Anyone who deals with the issue of inflation realizes that their hard-earned retirement savings are constantly being devalued and that they are almost forced to take risks in order to escape the devaluation of money. You quickly come across shares, ETFs, but also cryptocurrencies and, above all, Bitcoin.

During this instructive journey, you will learn about business models, balance sheets or perhaps technical analysis and make it a rule to only invest your hard-earned money in what you fully understand. This is the only way to counter fluctuations emotionally in the long term.

With Bitcoin, this path is anything but easy, as at some point you will start to question everything in your research – you work your way into subject areas such as society, politics, mathematics, economics, energetics, psychology and physics. Bitcoiners talk about slowly discovering the rabbit hole.

Our journey down the rabbit hole

You can easily recognize the beginning of our development in the selection of articles. Our articles on Bitcoin have become more regular, those on other cryptocurrencies less frequent, more detailed and more provocative. In recent weeks in particular, a number of Bitcoin articles have been published on TradingForFuture.com, which we would like to share with our readers at this point.

In the initial phase of our investor existence, we limited ourselves exclusively to various ETFs and individual stocks, but quickly added Bitcoin and some altcoins to our portfolio for reasons of diversification. We pointed out how even a supposedly low inflation rate affects our assets in the long term and criticized the fact that many would even gloss over this fact. We quickly discovered Bitcoin as a potential problem solver.

This was followed by various approaches to earning cryptocurrency as cashback through everyday spending and regularly exchanging it for Bitcoin. MiCa regulation within the European Union was just as much an issue as the tax registration of cryptocurrencies or the planned introduction of CBDCs such as the digital euro, which we still reject today.

Fullnode, Miner and UTXO

We found out that Bitcoin has been one of the most successful assets in monetary terms in recent years and showed how we buy our Satoshis and store them on a hardware wallet. We also built our first own full node and played around with the Nerdminer V2, which has since been accelerated by numerous updates. We hoped that the Bitaxe Ultra, a complete open source project from software to hardware, which is certainly only known within the community, would give us even more chances of finding a block and thus being rewarded in Bitcoin. Technically, we were concerned with the fee structure of Bitcoin and thus the management of UTXO in self-custody.

The highlight was, of course, our three-part series of articles in which we addressed widespread prejudices and myths about Bitcoin and examined them from the other side. We used numerous statistics and sources for this.

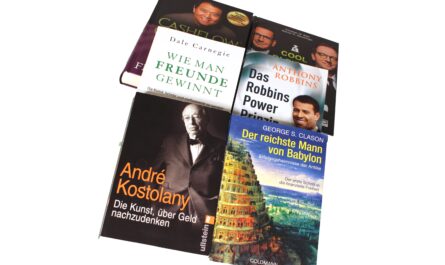

If you still haven’t read enough Bitcoin content, you are welcome to browse through one or two Bitcoin books. We recently published some book recommendations – above all, the Bitcoin Standard remains the most important read.

The latest articles on Bitcoin:

- Five book recommendations for Bitcoin

- A differentiated look at typical statements about Bitcoin (Part 3/3)

- A differentiated look at typical statements about Bitcoin (part 2/3)

- A differentiated look at typical statements about Bitcoin (part 1/3)

- Bitcoin only: No more staking, lending and co.

- Bitaxe Ultra: Efficient open source miner from the community

- Bitcoin savings plan in self-custody: pay attention to UTXO management

- Exciting updates improve the NerdMiner v2

- Blockpit: A good tax platform for cryptocurrencies

- CBDC: The digital euro must not come

- Project: Building your own Bitcoin and Lightning full note

- Save for 10 years: This is what 10,000 euros would have become

- Relai: Buying Bitcoin directly into your own wallet

- Better than playing the lottery: The NerdMiner v2

- MiCA: New EU guidelines for cryptocurrencies

- Crypto crisis: hardware wallet more important than ever

- Currency devaluation is turning the whole world into a casino

- Two crypto payment cards with lots of cashback

- The US dollar has lost over 90% of its purchasing power since 1913

- Inflation is often glossed over too much

- The effects of inflation

- Problem solver Bitcoin: the advantages outweigh the disadvantages

- Der Bitcoin-Standard Die dezentrale Alternative zum Zentralbanken

- Produkttyp ABIS BOOK

- Sprache Englisch

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-27 at 03:40 / Affiliate Links / Bilder von der Amazon Product Advertising API