In the third and final part of our short series of articles on the widespread myths and prejudices about Bitcoin, we once again throw four new aspects into the room and try to explain why they do not apply to Bitcoin or are even good for the network. We hope to have given our readers a better view of Bitcoin.

Bitcoin has no intrinsic value

It is a false assumption that Bitcoin has no value from an investor’s perspective, unlike shares, which are backed by entire companies with fixed assets, capital and patents, including know-how and knowledge. Value is always created by people who attribute value to an object, a service or even a virtual good. Value is always individual.

While some demonize digital goods, for others they are of great benefit and therefore of great value. The best example is digital art based on NFTs. One person may only see simple PNG images and would never spend several hundred euros on them, while another pays several ETH worth several hundred thousand US dollars for crazy monkey images. They want to be part of an exclusive community or simply participate in the hype out of greed. Just because it has no value to you doesn’t mean that it has to be the same for others, especially the majority!

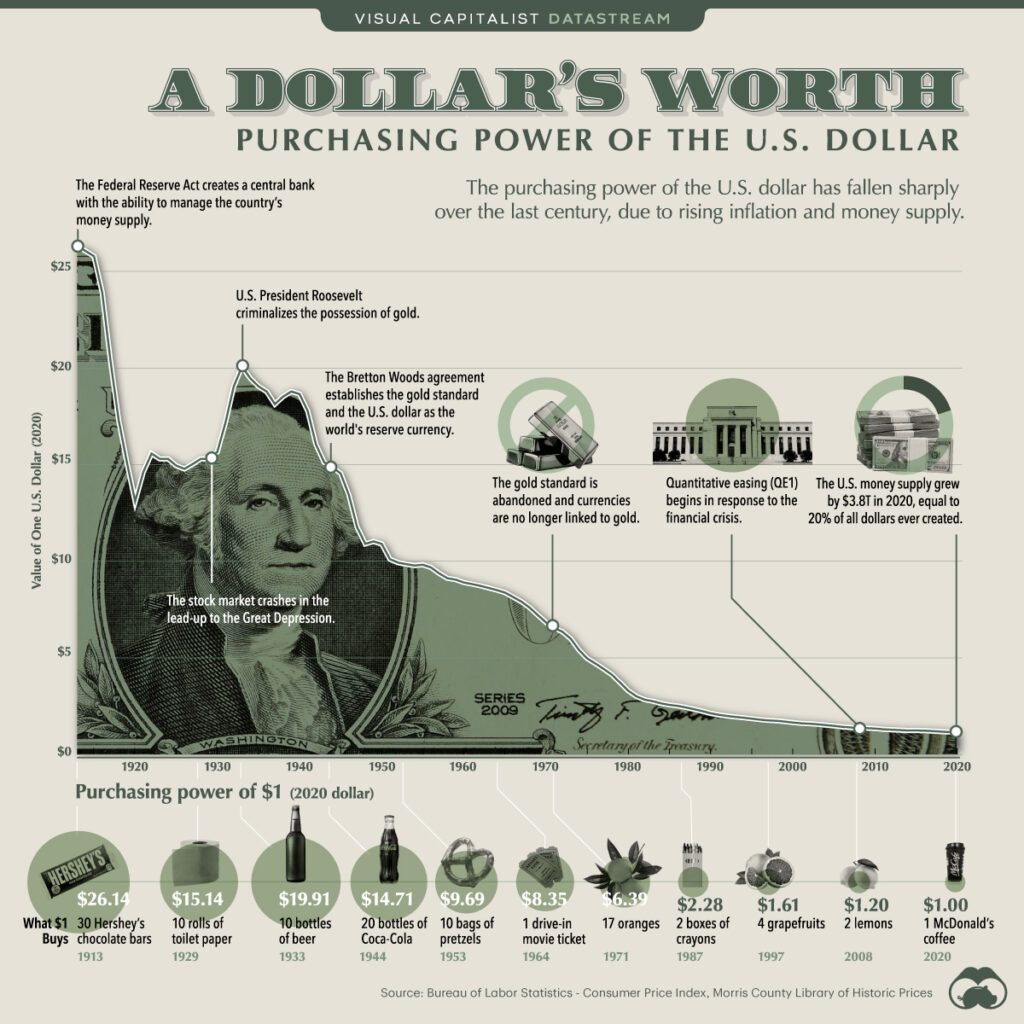

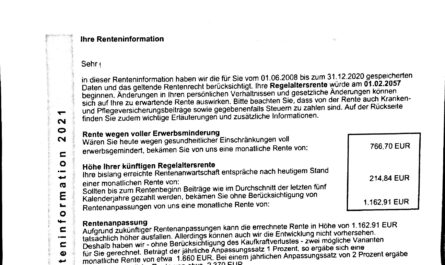

And another thing: what about the intrinsic value of traditional central bank currencies? Aren’t they just some printed scraps of paper or a number on the account? Fiat currencies are based on the fact that their users trust them and attribute a certain value to the money, which they can then exchange for goods or services. Since the end of the gold standard, there has been absolutely no backing behind it.

But here, too, Bitcoin offers a significant improvement: the money supply cannot be expanded, which can then influence inflation, meaning that each participant has to sacrifice more of their valuable lifetime to maintain their purchasing power or deal with investment issues. There is no central point. Bitcoin is ultimately more stable in value, even if exchange rates fluctuate significantly.

Bitcoin has too much volatility

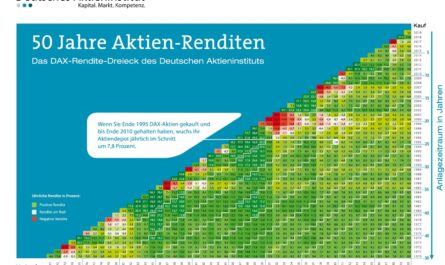

Volatility may be a form of risk – regardless of whether you are looking at shares, funds or currencies. In the case of Bitcoin, these fluctuations have been particularly high to date and can amount to five-figure sums within a few minutes. In everyday life, this can mean that if someone sends 100 US dollars worth of Bitcoin, this equivalent value will not reach the recipient until the transaction has been confirmed and the BTC exchanged. This problem will solve itself over the next few years if adoption continues to increase. In itself, however, a Bitcoin always remains a Bitcoin. Compared to other commodities, the market capitalization is still quite low and the market breadth is very thin. This means that even small changes in supply and demand can lead to substantial price fluctuations.

If you want to hedge against this problem today, you can simply use the Lightning Network and send your sats in a matter of seconds, even at considerably lower transaction costs. The statistics also show ever higher highs and higher lows in the price. If you hold Bitcoin for at least four years and buy regularly, you will also get the average price in the long term and have a good chance of ending up with a profit. Long-term thinking will always pay off.

Bitcoin can be banned

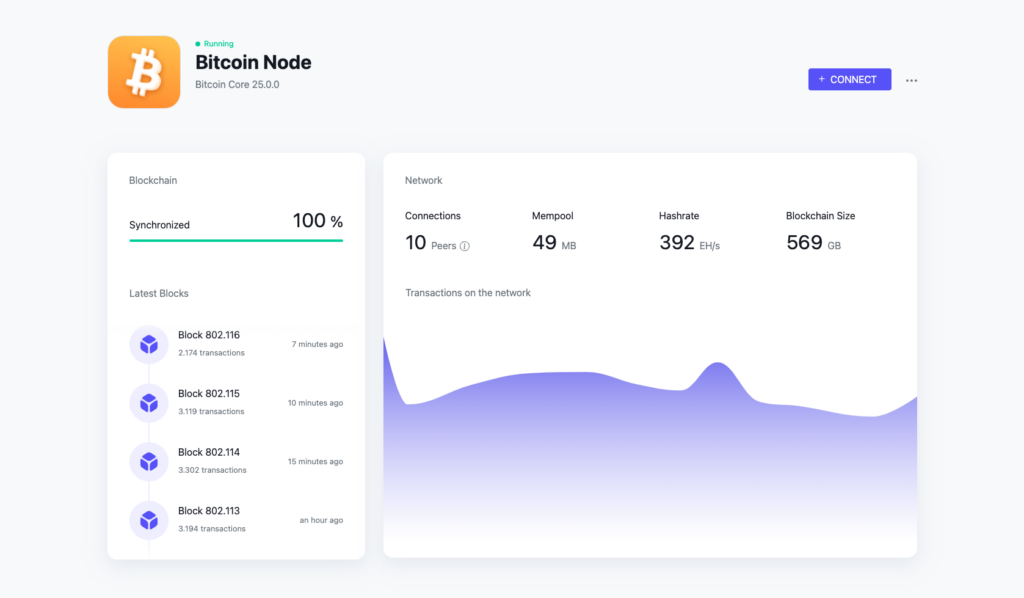

That is actually impossible. Anyone who, like us in a free democracy with any access to knowledge, has learned of the existence of Bitcoin and understood how the technology works will always know what they need to do to be able to use it in the event of a ban. Theoretically, all you need is internet access, a full node, a miner and perhaps a hardware wallet. You already have all the devices you need to run the Bitcoin code. The full node can be hidden in the Tor network, access can also be gained via it and no one will know that you are actually using Bitcoin.

In fact, in order to destroy Bitcoin, all these nodes and miners have to be taken off the network. Due to the decentralized nature of the network and the globally distributed hardware, this is tantamount to shutting down the internet. We are always in a position to rebuild and continue the network.

Of course, the situation is different if you were not lucky enough to grow up in a liberal democracy with responsible citizens. Then powerful entities in the form of the government try to keep their own citizens small and stupid. They must first learn of the existence of Bitcoin and know how to access this knowledge. If you don’t know about Bitcoin, you will probably never use it.

Bitcoin is decentralized across the entire world

But even if Germany or the EU were to impose a ban on Bitcoin, the network would not die. China imposed a mining ban a few years ago and was the largest supplier of hashrate until then. The computing power within the network plummeted after the ban, but has since reached one all-time high after another. The miners have simply moved elsewhere.

In the so-called block size wars*, a few larger companies tried to change the block size of Bitcoin to make the network faster. They even had the majority of miners on their side. However, the full node operators and users decided against it. A second network split up, which today operates as Bitcoin Cash, but has become completely irrelevant to the market and plays no role.

A network is worthless if it is not used. Bitcoin is decentralized across the entire world. No single entity can permanently harm it or destroy the network.

A quantum computer can destroy Bitcoin

This is also extremely unlikely. Even in the foreseeable future, it will not be possible to break the encryption methods of the Bitcoin network, and if a trend emerges, the Bitcoin community will probably switch to a new, modern and even more secure method through a joint decision. For the miners, the difficulty of the computing tasks remains dynamic, so that a new block is found every ten minutes on average. If the computing power increases and with it the probability that blocks will be found more quickly, the difficulty increases at regular intervals. Quantum computers are therefore not a real problem for Bitcoin.

Final words

In conclusion, the following can be said of all these statements: “DYOR – Do your own research” or “Don’t trust, verify”. No matter which arguments you find more convincing or which sub-areas into which Bitcoin can penetrate you consider more important: Everyone should always form their own opinion from various sources of information and make up their own mind as to whether they consider something useful and worthwhile. No one knows what the future will bring!

Previous articles:

- A differentiated look at typical statements about Bitcoin (Part 1/3)

- A differentiated look at typical statements about Bitcoin (Part 2/3)

- Bitcoin as a problem solver: the advantages outweigh the disadvantages

- Bitcoin savings plan in self-custody: pay attention to UTXO management

- CBDC: The digital euro must not come

- Project: Building your own Bitcoin and Lightning full note

- Better than playing the lottery: The NerdMiner v2

- Bitaxe Ultra: Efficient open source miner from the community

- Relai: Buy Bitcoin directly into your own wallet

- MiCA: New EU guidelines for cryptocurrencies

- Blockpit: A good tax platform for cryptocurrencies

- Bühler, Marco (Author)

Letzte Aktualisierung am 2024-07-25 at 06:25 / Affiliate Links / Bilder von der Amazon Product Advertising API