In addition to my nest egg and the replicated world portfolio to secure my retirement, I invest in individual stocks. The goal: to generate an additional cash flow that I can later use to cover my monthly costs for rent, electricity, insurance, smartphone, food, etc. and thus theoretically retire early. Time will tell whether the plan works out, but the whole thing is not obligatory anyway, since I have a job that I mostly enjoy and that fulfills me. At least today, I wouldn’t hang it up on the nail. Nevertheless, I find the goal of being able to live completely on my own and not depending on others very desirable. I want to achieve this goal with my long-term investments in individual stocks.

Apart from a few exceptions, all my individual stocks are dividend stocks. In other words, stocks that regularly distribute their profits to shareholders and thus allow them to participate in the company’s success. When selecting stocks, I not only made sure that the companies are in a good financial position and should therefore remain with me in the long term, but also that I am as broadly diversified as possible. I invest in many different industries, spread the money over several world regions and, above all, I have also made sure that I receive payments every month if possible.

Special focus on cash flow

While German stocks mainly pay out in the summer, there are companies, especially in the U.S., that pay out quarterly or even monthly. In fact, I receive several payments every month, but there are stronger and weaker months. Especially the first quarter is quite weak for me, whereas December and July are among my strongest months.

My focus on dividends has another advantage: In difficult times or even in crash times, I still receive regular payments, because dividends are based on the previous year’s profits. So in bad times, there is always a sign of life from my companies, which can build me up psychologically and motivate me to stay on the ball in crises. This worked very well for the Corona crash, during which I made a lot of money with the help of a previously prepared plan.

I also enjoy seeing my company’s products being well received by customers. At the Rewe checkout, I’m delighted when people in line push products from Unilever, Procter & Gamble or Nestle over the checkout belt, or eat burgers and chicken nuggets in a crowded McDonald’s. The large number of iPhones in people’s hands on the street pleases me just as much as the expensive Magnum bottle in the discotheque or the sports shoe on my feet.

I have to admit: Here I am a bit consumerist! 🙂

Boring shares for eternity

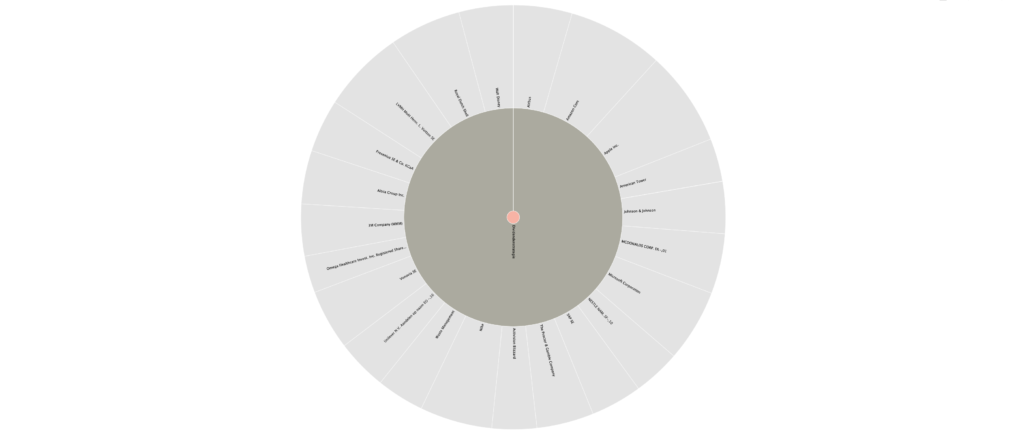

My stock positions are as follows:

- 3M Company

- Activision Blizzard Inc.

- Airbus SE

- Altra Group Inc.

- Amazon.com Inc.

- American Tower Crop.

- Apple Inc.

- Berkshire Hathaway Inc.

- Fresenius SE & Co. KGaA

- Johnson & Johnson

- LVMH Moet Hennessy Louis Vuitton SE

- McDonald’s Corp.

- Microsoft Corp.

- Nestle Inc.

- Nike Inc.

- Omega Healthcare Investors Inc.

- Royal Dutch Shell PLC

- SAP SE

- The Procter & Gamble Co.

- Unilever PLC

- Vonovia SE

- The Walt Disney Company Co.

- Waste Management Inc.

- Wirecard AG (tote Position)

Until recently, I also executed all positions via comdirect at 1.5% fees. In the meantime, however, I have moved the savings plans to Scalable Capital, because they can be executed completely free of charge via the Munich Stock Exchange. In addition, I regularly buy my biggest losers via a one-time purchase, which also costs me significantly less at Scalable Capital*. Wirecard AG is still a relic from times past. The position is completely lost and is of course no longer saved. However, I want to leave it in my portfolio as a memorial!