In the midst of the last crypto bull run and at a time when there was hardly any interest on traditional investments, we were forced to look for alternative investment opportunities to protect parts of our reserves from the decline in value caused by inflation. We quickly came across the numerous possibilities of staking, lending and liquidity mining. A mistake, as it turns out almost three years later – in many respects.

Around three years ago, we decided to invest part of our liquid reserves on crypto platforms in order to earn additional returns, primarily with stablecoins. For holders of the Jade Green Visa card from Crypto.com, there was sometimes a whopping 12% interest on USDC, which was paid out weekly and thus considerably more than with a traditional bank. However, the full interest rate was only available if the coins were made available to the platform for three months, as with a fixed-term deposit account. But even with flexible and daily available contracts, 8% APY was still possible.

The interest rates have since been significantly reduced. Currently, only up to 4% are possible, and not always on the full investment amount. This is not worth the currency risk to the US dollar and, above all, the platform risk, because similarly high interest rates may be available again on an overnight deposit account and then even with full deposit protection.

Possible losses, high tax expense

We invested another portion in the Terra LUNA network, which collapsed completely a few months later and became worthless. All of our deposits were suddenly worth nothing. We invested further parts in other coins and platforms in order to continuously increase their number with the help of staking, lending and liquidity mining. Although this worked well, the entire crypto market corrected significantly in the months that followed, resulting in a (temporary) loss of value in the books.

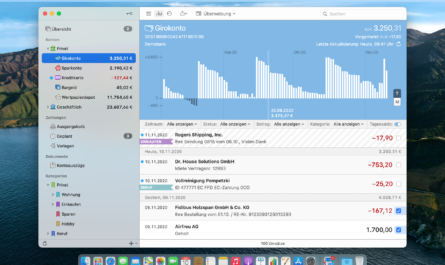

Another rude awakening came with the tax return. In Germany, all access to cryptocurrency must be recorded and logged at great expense via service providers such as Blockpit. The value is then calculated using the exchange rate at the time of the transaction.

In other words, anyone who receives coins and tokens through staking, lending and the like must immediately record their euro equivalent for the tax office. As we wanted to make maximum use of compound interest, we regularly reinvested all inflows and never sold them in order to realize any profits. As the entire crypto market collapsed and has not really recovered to this day, the deposited assets are still worth significantly less. Converted into euros, we no longer receive as much interest as we did at the start of the investment.

The end of the story: we had to pay taxes for 2021 for something that we no longer own in this equivalent value through no fault of our own. The coins that we had to declare as access at the equivalent value at the time have since fallen significantly in price. Due to the supposedly high income at the time, the tax office has also adjusted our advance payments and corrected them upwards. We are therefore still paying in advance for something that we no longer own. We certainly won’t be able to match the profits we made back then this year.

All of this costs liquidity that we could have used for other investments to ultimately generate more returns for us and therefore more taxes for the general public.

Bitcoin only is our solution

In addition to the high tax burden, the considerable loss of value and in some cases even the total loss of value, we have now spent several thousand hours studying Bitcoin and its impact on society and the environment with all its physical and thermodynamic aspects and have come to the following conclusion: Bitcoin is the greatest gift that no other coin or token will ever come close to. All other networks do not solve any new problems and are often only used to rip off others out of complete self-interest. They are pure scam.

We have therefore terminated all staking, lending and liquidity mining contracts and will sell the associated coins and tokens in the next bull cycle or exchange them for Bitcoin. Then we will no longer have any problems with time-consuming tax reporting or advance and back tax payments for assets that we no longer actually own.

- Der Bitcoin-Standard Die dezentrale Alternative zum Zentralbanken

- Produkttyp ABIS BOOK

- Sprache Englisch

- Ammous, Saifedean (Author)

Letzte Aktualisierung am 2024-07-27 at 03:40 / Affiliate Links / Bilder von der Amazon Product Advertising API