In recent weeks and months, we at TradingForFuture.com have repeatedly presented various exciting providers and projects that we use ourselves in everyday life – be it bunq as an everyday current account with many great functions, Blockpit as a service provider for our tax return, Relai for buying Bitcoin and Crypto.com for other cryptocurrencies or the Curve Mastercard for additional cashback. Of course, we also focused on various custody accounts such as Scalable Capital* or Trade Republic*. These offers are constantly being improved and expanded. A lot has also happened at Trade Republic and Plutus.it in recent weeks. We present the changes in detail.

Trade Republic introduces payment card with cashback

In January, the neobroker Trade Republic* announced that it would soon be launching its own payment card on the market and launched a pre-order campaign for interested customers shortly afterwards. The offer was very well received. Within three hours, more than one hundred thousand interested parties had signed up to the waiting list, and after a few days there were more than one million. Anyone interested can view their waiting position at any time and move up the list by referring friends in order to receive their card a little earlier.

But what does Trade Republic’s new offer include? The new payment card is a classic Visa debit card that can be used for everyday spending – whether at the supermarket checkout, petrol station or online. It can be used to pay wherever Visa cards are accepted. At first glance, this may seem like nothing new. However, the card grants an additional cashback of 1% on all legitimate transactions under the name “Saveback”. For every spend, the customer receives a refund of 1% of the actual transaction and this money is automatically credited to a share or ETF savings plan of their choice. It can be said that a small amount is saved with every expenditure.

In addition, Trade Republic grants a credit interest rate of 4% on the associated clearing account, which is one of the best offers on the market. The card also promises free cash withdrawals of at least 100 euros worldwide, advertises favorable exchange rates and is issued completely free of charge with the exception of provision. There is a choice of a free virtual card, a physical plastic version for 5 euros and a reflective metal card for a one-off fee of 50 euros. The latter alone is said to be a real eye-catcher. In addition, the app informs you of every new card transaction in real time and offers numerous security functions, such as blocking the card at the touch of a button.

But there are a few disadvantages: To activate the saveback, you have to have an active monthly savings plan of at least 50 euros. In addition, the maximum cashback is limited to 15 euros. So if you spend more than 1,500 euros via the card, you won’t get any more back. You usually receive the cashback at the end of the month.

More and less cashback at Plutus

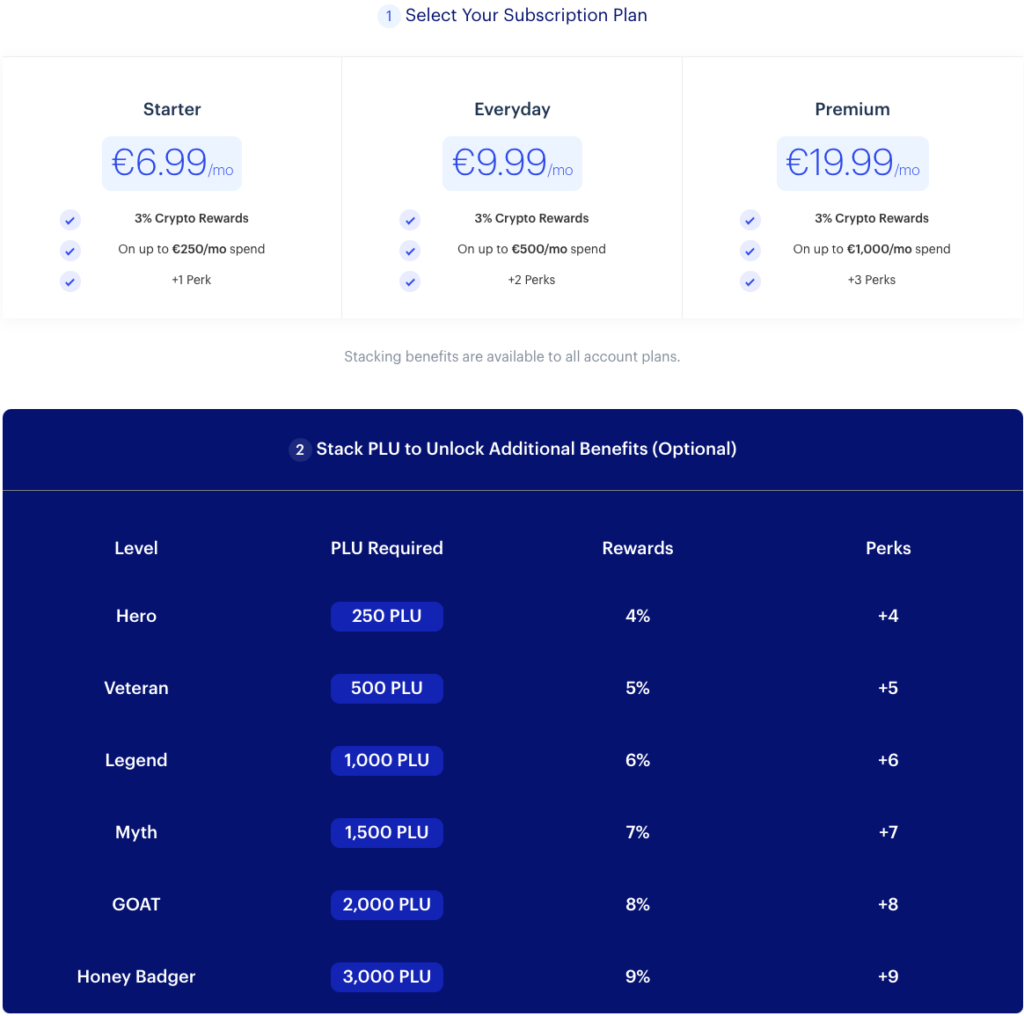

Plutus, the crypto cashback card that we have been using for months, has also seen some changes since we first introduced it. In short, there are significantly fewer rewards for free customers, but a good deal more for loyal stackers. Until the turn of the year, it was still possible to earn at least 3% cashback in PLU tokens for payment transactions of EUR 250 per month with Plutus*, but collecting cryptocurrency without a paid subscription is no longer possible in the long term. In order to receive rewards in future, you have to take out at least the Starter subscription, which costs €6.99 per month. You will then continue to receive cashback and a Perk for a turnover of 250 euros. After all, the starter subscription is free for new customers for three months.

If you are prepared to pay a monthly card fee of 9.99 euros, you can increase the cashback limit to 500 euros and also receive another Perk. The largest package for 19.99 euros offers cashback for sales of up to 1,000 euros and a total of three perks.

With the Perks, you can choose from various offers ranging from Netflix and Spotify to Aldi, where you get the full amount paid out in PLUs for the first 10 euros. Theoretically, this means that with the smallest subscription you get 17.50 euros back in PLU if you use the full amount.

Loyal stackers, on the other hand, are rewarded for holding additional PLUs in their wallet to unlock further benefits. Depending on the card tier, they receive up to 9% cashback and additional perks. With one of the middle offers – the Legend level – the stacker receives 6% cashback and six additional perks. Together with the starter subscription, seven perks and a limit of 250 euros are possible. This means that 85 euros can be earned in PLU tokens when fully used.

The cashback limit can also be increased by using PLU tokens. For example, for 20 PLU, which is equivalent to around 90 euros, you can get an additional cashback limit of 1,000 euros for one year. For the Legend level, you have to deposit 4,500 euros at the current exchange rate of around 4.50 euros.

All in all, this can be worthwhile, especially with the upcoming bull market. Of course, there is still a risk.

Keyfacts

- Trade Republic* has a new debit card

- … which grants cashback of up to 15 euros directly into your own savings plan

- however, this is linked to certain conditions

- Plutus* has a new subscription model

- Cashback is now only available for paying customers

- … but they may then receive more rewards