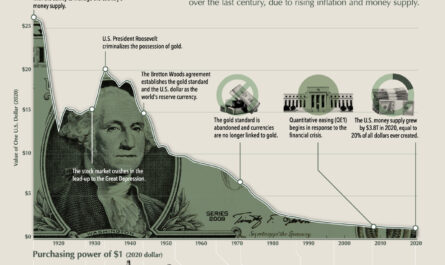

About two years ago, we pointed out the possibility of getting started in the expensive and very risky futures trading market via debt capital providers without equity. At the time, we criticized the strict rules and the sometimes high fees. This has changed, at least in part. We take a closer look at two providers that offer attractive discounts from time to time.

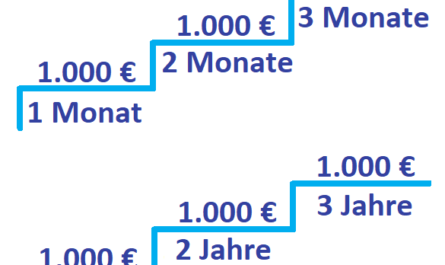

Important to know: In order to be capitalized accordingly, you must first go through an evaluation phase with all debt capital providers to prove that you are consistently profitable and can adhere to the rules. You are often not allowed to lose a certain amount per day and account and must achieve a different target in order to pass the test. After a successful evaluation phase, you finally receive a funded account, but you must first build up a certain threshold before you can make your first payouts. If you are good, you can do this in around two months.

While the trader incurs monthly subscription costs in the evaluation phase, these are waived in the second stage, whereby the profits to be paid out are split between the prop trading provider and the trader at different percentages. There are different fee structures depending on the provider. Leveraged providers like to entice traders with large account sizes. In reality, however, you only ever buy the drawdown that you have available. Because once this is reached, the account is immediately gone and you have to start all over again or even drop down a level.

Apex Trader Funding

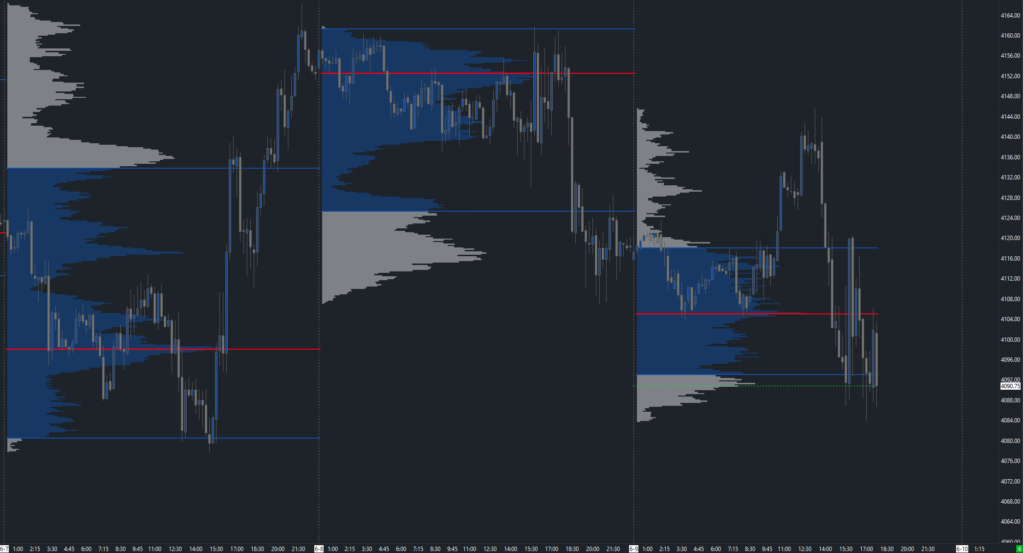

The rules of the Apex Trader Funding program have been significantly relaxed. There is no longer any scaling plan; only reaching the drawdown, which moves in real time, leads to a loss of the account. If the trader makes profits within a trading day but does not realize them, the drawdown automatically increases to the level of the potential profits achieved. Care must therefore be taken not to give up too much and to take profits steadily.

Trading during news is permitted, but holding positions overnight or even over the weekend is not. Both lead to the loss of the account. In addition, you may not scale up if the open position is in loss and the risk/reward ratio may not exceed 3:1. Small profits with large stops are not permitted at Apex.

The smallest account has a limit of 25,000 US dollars or a trailing threshold of 1,500 US dollars. A maximum of four mini or 40 micro contracts can be traded. The subscription normally costs 147 US dollars per month, but the provider often runs discount campaigns in which all accounts are offered at 80 or even 90 % off, so that this account model is regularly available for around 30 US dollars per month.

Larger accounts with 50,000 to 300,000 US dollars or a trailing threshold of 2,500 to 7,500 US dollars regularly cost up to 657 US dollars or less than 70 US dollars per month with a discount. The reset of an evaluation account always costs 80 US dollars. After passing the evaluation phase, you pay 85 US dollars per month or a one-off fee of 130 US dollars. Then the commissions for trade execution and the 90/10 profit split are added on top. The costs for the data feed and the software are always additional.

Topstep

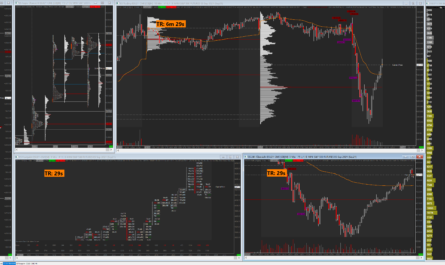

There is now only one rule at Topstep: become a funded trader! There is no longer a scaling plan or even a ban on news trading, only a maximum loss limit, which is only calculated after the end of the day. This means that lost profits do not play a negative role here. You just have to make sure that half of the total profit at the end of the evaluation was not made in a single day. There are a total of three account sizes from 50,000 to 150,00 US dollars, which allow a maximum loss of 2,000 to 4,500 US dollars and make between five and 15 mini-contracts possible. These normally cost between 165 and 375 US dollars per month. At the launch of TopstepX, however, you pay just 19 to 119 US dollars per month.

After passing the test, USD 149 is required to set up the funding account, after which the profits are split 90:10. For the first payout, you must have completed at least five trading days with a profit of at least USD 200 and a payout always affects the maximum loss limit. A full withdrawal of profits will therefore result in the account being closed. For the Topstep-X account, trades must be executed via the proprietary platform, which is somewhat rudimentary compared to SierraChart with regard to any indicators.

It remains a challenge

What remains is the well-intentioned advice: in the end, it’s not quite that easy. If you don’t keep on top of things, you will quickly lose your account or pay for one reset and one evaluation account after another. This can also quickly add up to large sums. It is different whether you trade with your hard-earned money or with borrowed capital, which is definitely demo money, at least during the evaluation phase.

For the proptrading providers, the offer remains a win-win situation: either they find capable traders who bring them regular profits, or they earn substantial amounts from their failure and their constant new attempts via the monthly and reset fee. The risk for them is limited in view of the existing rules.

Only those who have successfully traded a demo account for several months in a disciplined manner or have already made profits in a small live account should dare to try.

Letzte Aktualisierung am 2024-07-25 at 14:09 / Affiliate Links / Bilder von der Amazon Product Advertising API