Admittedly: I have only been investing in the crypto market since 2019, which is not quite two years. I initially thought cryptocurrencies were devilish stuff with no real countervalue or connection to the real world. But that changed quickly when I started to look more intensively into the topics of blockchain, but also staking, lending and NFTs. At the latest since I read the Bitcoin Standard*, I believe in Bitcoin above all. It could become the solution to our ailing monetary system, which is only based on mere trust of its users and is controlled by a few very powerful institutions that decide on our purchasing power to iron out their own mismanagement.

Cashback as a free savings plan

What also made me go deeper into the crypto space was the Crypto.com platform with its Visa card. Here, for every transaction I make in euros with the debit card, I receive a credit in their own cryptocurrency. I’m effectively buying for free by paying off my usual expenses like an automatic savings plan. If the value drops, there are more coins, if it rises, I simply get more shares. Calculated over decades, this can create a lot of value, just like a stock portfolio – as long as the coin and its platform remain in existence until then.

In the meantime, the token has become a real coin with its own blockchain, which opens up further possibilities with regard to smart contracts. In the meantime, I not only lend my coins on the platform, which is both a broker and an exchange, but on top of that I do so (semi) decentralized on the blockchain and rake in additional returns.

I hold CRO mainly to get the next level of Visa card to rake in even more benefits. Then I have a plan to withdraw the coins and reallocate them to other assets such as my stock portfolio.

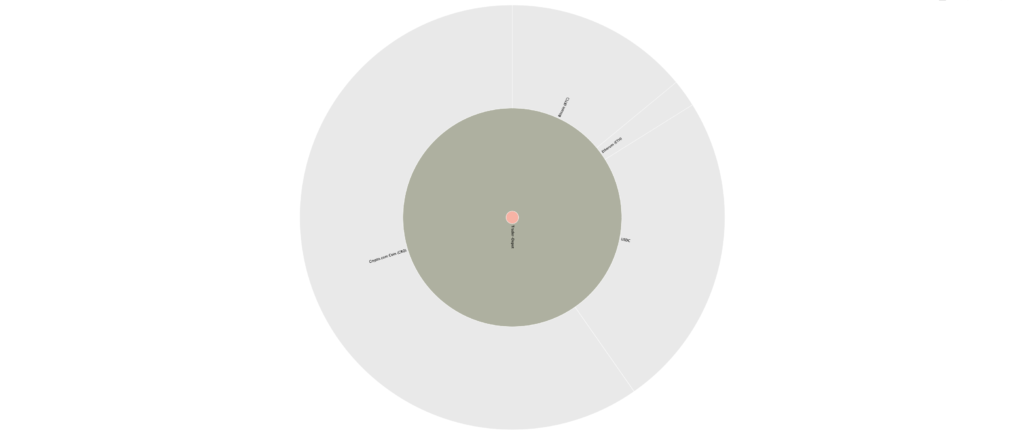

Manageable crypto portfolio

Otherwise, however, I am a Bitcoin maximalist: No other network will come close to the forefather of cryptos. It is the most secure in the world, and it will certainly not disappear. But I also hold Ethereum, as it is the blockchain that most other coins are built on and thus has some usecase.

Overall, my portfolio is quite manageable with CRO, BTC and ETH. Other coins I’ve farmed, I’ve mostly dumped and converted to my three main assets.

However, I also hold stablecoins like USDC as part of my nest egg, which I stake at high interest rates to offset dollar inflation risk. Otherwise, I try out a lot with NTFs and crypto gaming, which needs its own article and which would clearly go beyond the scope here.

Overall, I am very excited about the possibilities and opportunities of the crypto market. At times, my crypto portfolio was larger than my individual stocks. The volatility is enormous and therefore not recommended for beginners!

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-20 at 17:01 / Affiliate Links / Bilder von der Amazon Product Advertising API