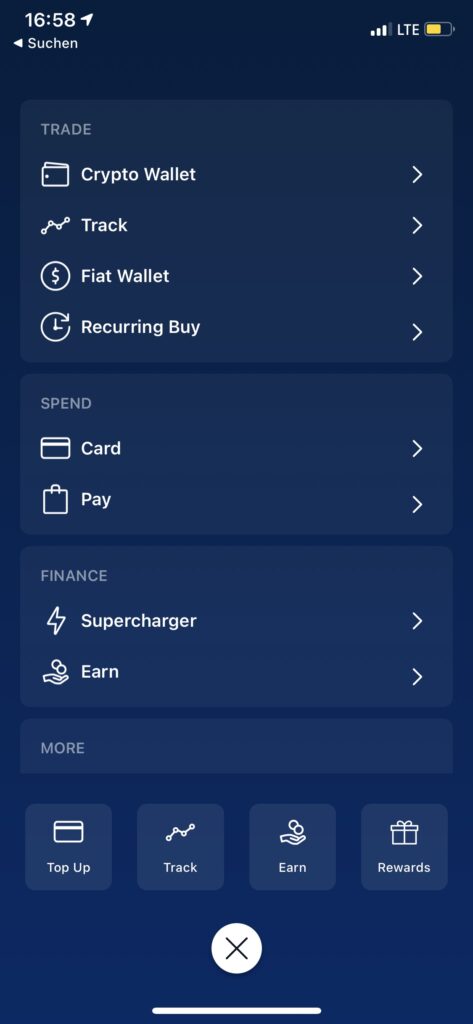

Basically, Crypto.com tries to combine the classic world of finance with the world of cryptocurrencies. Thus, it acts as a kind of bank that manages the deposits and as a kind of broker that takes care of the processing when buying and selling. This works not only conveniently from the smartphone via an app, but also partly via the desktop and the browser. One of the basic functions of the Crypto.com app, which is available for free in Apple’s App Store and Google’s Play Store, is buying and selling selected cryptocurrencies.

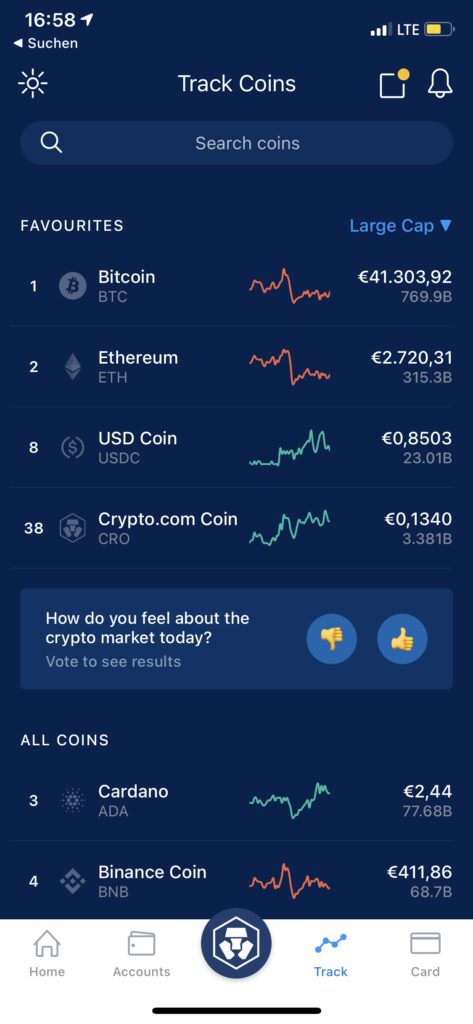

Included is, of course, bitcoin as the lead currency, but also many other important and well-known altcoins such as Ethereum, Cardano, Tether, Ripple or Litecoin and Uniswap. Various stablecoins like USDC or USDT can also be traded via Crypto.com.

Buy and sell

Coins can be bought with just a few taps via the app. Either directly by credit card or via a separate settlement account with its own IBAN, to which funds can be deposited free of charge from any checking account. For purchases via a MasterCard or Visa card, an additional charge of currently 2.99% is due for existing customers. Coins can also be exchanged for others directly. There are no fees, only the spread has to be paid. There is even a savings plan function. Known and liquid coins can be bought automatically at a specified day and amount. Crypto.com calls this function “Recurring Buy”. However, it is only accessible from a minimum amount of 45 euros, whereas individual coins can be purchased via a one-time purchase, sometimes from as little as one euro.

The coins are then managed directly in the Crypto.com app and can be transferred to their own wallets. As long as these are on the platform, one does not own the associated keys – “Not your Keys, not your Coins”. If Crypto.com disappears for whatever reason, the customers’ deposits are lost. This is a reason why you should choose several providers, especially in the crypto segment. However, the platform has taken out an insurance policy worth millions of euros to compensate customers at least partially in the worst case.

The individual coins can then be used for payment via the pay function. Here, merchants can integrate Crypto.com’s payment system on their website, similar to PayPal*, and thus accept various cryptocurrencies. Crypto.com itself uses the Pay function to sell vouchers for Amazon, Rewe or iTunes with a bit of a discount for the user. Of course, the coins can be transferred for free to friends and acquaintances who also use Crypto.com.

Visa card with high cashback

Probably the most important core product of Crypto.com are the Visa cards, which ultimately also brought us into the world of cryptocurrencies. They can be used to pay quite normally at the supermarket checkout or in a restaurant. They work anywhere Visa is accepted. Advantage: you don’t necessarily have to exchange your existing cryptocoins into euros, but you can load your card directly with fiat currency via bank transfer or another credit card, which doesn’t entail a tax case in Germany. Thus, Crypto.com brings the world of cryptos closer to the real world.

However, the whole thing can be extremely lucrative, because the platform’s Visa cards entice customers with high cashback rates that far exceed those of traditional banks, especially from Europe. Theoretically, there is up to 8% cashback, which can save a decent amount of money on purchases. The cashback is paid in cryptocurrency, with Crypto.com relying on its own utility token CRO, on whose blockchain the entire ecosystem is based.

Five different card tiers

How much cashback you get through Crypto.com Visa card depends on the card animal and the stake made. When ordering, depending on the card, a certain amount of euros equivalent to CRO must be deposited for six months. The more CRO one deposits and stakes on the platform, the more benefits one receives through the card.

With the Midnight Blue, no CRO coins have to be staked. In return, you only receive 1% cashback on your sales. For the Ruby Steel, a red metal card, on the other hand, 350 euros worth of CROs have to be purchased and staked away. For this, there is 2% cashback and a full refund of Spotify’s standard rate. Users of the music streaming service can deposit their Crypto.com card as a payment card and then receive the same amount credited in CRO tokens when the subscription amount is debited. This means that you get around 120 euros in CRO per year from Crypto.com alone if you are a Spotify user. With additional card turnover of around 1,000 euros per month, the necessary card stake for the Ruby Steel has thus already paid for itself after one year. However, the stake can be canceled at any time after six months and is therefore not lost. It is not a fee.

For the next higher card animal, the Royal Indigo or Jade Green, 3,500 euros must be deposited in CRO. For that, the cashback increases to 3% and Netflix is added to the Spotify option. Travelers will also enjoy unlimited lounge key access at the airport. Cardholders can use it as often as they like at airports to go to a separate lounge and wait there in peace for their flight to depart, sweetening the waiting time with drinks and snacks. In addition, there is even interest on the Stake in the amount of 10%, which is credited weekly.

In the higher tiers, cashback eventually rises to 5% and 8%, the Amazon Prime fee can be refunded monthly in CRO, and there’s up to 10% extra cashback on Expedia and Airbnb. One additional person can be taken to the airport lounge key lounge at a time for free. The black card also offers private jet service with complimentary champagne. However, it requires a whopping 350,000 euros to be deposited in CRO.

No extra fees

Incidentally, Crypto.com does not charge any fees for any of its cards. There is no annual fee, foreign transactions are settled at the usual Visa rate without surcharge, and cash can be withdrawn free of charge via allowances. In case of a card exchange or upgrade, however, a one-time fee of $50 is charged. Unfortunately, Apple Pay and Google Pay are currently not supported in Europe, but this can be circumvented via the Curve card*. Since a maximum of 25,000 or 250,000 euros can be spent via the card per month and year, the maximum cash back is limited.

Overall, one automatically buys CRO every month via the Visa card over one’s regular spending and thus benefits from the cost-averaging effect. During times when the CRO rate is low, there are more cashback coins, but during expensive times, there are fewer coins for each purchase. It is a good way to steadily increase one’s cryptocurrency position in the overall portfolio, and it is completely free. If you want, you can exchange or sell the CRO tokens from the cashback at any time.

Lending, Staking, Trading und NFTs

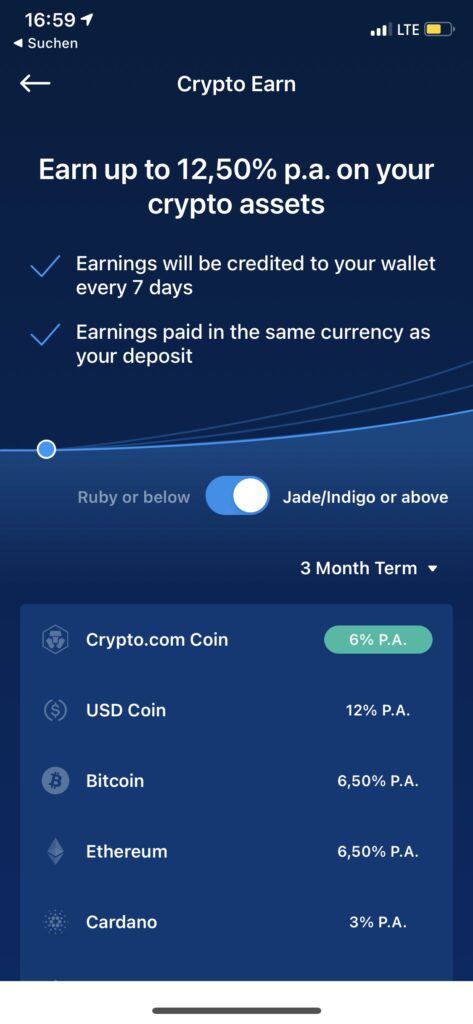

Via the Crypto.com app, the purchased coins or those generated via the cashback system of the Visa card can then be pushed into the earn program, where very high interest rates are sometimes enticing. Those who lend the in-house CRO coin to the platform for three months receive a proud 6% interest calculated over the year. For a one-month loan or flexible use, the APY amounts to 4 and 2%, which is still significantly higher than that of a regular call money account. On Bitcoin there is up to 4.5%, on Ethereum 5.5% and on Cardano still 2%.

Stablecoins are particularly lucrative. The USD Coin offers up to 10% APY. Another advantage is that, unlike the other coins, there is virtually no fluctuation in value because USDC tracks the value of the US dollar. However, there is a currency and platform risk. Holders of the higher card tiers starting from the Royal Indigo or Jade Green get even higher percentages, which creates an additional incentive for Crypto.com Visa cards.

The high interest rates come because there is a second medal of Crypto Earn. It is the credit function, through which customers can borrow various coins at sometimes significantly higher interest rates, for example, to trade on margin. However, the credit function is currently not available for German customers for regulatory reasons.

While the Earn program relies on lending, the CRO token can also be directly staked on the blockchain via Crypto.com’s DeFi wallet. Here, however, the tokens are not lent for loans, but one receives rewards for depositing them directly on the blockchain so that they can be used to generate new blocks and thus secure the network. In addition, one can participate in important votes that affect the network.

The Supercharger is another way to get more return from one’s coins. Here you can deposit your CRO with constant availability and farm other Coins depending on the action. In the past, there have been BTC, Dodge, Uni, Polkadot, and BOSON, among others. The returns depend on the liquidity of the entire pool.

Apart from that, Crypto.com still offers its own Exchange* and thus enables traders to do real exchange trading with cryptocurrencies. The exchange is much more professional than the app. Only professionals who know what they are doing should venture here. In return, there are significantly more functions, such as a candlestick chart, the option to set limit orders or to trade on margin.

Directly via the CRO blockchain, even NFTs can now be bought and traded. There are new promotions here on a regular basis.

Conclusion

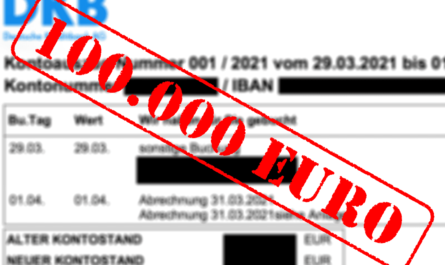

We have been using the platform for a little over a year and generate regular cash flow with it via the Visa card and the lending interest from the Earn program, and of course via staking directly on the blockchain. We have even traded the odd NFT in the meantime. The Ruby Steel card quickly became the next tier up. We entered the market at a time when the Bitcoin stood at around 15,000 US dollars and the CRO token was worth just under 11 euro cents, but in the meantime more than halved to 5 cents. The volatility on the crypto market is enormous, but thus offers many opportunities and risks. The Visa card, in conjunction with the Curve card*, is our main card and is used for all spending. We can definitely recommend Crypto.com! It is a platform for beginners and advanced users.

25 US Dollar Starting Credits for the Ruby Steel

Anyone who signs up for Crypto.com via our link* and orders at least the Ruby Steel card will get $25 in CRO credited to their wallet. For the referral we will receive the same amount.

Keyfacts:

- Crypto.com is an established provider with high security value

- core product is a Visa card with high cashback

- you get high interest for staking and lending

- more coins can be farmed via the Supercharger

- there is an exchange for real exchange trading

- NTFs can also be traded