While Bitcoin is climbing to one annual high after another these days and is thus increasingly coming back into focus for investors, we are bringing the topic of “taxes” closer to the fore. While with traditional investments in shares and ETFs, custodian banks take care of the necessary logging of price changes and inflows in the form of dividends and interest payments and even automatically transfer these to the tax office (provided they are based in Germany), you have to do this yourself when investing in cryptocurrencies. However, there are numerous useful tools for this, one of which we would like to present in more detail.

First of all: This article and the tool presented in it are no substitute for a tax advisor. Only they can and should provide legally compliant advice. In general, if you hold your crypto tokens for one year, you can sell them tax-free at a later date. If the investment period is shorter, any profits must be taxed in Germany, with different tax-free allowances applying.

Things get particularly complicated if you use a crypto payment card for your everyday spending, such as those from Crypto.com or Plutus, which offer an attractive cashback system. You then have to record every gain in order to be able to show the tax office any capital gains and losses, especially any additions, in your tax return. You are obliged to disclose to the tax office which tokens were acquired at what price.

High logging effort is simplified

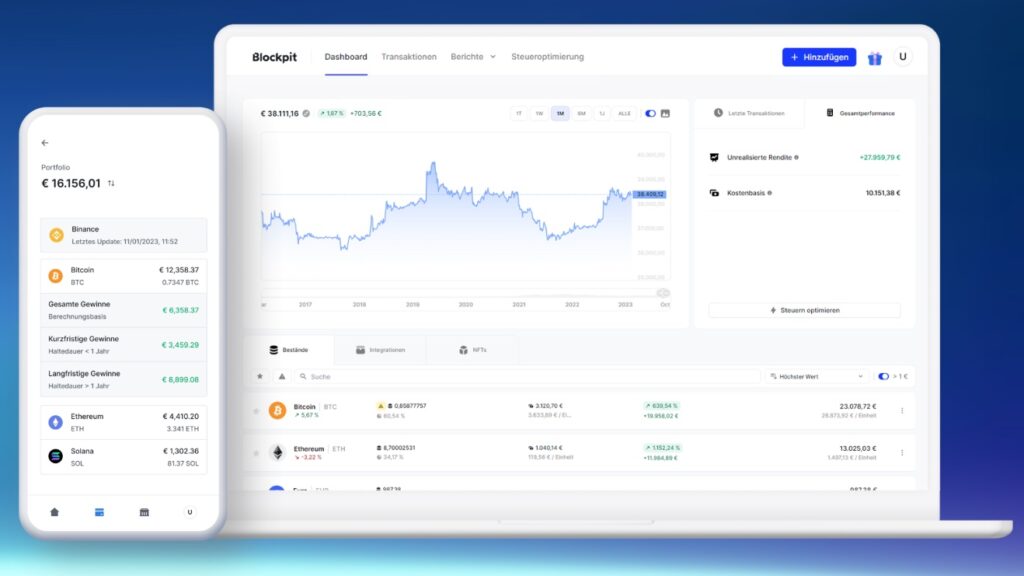

This logging is time-consuming and can quickly become confusing, especially as many providers or personal wallets often do not offer any support. However, there are some third-party applications that make this effort easier and can also determine personal statistics and key figures more easily and prepare them graphically. The data can then be exported for the next tax report. Over the past few years, we have tried out a number of these platforms and finally chose the Austrian provider Blockpit* as the best. Even though the tool comes from a neighboring country, it is also designed for German customers and German tax offices.

First, the platform must be fed with the transaction history. With Blockpit, this can not only be entered manually, but also via a large number of wallets, whereby the tool then pulls the data directly from the blockchain via the public address or public key of the wallet and processes it accordingly. Many common Bitcoin and Ethereum wallets are supported, as well as more exotic coins and tokens. Blockpit can even communicate directly with the exchange via an API and thus obtain the transactions fully automatically.

The most popular providers such as Coinbase, Bitpanda, Kraken, Binance and Crypto.com are also supported. Data can also be entered using CSV import, which is then prepared accordingly using a template.

Comprehensive portfolio tracking

Blockpit* then uses this data to generate statistics and key figures in real time that are important for tax purposes. The tool automatically determines the buy and sell price and can therefore provide an overview of your own losses and profits. When simply transferring coins from the exchange to your own hardware wallet, the transaction fees incurred are automatically recorded and the transaction is recorded as a simple transfer between your own accounts without affecting the holding time. Interest and staking gains are also logged accordingly. It even supports some NFTs, DeFi platforms and even derivatives of leveraged products. Over 50 different exchanges are supported by Blockpit.

In addition to the option of creating a tax report, Blockpit can also carry out tax optimization to reduce any additional payments due. The platform offers a user-friendly and intuitive interface, making it easy for even beginners to keep track of their tax obligations. All data is stored exclusively on specially hosted servers, using advanced encryption technologies for both storage and transmission. This means that users’ personal information can be treated confidentially.

Tax return from around 50 euros

The use of Blockpit* is initially free of charge, although no tax reports or a pre-filled declaration in PDF format can be created. In the free version, the tool can mainly be used for portfolio tracking and can be tested extensively thanks to unlimited imports. If you want the latter, you have to pay.

The Lite version costs 49 euros for each tax year, with the number of transactions limited to 50 per year. Anyone who carries out up to 1,000 transactions per year and would also like to use the tax optimization feature will have to pay 99 euros per year. The next level for 249 euros allows 25,000 transactions, while the unlimited version costs 599 euros and is therefore only suitable for absolute crypto enthusiasts and traders.

If you would like to try out Blockpit and later decide to purchase a paid tax report, you can get a 15% discount on your first license purchase via our link*.