These are turbulent times in the crypto markets. What began in May with the collapse of TerraLUNA has now expanded significantly. More and more providers are stumbling in the bear market. With FTX, even one of the largest central exchanges has been hit and that despite being one of the most regulated.

By depositing its own token as collateral, FTX had been able to take out large loans while speculating with its customers’ deposits. As the FTT price plummeted after the first rumors emerged, the system was exposed, a bank run and even a hack finally killed the company. As a result, many customers will probably never get their deposits back, and in some cases their entire savings will be affected. A bitter setback and a real super disaster for many.

Those who leave their cryptocurrencies on exchanges can earn high interest rates and steadily increase their coins, but in the event of a hacker attack or insolvency of the provider, everything is at risk – “Not your keys, not your coins” is an often quoted saying in the crypto scene. Since even the largest and supposedly most secure providers can be affected, it is especially important to take this to heart now.

A hardware wallet is the most secure solution

Although you can store your deposits on software wallets such as Metamask or Trustwallet, the most secure option remains a hardware wallet. These are physical devices, usually in the form of a USB stick, which, unlike software wallets, are not connected to the Internet and are therefore referred to as cold storage. The private key is stored exclusively on the device. In addition, transactions are not triggered online until they have been signed offline on the device beforehand. This prevents deposits from being withdrawn if the user’s own computer is hacked. Furthermore, the hardware wallet is additionally secured by a PIN so that it becomes useless for any thieves.

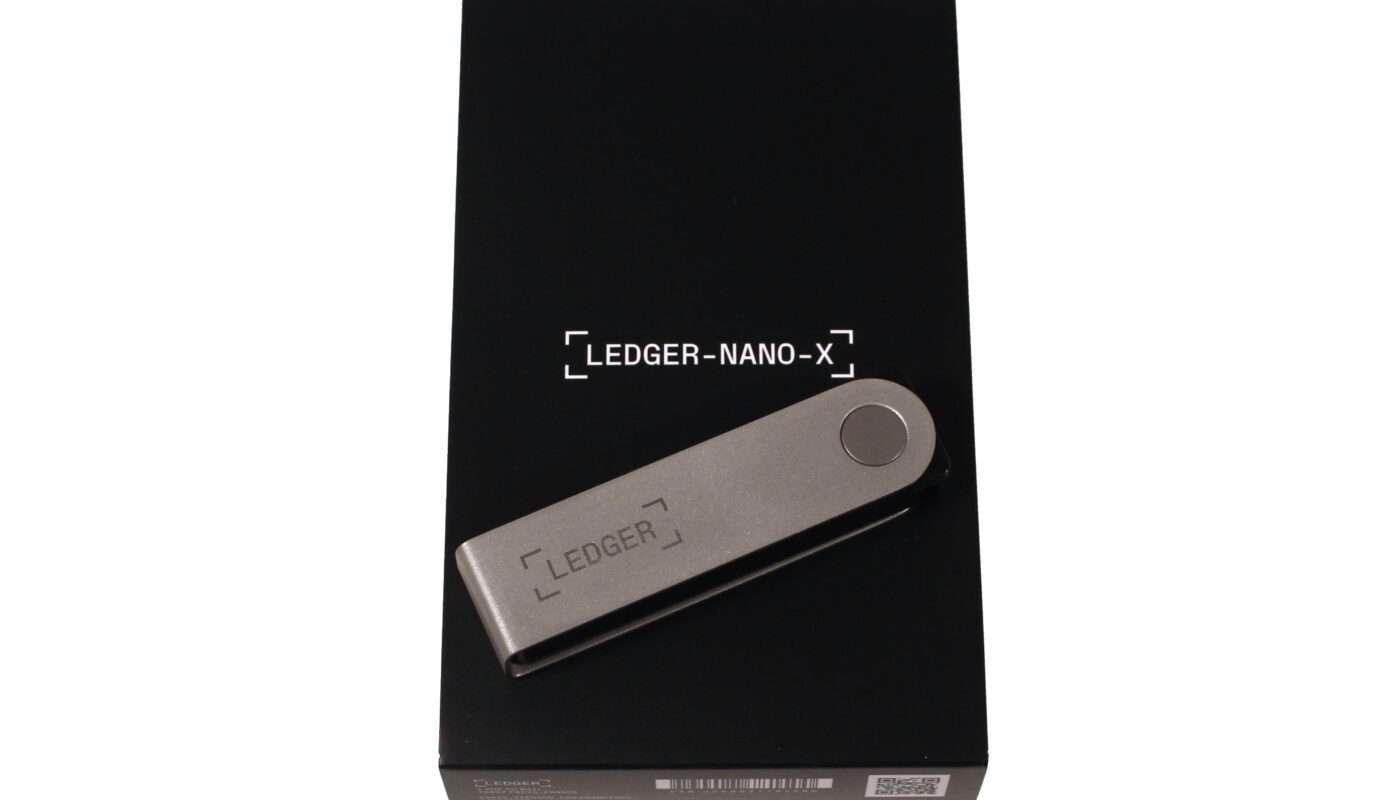

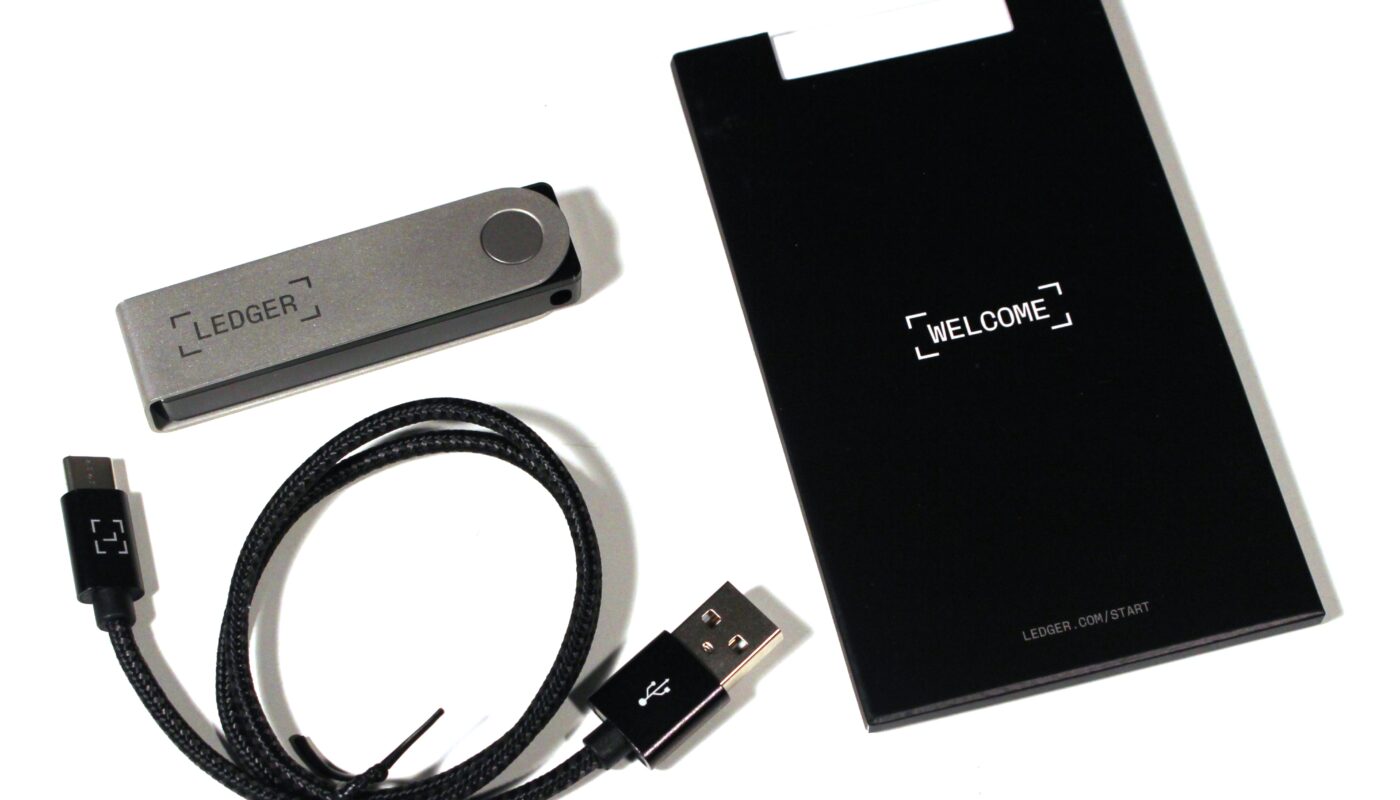

One of the best-known providers for such a crypto wallet is the French company Ledger. They currently offer two different solutions, the Ledger Nano S Plus and the Ledger Nano Ledger X*, which are available for around 80 and 150 Euros. Both connect to the Windows or macOS computer via USB-C and are based on the Ledger Live software. Both offer an integrated display with two separate buttons, which can be used to display the recovery phrase or confirm transactions, among other things.

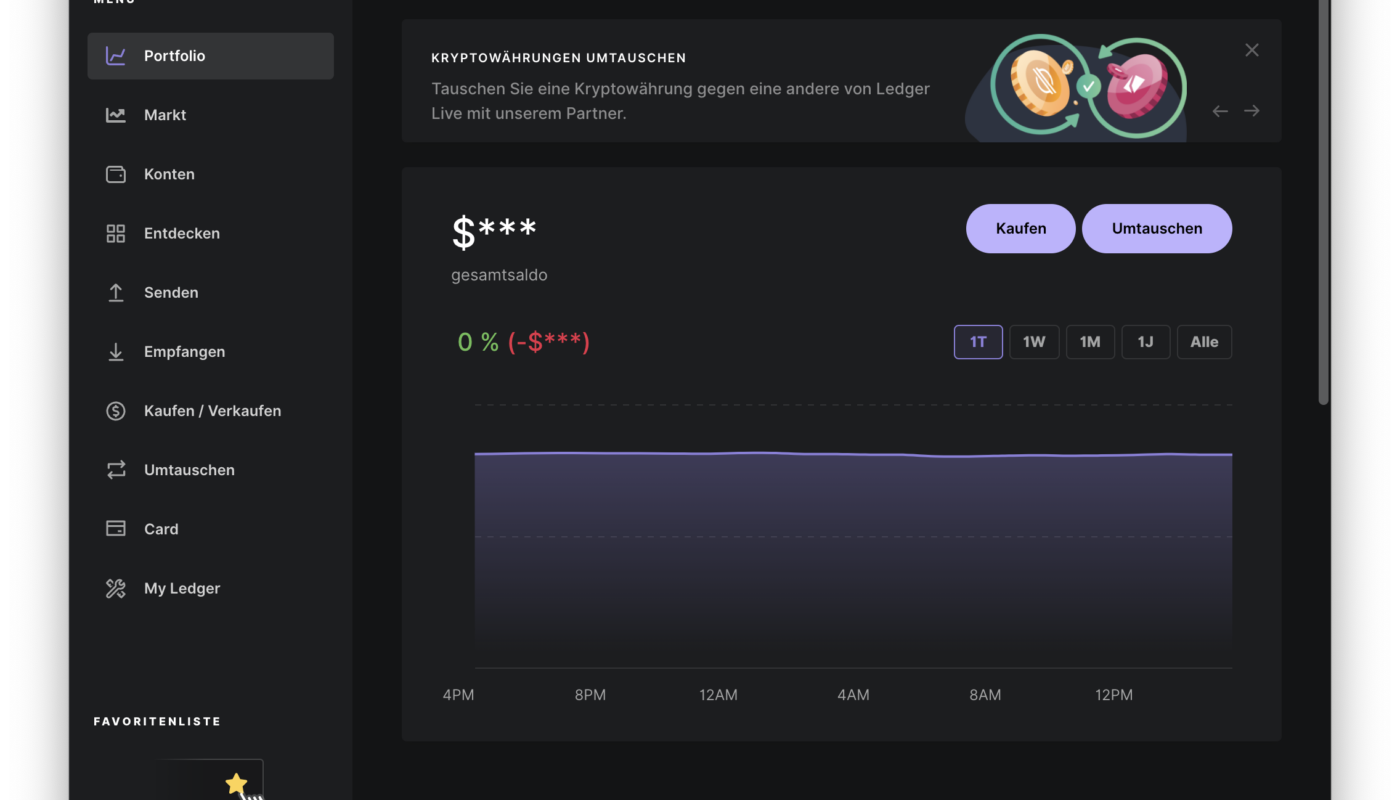

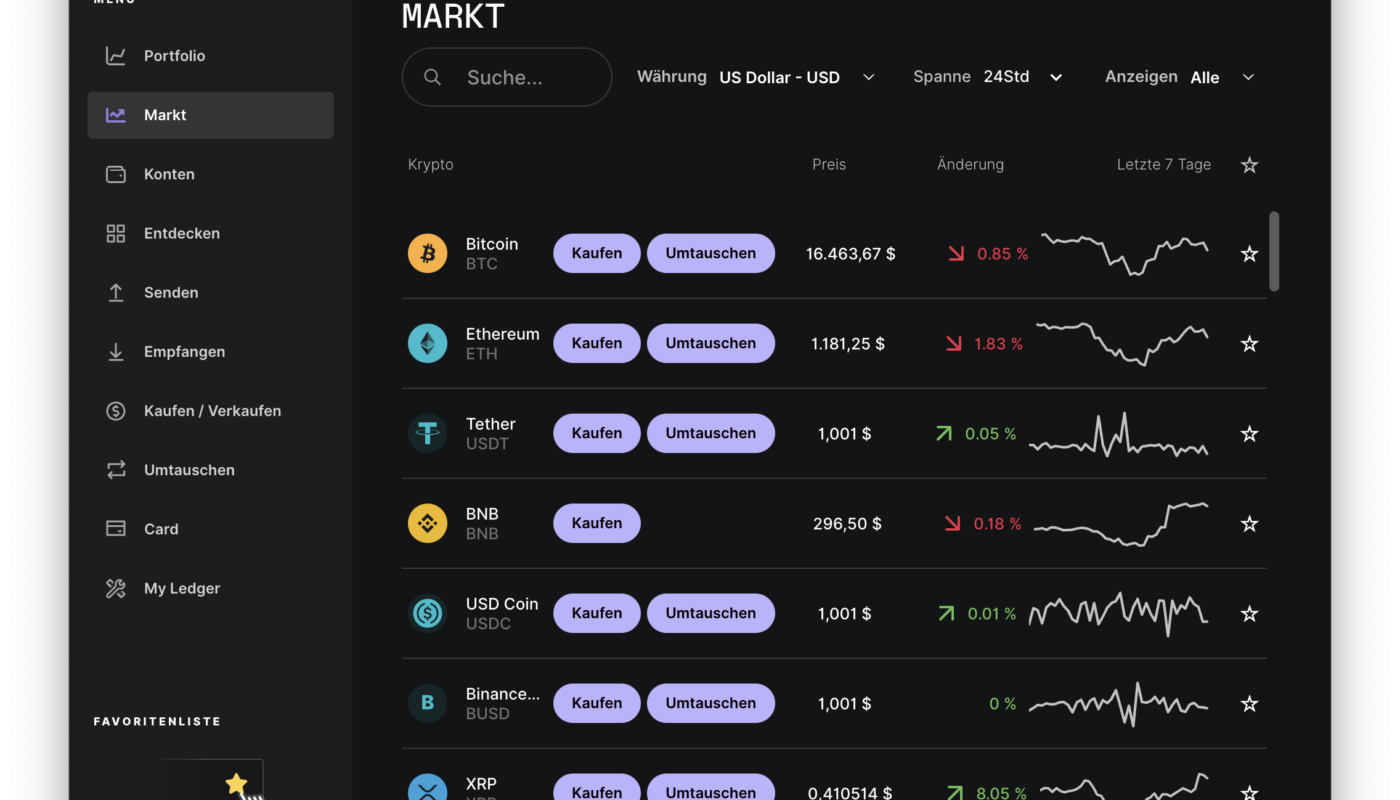

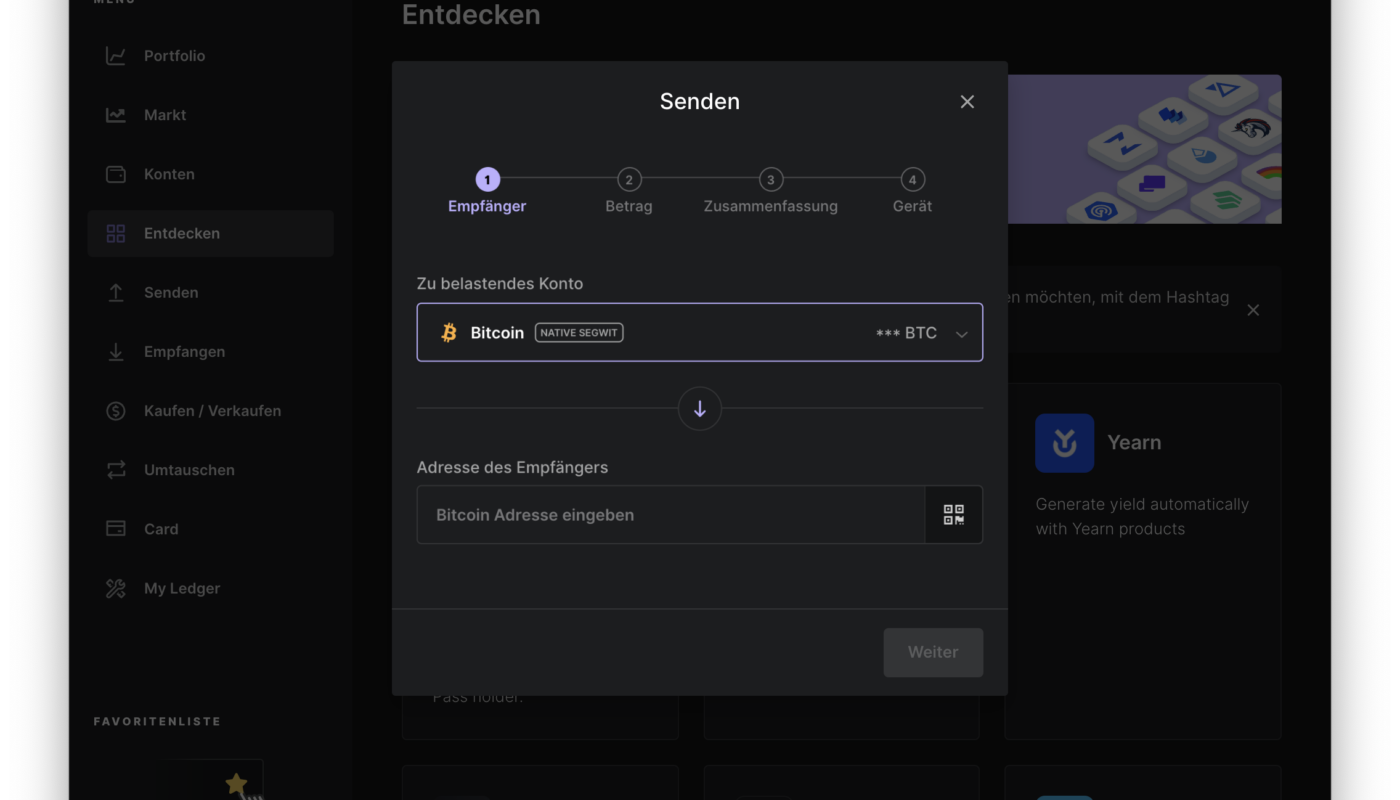

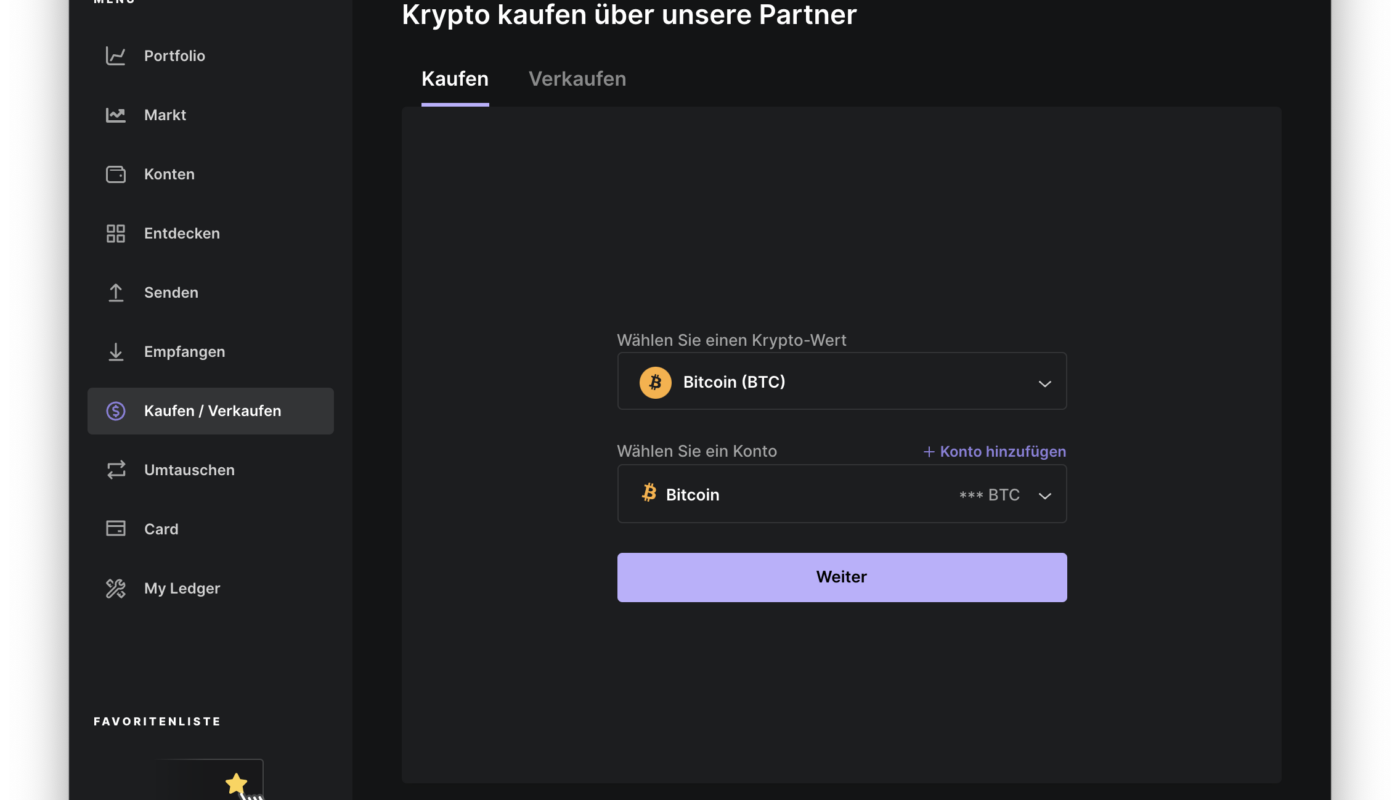

Over 100 apps are supported, although a separate app has to be installed for each blockchain, which can, however, be configured conveniently via Ledger Live. In addition, NFTs and even DeFi apps are thus supported. Even the direct purchase and exchange of cryptocurrencies is possible.

Security costs convenience

However, this high level of security has one drawback: the system is quite complicated for daily payments. For example, the ledger stick has to be connected for each transaction, then unlocked with the PIN and each booking confirmed by pressing a button. The high price is also likely to deter many.

Those who do not perform transactions on a daily basis and have already invested a few Euros in the crypto market should definitely think about using a hardware wallet. The biggest difference between the Ledger Nano X and the Nano S Plus* is the Bluetooth chip of the more expensive model. It can also be used to perform transactions with a mobile device and thus also on an Apple iPhone with iOS 13.

Both cryptowallets are available in several colors. The software guides you through extensive documentation, but you should proceed with utmost concentration and some time investment. The initial setup takes a good half hour.

We recently opted for the Ledger Nano X for around 150 Euros*.

Keyfacts

- more and more crypto exchanges get into difficulties

- in case of insolvency the customers are threatened with total loss

- only with own wallets you always have access

- “Not your Keys, not your Coins”.

- the safest solution are hardware wallets

- we recommend the Ledger Nano X