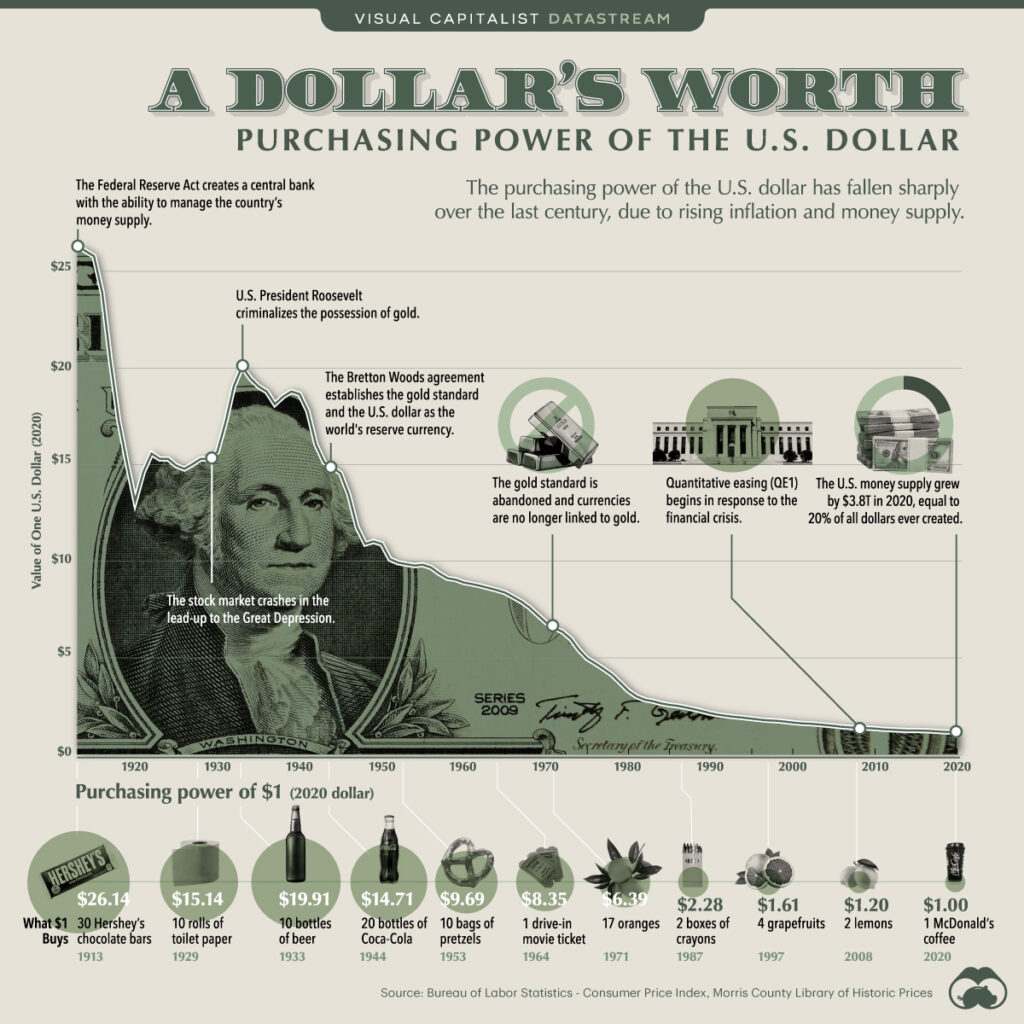

It doesn’t matter whether it’s 2% inflation or, as recently, almost 6%: Over the decades, even supposedly small figures have had a major impact. Since its inception, the U.S. dollar in particular has steadily depreciated as a reserve currency and lost purchasing power. Today, one U.S. dollar buys fewer goods and services than it did in the 1900s, when the currency was officially put into circulation.

In 1913, for example, you could buy 30 Hershey’s candy bars, but today you can only buy a single bar – at Walmart, at least, it costs US$0.98. Today, you pay $1.96 for a 2-liter Coke. In 1944, you could still get 20 bottles of Coca-Cola for one U.S. dollar, and thus for just under half that amount.

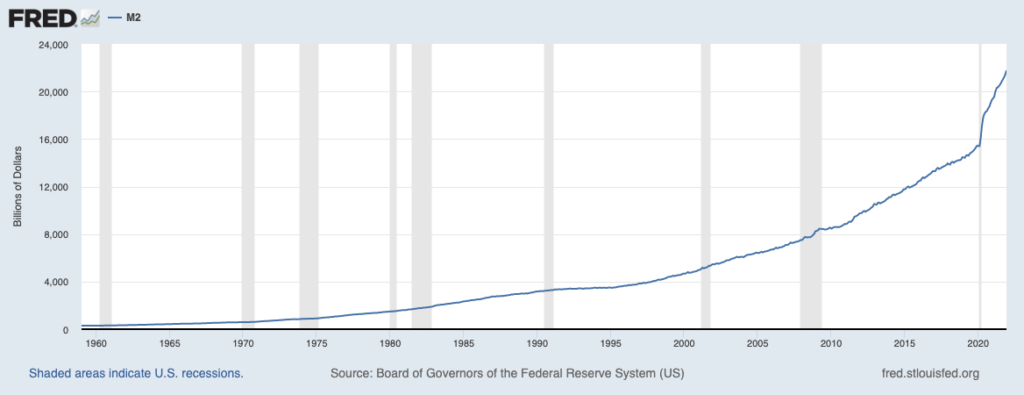

Since the FED administers, the money supply rises drastically

Since 1913, the Federal Reserve (FED), the central bank of the U.S., which is after all composed of twelve banking houses, manages the money supply of the U.S. dollar. Its purpose is to ensure economic stability. From time to time, however, more and more dollars came into circulation, causing the average price of goods and services to rise, while purchasing power steadily declined. By 1929, the value of the consumer price index (CPI) was 73% higher than in 1913, but one U.S. dollar was only enough for ten rolls of toilet paper at that time.

Between 1929 and 1933, deflation and a decline in the money supply caused purchasing power to rise again significantly (+31%), only to depreciate again sharply to finance the Second World War and the Korean War. In the 1970s, the money supply was finally so high that it was no longer backed by gold. President Nixon – to finance the Vietnam War – ended the gold standard. This finally removed the limit on the printable money supply, and the inflationary monetary system was perfect.

Since then, the FED has continuously increased the money supply and let the money printing machines run at full speed. There are now over 21.767 trillion US dollars in circulation. By 2010, the money supply had exploded by a factor of 1,900x, because around 1900 there were just 7 billion US dollars in circulation. The upward trend was even more pronounced at the beginning of the Corona pandemic. By 2021, the money supply had climbed from $4.6 trillion to $19.5 trillion in the last two decades. About 20% of all U.S. dollars in circulation were thus created in 2020 alone, about $3.4 trillion. Meanwhile, another nearly 2.3 trillion U.S. dollars have been added. About 40% of all U.S. dollars created were created in the last two years – that’s one in four dollars.

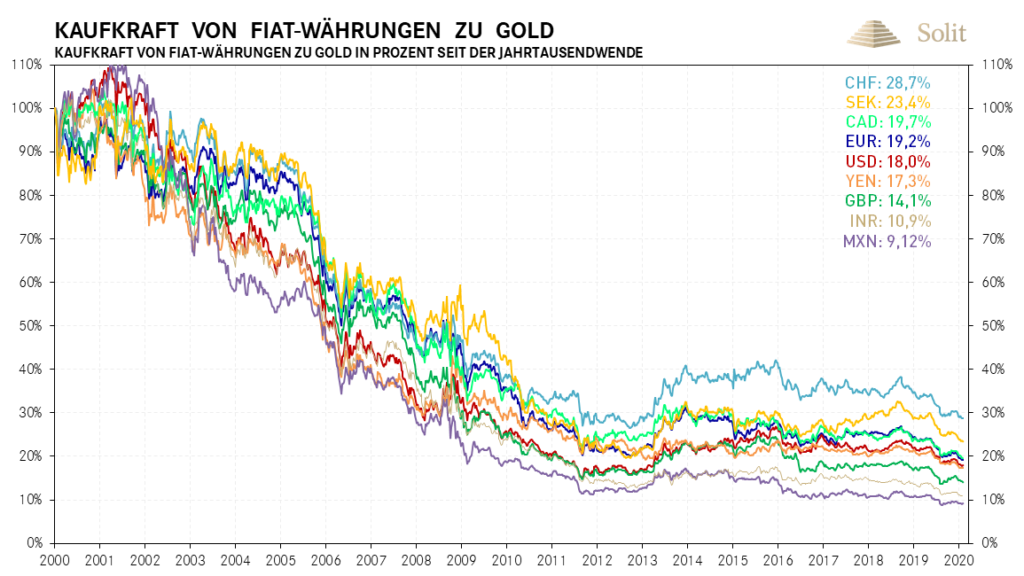

Also to gold devalues FIAT significantly

Meanwhile, gold has become a good measure of inflation despite its often fluctuating performance. The precious metal looks back on a constant purchasing power, because even today an ounce of gold can be used to purchase roughly the same material assets as a few centuries ago. If we take gold as an inflation barometer, we see that the major world currencies have depreciated by between 65% and 82% against gold since the year 2000. The U.S. dollar lost 79%, the euro even 80.8%.

The demonetization will go on for the time being by the steady expansion of the money supply in such a way, means however always expropriation of the people. The one who is careful and thrifty with his money is punished. One is almost forced to take risks or to shift his consumption from tomorrow to today by loans. We recently published an extensive article on this topic. There is already a proposed solution: Bitcoin and its disadvantages do not even look that bad when viewed in a differentiated way.

Keyfacts:

- the FED has steadily expanded the money supply of the US dollar

- …and thereby continuously lowered everyone’s purchasing power

- in 1913 one US dollar bought 20 cans of cola

- …today it is not even one anymore

- 20% of all US dollars were created in 2020 alone

- also to gold devalues FIAT considerably