After looking at the first three widespread myths and prejudices held against Bitcoin last week, in the second part of our three-part series of articles we continue with the next four statements which, on closer inspection, shed a completely different light on the most important digital currency.

Bitcoin consumes too much energy

Admittedly: Operating the Bitcoin network requires a lot of energy – it is not often that headlines make the rounds that the Bitcoin network would exceed the annual electricity requirements of entire countries. According to the Cambridge Center for Alternative Finance, the global energy requirement of Bitcoin is around 80 terawatt hours, which corresponds to around 0.4% of the total electricity generated worldwide.

The high energy consumption is a feature

However, the high power consumption is a feature of Bitcoin, because a high energy consumption means more security for the network. In order to manipulate the blockchain, attackers theoretically need more computing power than half of the total hash rate. Those who have at least 51% of the available computing power can find blocks faster and thus write them to the blockchain with false transactions. This costs a lot of energy and money. As things stand today, even financially strong entities and states cannot (or can no longer) afford this effort.

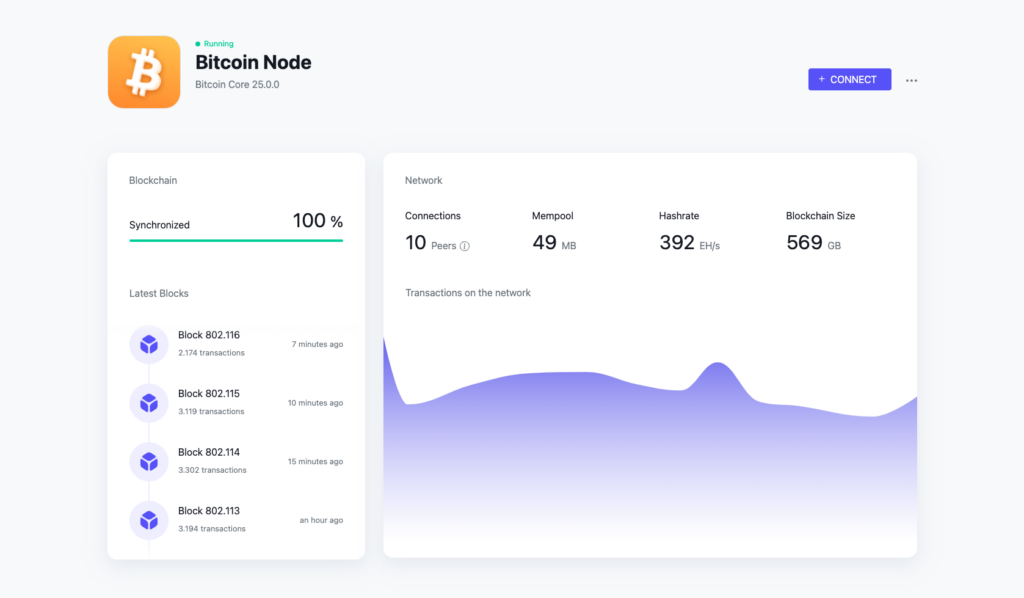

The higher the power consumption of the network, the more difficult it will be for individuals to attack it. Energy must be expended to create new Bitcoin, as is the case with any other commodity. This is the main component of the proof-of-work concept. However, the nodes also contribute to the security of the network by verifying all transactions in the blocks and by storing the entire blockchain. Only when they recognize a new block are the miners remunerated for solving the computational task. In contrast to the miners, however, the energy required for this is considerably lower.

Compared to the proof-of-stake mechanism, which has been used for the Ethereum blockchain and many others for some time, the PoW method is much more secure, as it cannot be used by a central group to maintain sovereignty over the network in order to decide on future changes. Vitalik Buterin, the creator of Ethereum, still owns the majority of the ETH coins created and can therefore exert considerable influence on the future development of the network and determine its progress. On top of that, he became one of the richest people in the world by creating the tokens almost free of charge. This is not possible with Bitcoin.

On the other hand, Bitcoin makes banks and even central banks superfluous, which also require a great deal of energy with their SWIFT payment system or the infrastructure of Visa and Mastercard. Precise payments can hardly be calculated. Bitcoin would save all these systems with broad acceptance. And think of gold, whose mining and transactions also require a lot of energy!

Bitcoin only uses dirty electricity

That too was once the case. In the early days of Bitcoin, it was still possible to mine profitably with any reasonably fast computer, but today, due to the sharp increase in hashrate and the associated difficulty, far more powerful hardware is required. ASICs that have been specially developed for this task are best suited. This means that mining from your own socket is only profitable to a limited extent. Anyone who wants to mine Bitcoin is dependent on cheap electricity. The cheapest electricity, which is also available everywhere, is generated from renewable energies such as wind, hydropower and solar power. Even geothermal energy is often used.

Bitcoin provides incentives for renewable energies

Bitcoin can create an incentive to make such technologies usable. Competition between miners is even spurring this on, as it puts pressure on the price of energy supply. Operators are almost forced to invest in innovative mining technology and the expansion of renewable energies.

This development makes Bitcoin one of the greenest networks around today. Over 50% of the electricity required for operation comes from renewable energy sources. Another plus point: large mining farms can stabilize the electricity grids, which have to contend with unpredictable fluctuations, especially with regard to renewable energies.

Mining systems can be switched on and off quickly, for example to take overproduced electricity or to be switched off during heavy loads in order to ensure security of supply. This gives electricity producers an additional incentive to invest in such technologies and at the same time a monetary incentive that they can pass on to every end customer. Currently, overproduced electricity is sold at spot prices to companies that can absorb high energy costs in the short term. Every single electricity customer subsidizes this. With Bitcoin mining, it would be the other way around.

There are enough angles that can put a positive spin on Bitcoin’s hunger for energy. A look at the latest KPMG report further underpins this. A very good article on this was also recently published by Wirtschaftswoche.

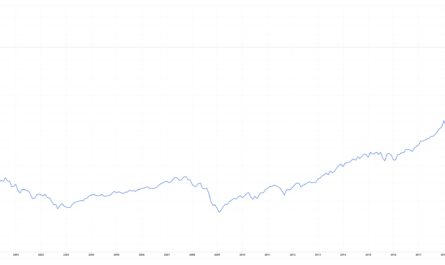

Bitcoin is distributed unfairly

Anyone who got into Bitcoin early on now potentially owns a high equivalent value, which has certainly led to a strong concentration of wealth. But is this really unfair? Anyone who has been involved since the beginning and has held on to their shares to this day has taken a big risk for which they are now being paid. The early buyers have made the network what it is today and opposed the constantly negative press. Is it really unfair that the operators of the network are making money from it? It is always fair when everyone has the same opportunity – everyone would have had the chance to get in early and learn to understand Bitcoin in its infancy. After all, you’re always smarter afterwards.

More importantly, however, anyone who owns large amounts of Bitcoin has no influence on the network and can never change it because they are always dependent on the majority of everyone. If you hold a lot of shares, you create an additional shortage of Bitcoin and therefore more value for all other Bitcoin holders. On the other hand, those who own a lot in the fiat system ensure that others have less.

The Cantillon effect means that it is precisely those who are closer to money creation who benefit from the expansion of the money supply. Those who are creditworthy can, for example, buy several properties and pay them off through rent until they are amortized. Those who are not considered creditworthy, on the other hand, cannot use this leverage to improve their financial position later on. This is taken to extremes with large companies: Volkswagen or BASF use loans in the billions to expand their market power. The financial elite benefits from the system while ensuring that the gap between rich and poor continues to widen. That is the real injustice!

With Bitcoin, wealthy entities will not be able to rest on their laurels because the fixed supply will automatically be better distributed over time the more network participants generate demand.

Bitcoin is a pyramid scheme

Many critics accuse Bitcoin of being a Ponzi scheme in which a few make a profit at the expense of many small investors. Investors would only profit if there were others who then got in at a higher price. In reality, however, the question must be asked to what extent this does not also apply to every other asset and every stock exchange that sells traditional hedge funds, shares or ETFs.

A Ponzi scheme collapses when the demand for the asset no longer exists. This does not apply to Bitcoin. Nobody can simply change the supply or demand from one day to the next. The characteristics of Bitcoin only change when the majority votes for them and not by individuals as in a Ponzi scheme. Bitcoin has a limited supply of 21 million coins, which is infinitely divisible. These fractions can be distributed among all participants, regardless of how many participate in the network. The value increases with acceptance, distribution and use, primarily due to its monetary properties.

We will continue in the third part, which will be published next week!

- Der Bitcoin-Standard Die dezentrale Alternative zum Zentralbanken

- Produkttyp ABIS BOOK

- Sprache Englisch

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-27 at 03:40 / Affiliate Links / Bilder von der Amazon Product Advertising API