During an online event at the World Economic Forum Davos, Christine Lagarde, President of the European Central Bank, admitted at the end of January that she had underestimated inflation. Accordingly, the outlook was “fraught with great uncertainty.” In fact, prices in Germany have risen considerably in recent months. The Federal Statistical Office recently put the average inflation rate at 5.3%, which is well above the level of recent years, but above all above the ECB’s target. Consumer prices for food rose by 6% in the ECB’s basket of goods, and energy prices even had to be increased by 18.3%. The monetary watchdogs themselves are no longer so sure that this situation could soon ease again.

We have already gone into detail about the effects of inflation on savers from a financial perspective in a separate article. But inflation has far more impact on our society than many people assume and is therefore often downplayed. To show the far-reaching problems, we have to go very far out on a limb and back to dry theory.

Consume today, pay tomorrow

In a small remote village, two workers took care of the water supply for their community every day. Every day, they left home early, took their empty buckets with them and walked to a small spring at the top of a mountain where they could fill the buckets with fresh drinking water and then return to the village fully packed. Depending on the demand for fresh drinking water, the two had to make the ascent and descent several times.

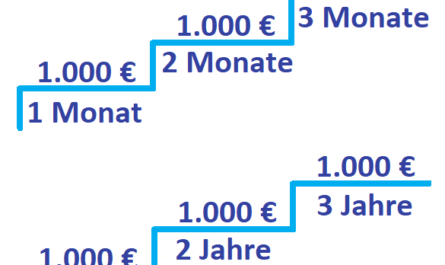

One day, they both decided to become investors and build a water pipeline for the village. Not only did they want to simplify their actual work, but in addition, they wanted to significantly improve the supply for their fellow villagers. While one worker put aside his surplus income from the sale of water every day, the other worker went without further ado to the bank and told it about their joint venture. The bank granted the worker a loan, which the worker was to pay back over the next few years with his increased earnings.

Since the money was inflationary, the bank went to the central bank to get the money needed for the loan. The latter, in turn, created the banknotes out of nothing and gave the freshly printed bills to the bank and thus to the worker. In the short term, this inflated the money supply. With the entire credit sum the worker finally built his water pipe and could thus increase his income and from time to time pay off his loan.

The other worker, who had gone to the spring with him earlier and wanted to save his water pipe, now had several problems at the same time: Due to the temporarily expanded money supply, his previously saved money became worth less, which meant that he had to put even more aside and, on top of that, needed more time to be able to make his investment. Now that all the pipes were being used to build the other worker’s water pipe, the supply of pipes has decreased and the price has increased as a result.

So the frugal and careful worker has been doubly penalized: he cannot compete immediately, but on top of that he has to spend more money than the other worker who simply moved his investment into the future. One worker gets his way earlier on the basis of debt and at the expense of the other.

High vs. low time preference

In concrete terms, this means: Anyone who obtains a loan in an inflated monetary system has a high time preference. They want to consume today and pay for it tomorrow. On the other hand, those who are careful and prudent with their money have a low time preference, but in such a system they are at a disadvantage. Due to the constantly inflating money supply and the continued consumption of others, prices rise continuously. The money on the high edge is constantly devalued.

Since it is not worthwhile to keep the money in the account, savers are obliged to take risks. In an inflationary system, people therefore consume like idiots. To put it bluntly, everyone buys crap because everyone can produce and finance this crap without any problems. In a deflationary system, people think twice about who they entrust their hard-earned money to, because it would steadily increase in value in the account anyway. People consume more consciously and produce more efficiently.

Innovation is much more efficient under deflation

That innovations like the electric car would only have been possible thanks to inflation is therefore simply not true. Even without someone at the money spigot, people can lend money to each other in a deflationary system – such as Bitcoin. However, you only lend the money for really good investments that move society forward. Venture capital is spent more deliberately because you don’t have to counter demonetization. Loans can no longer be made at the expense of the future.

All other savers also benefit because the money brings a return and actual return. Inflation completely destroys this advantage. Much worse: In an inflated system, a few determine the money supply and thus the purchasing power of all. In the worst case, they print money to lower their own debts or even to be able to finance world wars – as happened with the Nazis under Adolf Hitler or the Vietnam War under President Nixon. Whenever inflation got out of hand, something bad happened.

Inflation is partly to blame for the widening gap between rich and poor. While the poorer sections of the population are finding it increasingly difficult to afford the cost of living at all because of the rise in the cost of living, the better-off groups do not have this problem – they can easily cover their basic needs even at 6% higher costs.

Saving is the only way out (actually)

Meanwhile, saving is the only way out to escape all the problems: Those who have saved money create freedom and security for themselves and ultimately go through life more carefree and easier. Instead, to exaggerate, we eat the food that makes us sick in order to then buy the industry’s drugs that make us healthy again. We walk through life like zombies, only to earn our daily living with inflationary money.

Whether an inflationary or deflationary system – neither system will solve one problem: Poverty. But only this much about it: Today, you’re a winner if you incur debt. You consume earlier than others, while debts steadily depreciate, making it easier to pay them off. On the other hand, those who save and are actually careful with their money can buy less and less. He is punished.