Bitcoin is surrounded by a multitude of prejudices and myths, which are unfortunately spread far too often without consideration. Many of these statements may be correct in essence, but on closer inspection of the big picture they are often essential. The actual negative headline could be significantly toned down, if not turned into a positive. These include, for example, the high energy input, which is greater than that of entire nations, or that Bitcoin is just some computer numbers with no real value.

Bitcoin not only delves into technical intricacies, but also quickly encompasses social and physical aspects. Understanding Bitcoin is not easy and does not happen overnight. In a three-part series of articles, we have taken on some of the most well-known preconceptions and examined them from a different angle.

Bitcoin has no real use case

When Bitcoin was launched just over 15 years ago by Satoshi Nakamoto, there were actually no real-world use cases due to its limited distribution and the fact that many had not yet discovered the potential benefits of the network for themselves. The first Bitcoin block, referred to as Block 0 or Genesis, could not yet provide a reference to a previous block and only contained a single transaction, which in this case went to an address belonging to Satoshi Nakamoto, but whose Bitcoins could not be spent.

The first meaningful transaction went down in the history books of the still young network in 2010. At the time, the still small Bitcoin community was wondering what value the new digital money could have and whether it could really be used to buy something real. A short time later, one user exchanged 10,000 Bitcoin for two Papa John’s pizzas, which would be worth around 620 million US dollars at today’s exchange rate. Since then, the Bitcoin community has called for “Bitcoin Pizza Day” every year on May 22.

Bitcoin in emerging markets

Cryptocurrencies are now being used in emerging countries in particular. El Salvador, for example, has made Bitcoin its national currency. A typical use case here, in addition to payment in supermarkets or restaurants, is as a money transfer. Many Salvadorans live abroad and send part of the income they earn there to their families in this small country in Central America, which generates a large part of its gross national product through currency transactions. The processing of international transfers via cryptocurrencies is significantly cheaper and faster. This is shown by the latest figures from Chainanalysis, among others.

However, even those who do not have access to an account or the banking system are increasingly turning to cryptocurrencies such as Bitcoin, as is often the case in regions of Africa. Here, Bitcoin creates an incentive for the development of infrastructure – electricity grids, internet and smartphones are only brought to these regions as a result.

Inflation protection and donations

Bitcoin has also become an important store of value despite, or perhaps because of, its fluctuating value compared to traditional fiat currencies. In times of financial instability caused by hyperinflation, for example, savvy citizens turn to digital money. Prominent examples include the Turkish lira and the Venezuelan bolívar. According to Chainanalysis, in 2022 alone, people in Venezuela were able to hedge against the decline of their national currency and receive US dollars worth over 34 billion US dollars.

Following the outbreak of the Russian war of aggression in Ukraine, people donated cryptocurrency worth a total of more than 56 million US dollars to the cruelly invaded country. In February 2023, donations worth more than 6 million US dollars were collected for the earthquake victims in Turkey and Syria. Bitcoin is suitable for quick, uncomplicated monetary donations that cannot be intercepted by any state institution, squatters or disputes.

Store of value against inflation

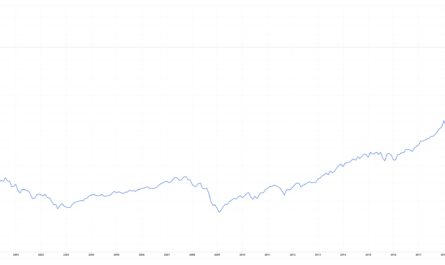

However, the most important real-world use case is the store of value. No other asset has outperformed the markets in recent years like Bitcoin. Anyone who has held Bitcoin for at least four years in the past and regularly bought more via a savings plan has always achieved a positive return. Bitcoin moves in cycles. The increasing scarcity due to spot ETFs, the next halving and the ever decreasing stocks on the exchanges suggest further price increases.

Bitcoin is not suitable as a means of payment

The fact that Bitcoin would not be suitable as a means of payment has already been refuted by the above statements. However, further statements can also be added at a technical level. On average, the miners need around ten minutes to find a new block and thus add new transactions to the blockchain. In the worst case scenario, a transaction takes exactly ten minutes to be confirmed for all network participants. In addition, depending on the utilization of the network and the demand for blockchain storage space, fees can be significantly higher than for traditional credit card payments. Both can be impractical and uneconomical when paying for goods and services in everyday life.

Lightning as a 2nd layer makes payments more efficient

However, the Bitcoin community offers a solution even for this: going via the so-called 2nd layer, such as Lightning. Lightning works like a peer-to-peer payment system, for which an additional blockchain is set up on the main layer. Using nodes and channels, the transactions are collected from all participants and only finalized and entered into the cash book and thus the Bitcoin blockchain when they are resolved. Only then are the real Bitcoin transaction fees incurred.

While a Bitcoin node stores and secures all transactions, a Lightning node only takes care of its own nodes and channels, with which it communicates within the network and loops through the payments of other users in a P2P manner by moving the liquidity provided. In contrast to the main layer, node operators can call up transaction costs for this service and thus earn a few sats.

Lightning makes payments via the Bitcoin network significantly cheaper and considerably faster – especially for small amounts. Paying for a pretzel at the bakery via Bitcoin is thus becoming a viable option for everyday use.

Bitcoin is only used by criminals

In principle, Bitcoin cannot help how it and the network are used. In the early days in particular, the cryptocurrency was extremely popular on the darknet, allowing marketplaces and their users to pay for their illegal goods and services under the radar. At its peak, providers such as Silk Road, which was shut down by law enforcement authorities in 2013, accounted for almost 20 % of all transactions within the network.

Significant decline in criminal activity, Bitcoin only pseudonymous

Over the last ten years, however, this has decreased significantly due to the further spread and increased pressure from the authorities as well as increasing regulation, according to Chainanalysis. The analysis firm estimates that less than 0.34% of the total transaction volume of all cryptocurrencies in 2023 was illegal. Of this 0.34%, only a fraction was accounted for by Bitcoin alone. There was also a sharp decline in risky transactions, such as the use of mixer services or dubious exchanges, while the number of transfers to addresses linked to illegal activities also fell significantly.

By way of comparison, it is estimated that in the traditional financial system, around 2 to 5% of global gross domestic product is linked to money laundering and therefore illegal activities. Bitcoin transactions are transparent. Every activity is stored on the blockchain, which makes it traceable for everyone. Once you have found out who is behind a wallet, all activities and transactions can be traced. More and more law enforcement agencies are therefore carrying out chain analyses to uncover and prove criminal activities.

Bitcoin is only pseudonymous and by no means anonymous – especially if you use the gateways to fiat. Added to this is the stricter regulation of crypto exchanges and providers in particular – a so-called KYC (Know You Customer) procedure is often required, within which customers must identify themselves with ID documents and proof of income.

The second part, which will be published next week, will continue!

- Der Bitcoin-Standard Die dezentrale Alternative zum Zentralbanken

- Produkttyp ABIS BOOK

- Sprache Englisch

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-27 at 03:40 / Affiliate Links / Bilder von der Amazon Product Advertising API