Even if the stock market only knew the direction upwards in the long term, it is still not a one-way street. There are regular sharp sell-offs or even smaller to larger crashes, as was the case most recently in February during the Corona pandemic when almost the entire world went into lockdown. At that time, the DAX plummeted from its former highs of just under 13,800 points to an interim low of 8,442 points, losing almost 40% of its value. Investors who do not have a preconceived plan run the risk of being infected by the market’s panic and perhaps selling emotionally at a loss.

Of course, I was already aware that a crash could happen at some point when I bought my first shares. At the beginning, I didn’t think much about it, because I only had a few hundred euros in my portfolio. Over time, however, the value grew more strongly through the monthly savings installments and I imagined how I would feel if 50% of it were missing all at once. I realized that I would need a contingency plan for that.

I started building up additional cash on top of the monthly savings plans so that I would have extra cash on hand for re-buying in case of a more severe setback. In the end, a complete sale was and is out of the question for me, because I still have more than 30 years until my actual retirement. Time in which the market can easily recover after a crash and time during which there will certainly be another one.

10% decline means 1.000 Euro extra investment

In order not to lose the entire cash balance for the re-buys already at the first setback, I decided to re-buy for 1,000 euros for each setback that would lose 10% within a few days. In the Corona crash, that meant three re-buys for me, and I narrowly missed out on a fourth. While I was happy to have bought the first 1,000 euros at a good price, I had to watch how these 1,000 euros became less and less immediately after the execution of the second order. The next 1,000 euros I could still invest with a clear conscience.

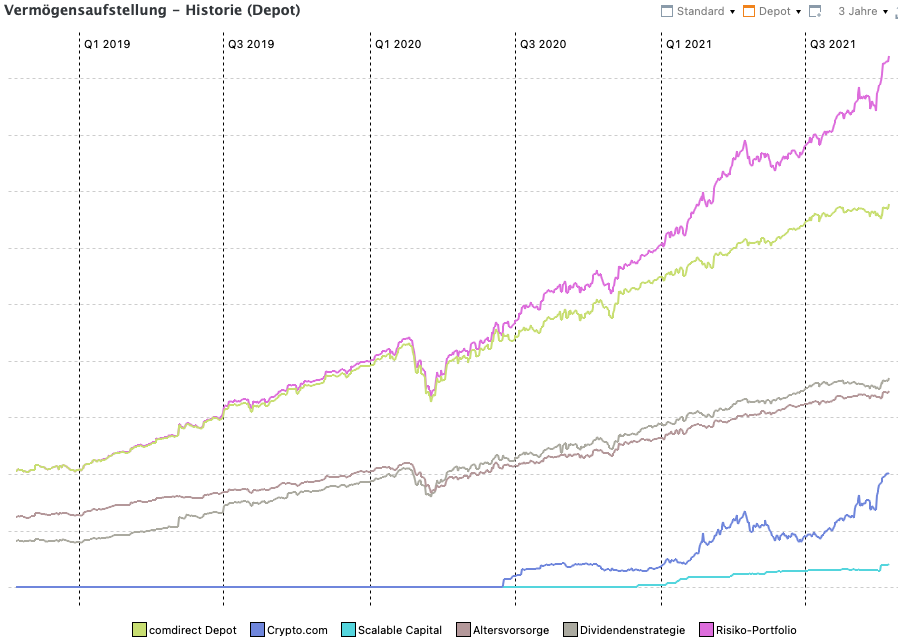

However, when these 1,000 euros also became steadily less, my head began to brood. I thought about how I would feel if the next 1,000 euros were also steadily decreasing. However, since I had previously put this contingency plan in place, only its mindless exercise was valid for me, and so I put the next 1,000 euros into my portfolio. At -36%, the peak was finally reached. The bottom formation with subsequent, almost V-shaped recovery occurred. The additional 3,000 euros invested really paid off today – in the meantime, the portfolio has climbed to new highs.

But that’s not all: I also increased my monthly savings rate, which I still pay in regularly today. So I didn’t just make additional one-off purchases, but supplemented them with a higher savings rate. Why? At the time of Corona, social life was massively restricted in some areas. There was virtually no opportunity to spend any money at all. Regular visits to bars and restaurants simply could not take place. Of course, that also paid off.

Currently, I try to maintain this monthly savings rate. However, I know that I will have to cut back on this again next year at the latest. The depleted cash reserves for the next potential crahs with its 10% declines will have to be replenished.

Emotionless like a robot

Having a plan for the crash that you just bluntly implement like a robot is golden. It prevents investors from acting emotionally in a crash and realizing their losses without buying cheap.

Keyfacts

- if you have a plan for the crash, you are prepared

- preparation helps to stay rational

- without emotions it is easier to keep one’s nerves

- re-buying is the real yield-boost of every portfolio