One of the biggest advantages of Bitcoin is the fact that you are no longer dependent on trusted parties and always act on your own responsibility on the network. However, this personal responsibility may also be a disadvantage for many, as you cannot turn to support and hope for goodwill if you lose your own private key or if the recipient address is incorrect. If you act on your own responsibility, you always have to live with the consequences and therefore always be prepared for all possible scenarios.

In order to always have proof of actual ownership of your Bitcoin and not be dependent on exchanges that can go bust or scam at any time, it is advisable to store it on your own wallet. Ideally, you should use providers such as Relai, which transfer purchases directly to your own wallet, and of course a hardware wallet where the private key never leaves the device and which requires additional confirmation to carry out transactions.

As with shares and ETFs, a regular savings plan is recommended to counteract volatility and pay the average over the long term. However, it is precisely this approach that can lead to expensive problems in the long term – keyword: “Unspent Transaction Output” or UTXO for short.

Transaction fee is independent of the amount

To understand the problem, you need to take a deeper look into the world of Bitcoin and its transaction logic. Every Bitcoin transaction is made up of so-called inputs and outputs on the blockchain, which are later assigned by the wallets to the senders and recipients in order to form the respective balances. In a broader sense, a Bitcoin transaction works like the exchange of traditional cash.

Let’s assume we keep 90 euros in our wallet in the form of a 50-euro, a 20-euro and a 10-euro bill as well as two 5-euro bills. Now we want to pay something for 25 euros and have to select the banknotes that match the amount as closely as possible. In this case, we select a €5 bill and a €20 bill. These are effectively the inputs that we put into the transaction, while the recipient of the payment receives the output in the full amount of 25 euros.

The banknotes in our wallet and purse are nothing more than outputs from past transactions that we have not yet spent: Unspent Transaction Output.

| UTXO in Wallet | Input | Output |

|---|---|---|

| 50 euro bill | – | 25 Euro (Recipient) |

| 20 euro bill | 20 euro bill(Sender) | – |

| 10 euro bill | – | – |

| 5 euro bill | – | – |

| 5 euro bill | 5 euro bill (Sender) | – |

Change makes things more complicated

Applied to Bitcoin, this means that every time we receive Bitcoin, we accumulate a UTXO in our wallet, which we can later use as an input for a transaction. It becomes more complicated if we cannot settle the amount of an output directly with one or more inputs, because UTXOs can only ever be spent in full. Then we have to work with change.

If we now want to pay 21 euros with our banknotes, we put our received outputs into the transaction as inputs as appropriately as possible. So again the 20 and 5 euro bills. We then expect change in the amount of 4 euros as additional output, which is then transferred back to us. We receive a new UTXO in the amount of the change.

| UTXO in Wallet | Input | Output |

|---|---|---|

| 50 euro bill | – | 21 Euro (Recipient) |

| 20 euro bill | 20 euro bill | 4 Euro (Sender) |

| 10 euro bill | – | – |

| 5 euro bill | 5 euro bill | – |

| 5 euro bill | . | – |

As with cash, UTXO cannot be split, but must always be spent in full. We overpay the recipient and receive a new change output from the network back to our address. The transaction fee for the miners is not transferred separately, but corresponds to the difference between all inputs and outputs and therefore the amount that was not explicitly spent. The receiver receives slightly less than the sender sent. The network fees are based on the storage space required for each transaction and each UTXO requires space in the blockchain.

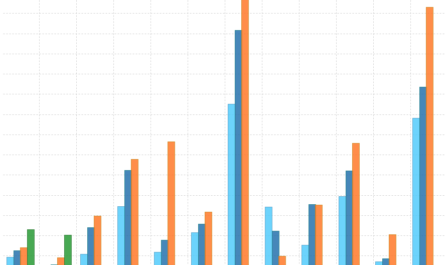

The more UTXOs a transaction contains, the more storage space is required and the higher the transaction fees. They are always independent of the transfer amount. This can be a particular problem if a UTXO only contains a few sats that would exceed the transaction amount. Bitcoin dust is created for which a transaction is not worthwhile as the fees are higher than the actual value. It is monetarily uninteresting to move these stats. But even with savings plans, you should always keep an eye on your UTXOs, as you receive an additional UTXO with every transaction to your wallet. With monthly execution, that’s twelve UTXOs per year, and 52 with weekly execution.

Anyone who wants to sell their Bitcoin later on must therefore expect to pay high transaction fees – especially when the utilization of the network and the demand for blockchain storage space are high.

A calculation example

We have a weekly Bitcoin savings plan amounting to the magic 21 euros. After two years, we want to send the total amount at a then current mining fee of 150 sats/vB. We have a total of 104 UTXOs. Each UTXO occupies 148 bytes and therefore 15,392 bytes cumulatively. In addition, there is an output of 34 bytes and a basic overhead of 10 bytes, which is added to each transaction. The example transaction is therefore 15,392 + 32 + 10 = 15,434 bytes in size.

With the mining fee mentioned above, this amounts to 2,315,100 sats, which corresponds to almost 900 US dollars at a Bitcoin price of 40,000 US dollars. For comparison: the same transaction with only one input comes to just 190 bytes and therefore costs only 28,500 sats and therefore only around 11 euros at the same exchange rate. A transaction size calculator and Mempool.space can help here.

Fees with 104 UTXOs:

104 x 148 Bytes (Input) + 1 x 32 Bytes (Output) + 10 Bytes (Overhead) = 15.392 Bytes * 150 sats/vb (Minig-Fee) = 2.315.100 sats (Fee)

Fees with 1 UTXO:

1 x 148 Bytes (Input) + 1 x 32 Byte (Output) + 10 Bytes (Overhead) = 190 Byte * 159 sats/vb (Minig-Fee) = 28.500 sats (Fee)

The solution: Strategic UTXO management

All individual UTXOs can be merged into one UTXO via a single transaction to your own wallet, which is best done during market phases with low network fees. Although this costs one-off transaction fees, the process reduces the transaction fees for the future, as your own UTXOs are constantly reduced despite regular savings rates.

With Ledger Live, you can not only set the fee you are willing to pay per vByte for an outgoing transaction, but also select the UTXOs you want to use. When transferring the entire Bitcoin balance to your own address, a single output is generated from all individual UTXOs and therefore only one subsequent input.

You should also plan ahead and not carry out every single transaction directly on the hardware wallet. You have to find your own middle ground and leave coins on exchanges for a little longer. This makes your Bitcoin investments more efficient. Alternatively, you can use the Lightning Network, for which we have also been operating a full node for some time. In this case, Bitcoin transaction fees are only incurred when a channel is closed.

- Der Bitcoin-Standard Die dezentrale Alternative zum Zentralbanken

- Produkttyp ABIS BOOK

- Sprache Englisch

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-27 at 03:40 / Affiliate Links / Bilder von der Amazon Product Advertising API