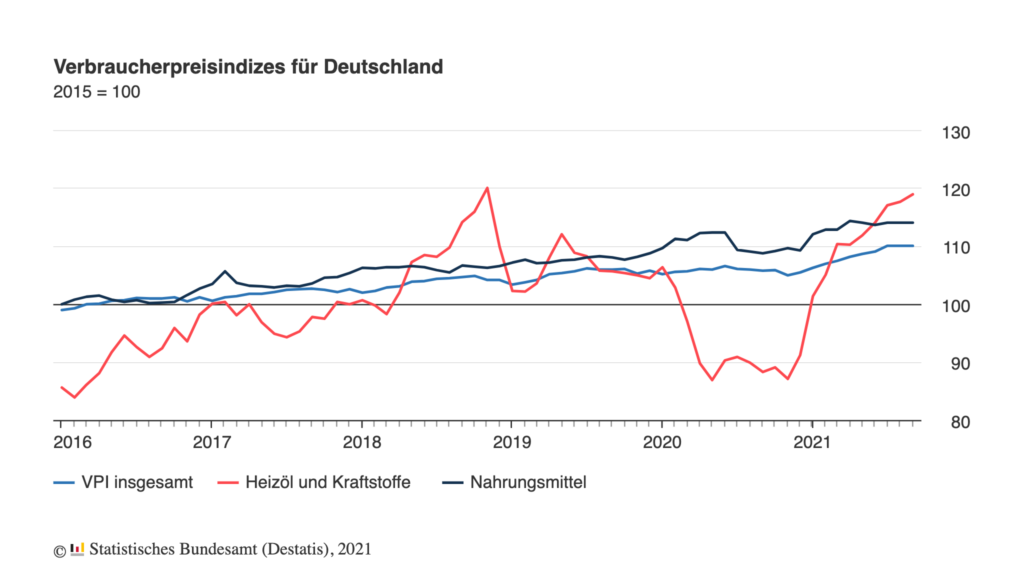

As the Federal Statistical Office stated in Wiesbaden last Wednesday, prices in Germany again rose sharply last month. Compared to the same month last year, prices rose by an average of 4.1% in September. It is the highest inflation rate in 28 years. In the previous months of July and August, inflation had still been just under 4%. There are several reasons for this: Above all, the temporary reduction in the sales tax for the Corona pandemic and the even negative price of crude oil at times ensured significantly lower prices last year and are now leading to high rates of increase. However, the ongoing supply and production bottlenecks worldwide are also having a strong impact on prices.

Inflation is long-term currency devaluation

But what does inflation actually mean for consumers and what exactly is its impact? The inflation or inflation rate is the percentage change in the consumer price index compared with the same period of the previous year, measured and calculated using a fictitious basket of goods. This contains a variety of products and services that average private households consume within a year. It includes not only food, but also potential spending on housing, mobility, leisure and lifestyle. Depending on consumer behavior, actual personal inflation may therefore differ. Not everyone buys a new TV every year or goes on vacation at least once a year.

In order to keep price levels stable, the European Central Bank is trying to keep the inflation rate below 2%. This is not intended to discourage consumers and companies from spending or investing. In Germany, the inflation rate in recent years has mostly been between 1.1% and 1.8%. A significantly higher increase is forecast in the coming years. In the long term, this will impact everyone’s wallets and continuously reduce the purchasing power of their own money.

Calculation of inflation and purchasing power

Over decades, even a low inflation rate has a massive impact on the purchasing power of money. A person who spent about 1,000 euros a month, as in the previous year, will be able to buy less next year if the inflation rate is 1.5%. The future price of spending has increased by 1.5% to 1,015 euros (1,000 / 100 x 101.5 ). Or to put it another way, the 1,000 euros last year are worth only 985.23 euros ( (old price level / new price level x 100) – 100) . The consumer had to accept a loss of purchasing power of 1.47% (100-(new purchasing power / old purchasing power x 100).

If we now extrapolate this to ten years, we will have to pay 1,160.55 euros for the same expenditure in the future and accept a price increase of 16.06 %. The loss in purchasing power is 13.83%, and the future purchasing power is only 861.67 euros. However, the figures are very conservatively calculated at 1.5%. Assuming an inflation rate of 2%, the former 1,000 euros can only be used to buy goods worth 820.35 euros after ten years, or 1,219 euros will have to be spent on the same basket of goods.

The personal inflation rate can be calculated on the website of the Federal Statistical Office.

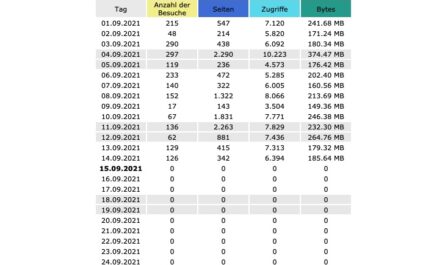

Various comparative calculations made

| Initial price | Period | Inflation rate | Loss of purchasing power | Future purchasing power | Future price | Increase in price |

|---|---|---|---|---|---|---|

| 1.000,- | 1 Year | +1,5 % | -1,47 % | 985,23,- | 1.015,00,- | +1,5 % |

| 1.000,- | 10 Years | +1,5 % | -13,83 % | 861,67,- | 1,160,55,- | +16,06 % |

| 1.000,- | 20 Years | +1,5 % | -25,75 % | 742,48,- | 1.346,86,- | +34,69 % |

| 2.000,- | 1 Year | +2,0 % | -1,96 % | 1.960,79,- | 2.040,00,- | +2,01 % |

| 2.000,- | 10 Years | +2,0 % | -17,96 % | 1.640,70,- | 2.437,99,- | +21,90 % |

| 2.000,- | 20 Years | +2,0 % | -32,70 % | 1.345,95,- | 2.971,90,- | +48,60 % |

High inflation can act like a negative spiral. Because of higher prices, companies may have to lay off workers, cut wages, reduce production or make less profit. Alternatively, they pass the higher prices directly on to consumers to cover their costs. Private households can afford less for their money, and the propensity to save falls.

Protection against inflation

Anyone who only has their money in a call money account, where they only receive around 0.1% interest in the current low-interest environment, automatically has to accept a loss of purchasing power due to the higher inflation rate. In the long term, an individual’s financial investment must always yield at least as good a return as the annual inflation rate. In order to protect one’s assets from monetary devaluation in the long term, one should use the call money account only for the nest egg and planned expenses in the future. The rest should be invested in stocks and tangible assets, as we repeatedly propagate and demonstrate in this blog. A broad diversification of assets is a mandatory requirement to keep the risk as low as possible.

Keyfacts:

- rising prices have massive effects on purchasing power in the long run

- Downward spiral can further intensify effects

- Investment must yield a higher return than the rate of inflation

- Currently only possible with investments in tangible assets